Question: THIS IS A QUESTION A Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2020 and

THIS IS A QUESTION "A"

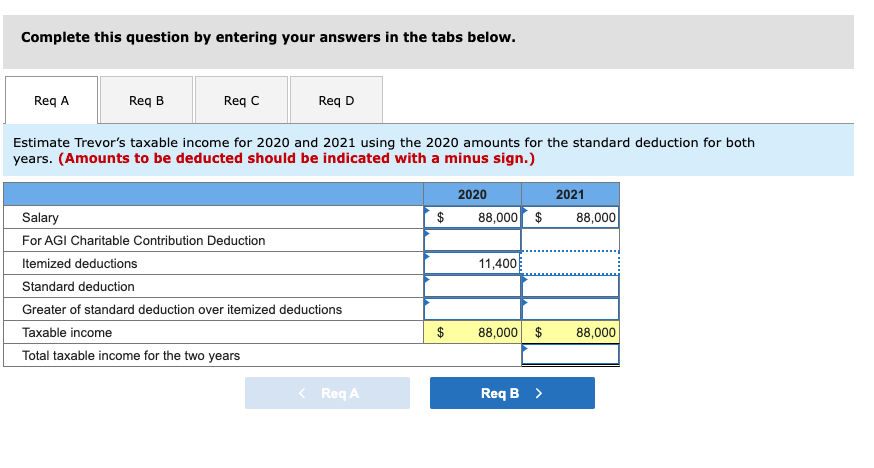

Trevor is a single individual who is a cash-method, calendar-year taxpayer. For each of the next two years (2020 and 2021), Trevor expects to report AGI of $88,000, contribute $8,400 to charity, and pay $3,000 in state income taxes. Assume CARES Act applies. Required: a. Estimate Trevor's taxable income for 2020 and 2021 using the 2020 amounts for the standard deduction for both years. b. Now assume that Trevor combines his anticipated charitable contributions for the next two years and makes the combined contribution in December of 2020. Estimate Trevor's taxable income for each of the next two years using the 2020 amounts for the standard deduction. c. Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,400 and $16,000, respectively, each year. Estimate Trevor's taxable income for each of the next two years (2020 and 2021) using the 2020 amounts for the standard deduction and also assuming Trevor makes the charitable contribution of $8,400 and state tax payments of $3,000 in each year. d. Trevor plans to purchase a residence next year, and he estimates that additional property taxes and residential interest will cost $2,400 and $16,000, respectively, each year. Assume that Trevor makes the charitable contribution for 2021 and pays the real estate taxes for 2021 in December of 2020. Estimate Trevor's taxable income for 2020 and 2021 using the 2020 amounts for the standard deduction. Complete this question by entering your answers in the tabs below. ReqA ReqB Reqc ReqD Estimate Trevor's taxable income for 2020 and 2021 using the 2020 amounts for the standard deduction for both years. (Amounts to be deducted should be indicated with a minus sign.) 2020 88,000 $ 2021 88,000 $ 11,400 Salary For AGI Charitable Contribution Deduction Itemized deductions Standard deduction Greater of standard deduction over itemized deductions Taxable income Total taxable income for the two years $ 88,000 $ 88,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts