Question: This is a question for taxation. Please answer it correctly.None of the answers in the Chegg are correct. and also the question is complete. Dr.

This is a question for taxation. Please answer it correctly.None of the answers in the Chegg are correct. and also the question is complete.

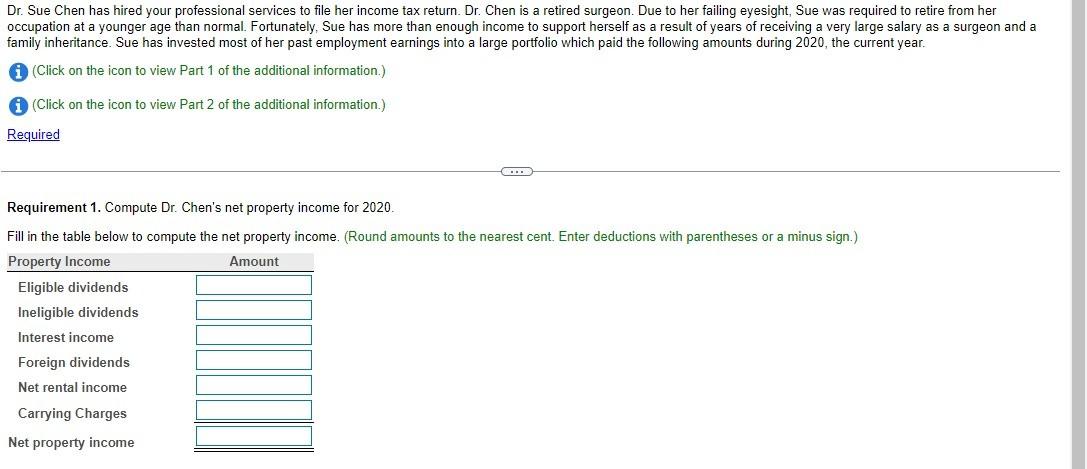

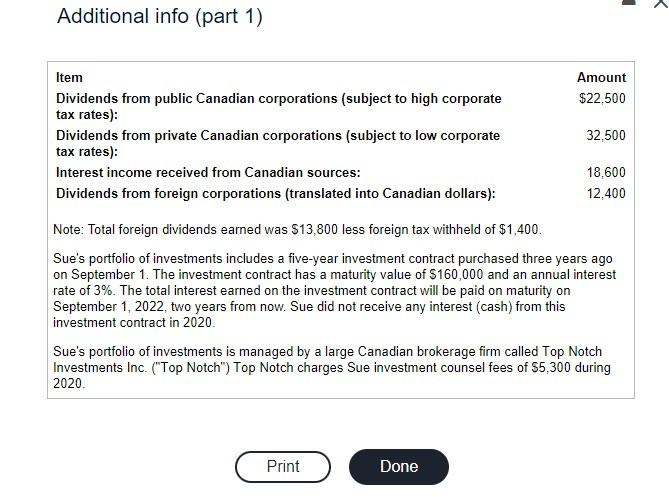

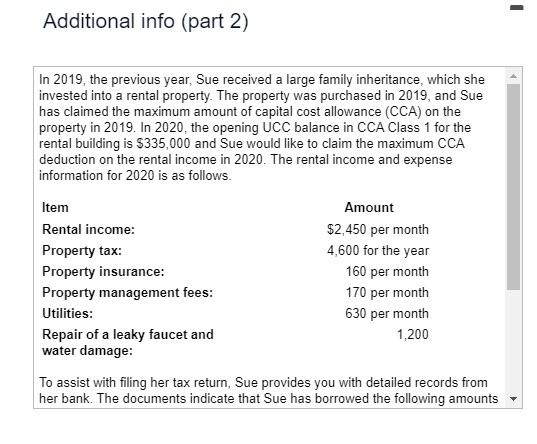

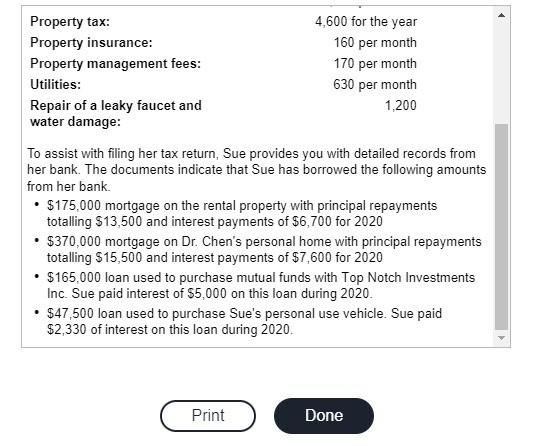

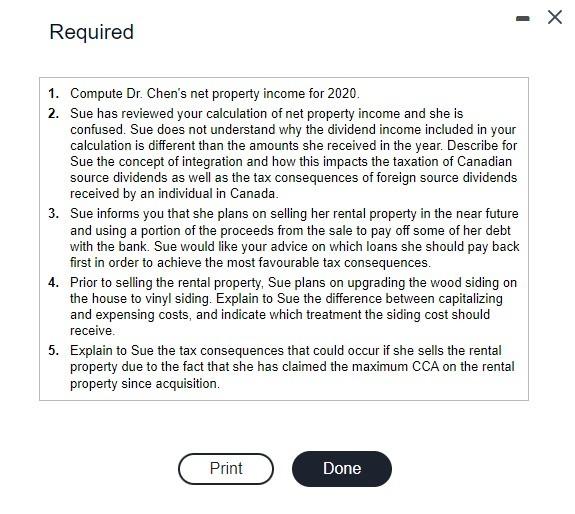

Dr. Sue Chen has hired your professional services to file her income tax return. Dr. Chen is a retired surgeon. Due to her failing eyesight, Sue was required to retire from her occupation at a younger age than normal. Fortunately, Sue has more than enough income to support herself as a result of years of receiving a very large salary as a surgeon and a family inheritance. Sue has invested most of her past employment earnings into a large portfolio which paid the following amounts during 2020 , the current year. (Click on the icon to view Part 1 of the additional information.) (Click on the icon to view Part 2 of the additional information.) Requirement 1. Compute Dr. Chen's net property income for 2020. Fill in the table below to compute the net property income. (Round amounts to the nearest cent. Enter deductions with parentheses or a minus sign.) Additional info (part 1) Item Dividends from public Canadian corporations (subject to high corporate $22,500 tax rates): Dividends from private Canadian corporations (subject to low corporate 32,500 tax rates): Interest income received from Canadian sources: 18,600 Dividends from foreign corporations (translated into Canadian dollars): 12,400 Note: Total foreign dividends earned was $13,800 less foreign tax withheld of $1,400. Sue's portfolio of investments includes a five-year investment contract purchased three years ago on September 1 . The investment contract has a maturity value of $160,000 and an annual interest rate of 3%. The total interest earned on the investment contract will be paid on maturity on September 1, 2022, two years from now. Sue did not receive any interest (cash) from this investment contract in 2020 . Sue's portfolio of investments is managed by a large Canadian brokerage firm called Top Notch Investments Inc. ("Top Notch") Top Notch charges Sue investment counsel fees of \$5,300 during 2020. Additional info (part 2) In 2019, the previous year, Sue received a large family inheritance, which she invested into a rental property. The property was purchased in 2019 , and Sue has claimed the maximum amount of capital cost allowance (CCA) on the property in 2019. In 2020, the opening UCC balance in CCA Class 1 for the rental building is $335,000 and Sue would like to claim the maximum CCA deduction on the rental income in 2020 . The rental income and expense information for 2020 is as follows. To assist with filing her tax return, Sue provides you with detailed records from her bank. The documents indicate that Sue has borrowed the following amounts To assist with filing her tax return, Sue provides you with detailed records from her bank. The documents indicate that Sue has borrowed the following amounts from her bank. - $175,000 mortgage on the rental property with principal repayments totalling $13,500 and interest payments of $6,700 for 2020 - $370,000 mortgage on Dr. Chen's personal home with principal repayments totalling $15,500 and interest payments of $7,600 for 2020 - $165,000 loan used to purchase mutual funds with Top Notch Investments Inc. Sue paid interest of $5,000 on this loan during 2020. - $47,500 loan used to purchase Sue's personal use vehicle. Sue paid $2,330 of interest on this loan during 2020 . 1. Compute Dr. Chen's net property income for 2020. 2. Sue has reviewed your calculation of net property income and she is confused. Sue does not understand why the dividend income included in your calculation is different than the amounts she received in the year. Describe for Sue the concept of integration and how this impacts the taxation of Canadian source dividends as well as the tax consequences of foreign source dividends received by an individual in Canada. 3. Sue informs you that she plans on selling her rental property in the near future and using a portion of the proceeds from the sale to pay off some of her debt with the bank. Sue would like your advice on which loans she should pay back first in order to achieve the most favourable tax consequences. 4. Prior to selling the rental property, Sue plans on upgrading the wood siding on the house to vinyl siding. Explain to Sue the difference between capitalizing and expensing costs, and indicate which treatment the siding cost should receive. 5. Explain to Sue the tax consequences that could occur if she sells the rental property due to the fact that she has claimed the maximum CCA on the rental property since acquisition

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts