Question: this is a question from book Modern working capital management by Frederick C. Scherr. I also need solution to problem 3.2 and 3.3... can anyone

this is a question from book Modern working capital management by Frederick C. Scherr. I also need solution to problem 3.2 and 3.3... can anyone provide me with solution to these problems?

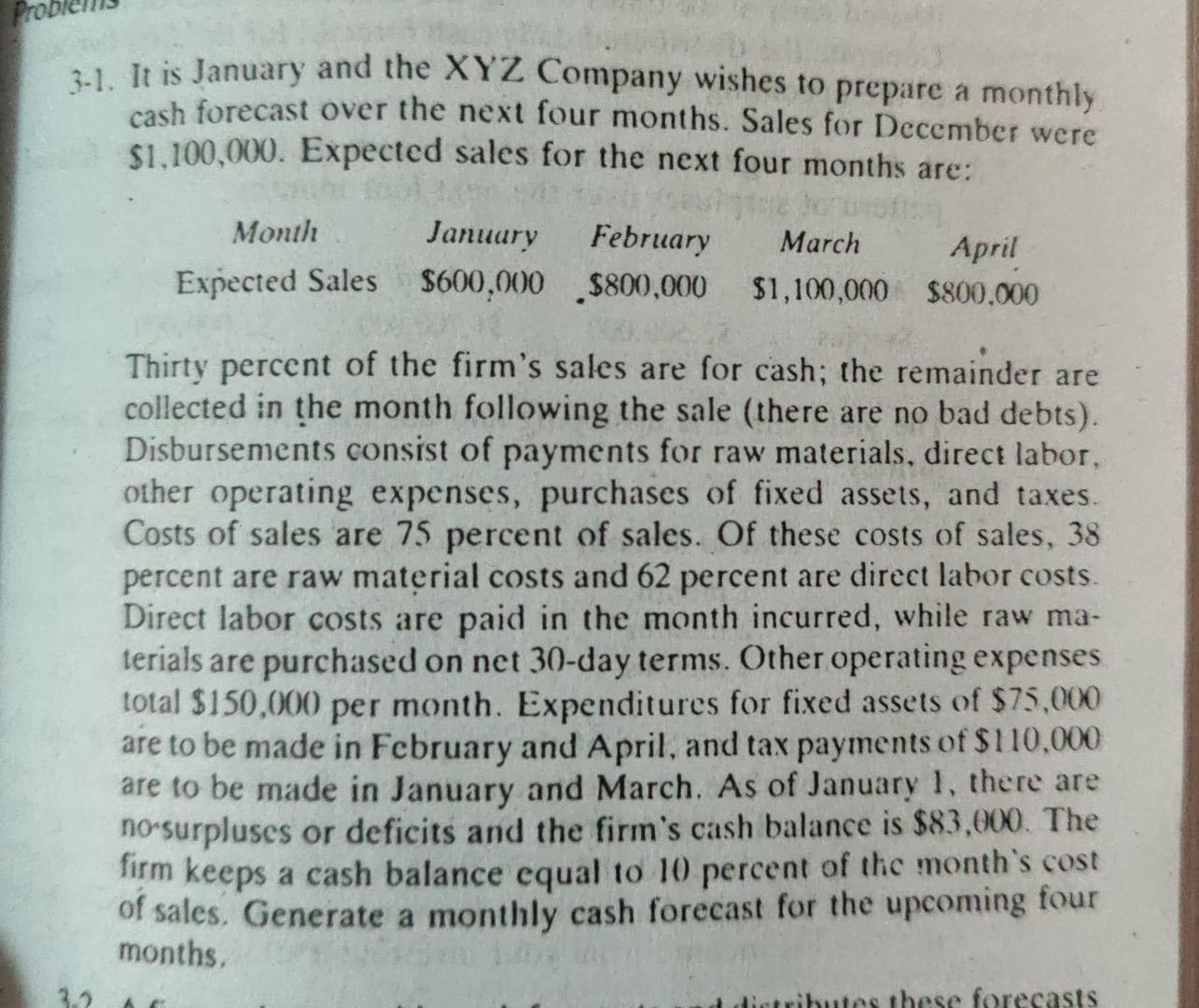

Problems3-1

It is January and the XYZ Company wishes to prepare a monthly cash forecast over the next four moths. Sales for December were $1,100,000.

Expected sales for the next four months are:

January : $600.000

February: $800.000

March: $1.100.000

April $800.000

30% of the firm's sales are for cash: the remainder are collected in the month following the sale (there are no bad debts). Disbursements consists of payments for raw materials, direct labor, other operating expenses, purchases of fixed assets, and taxes. Cost of sales are 75% of sales. Of these cost of sales 38% are raw material costs and 62% are direct labor costs. Direct labor costs are paid in the month incurred, while raw materials are purchased on net 30-day terms. Other operatig expenses total $150,000 pe month. Expenditures for fixed assets of $75,000 are to be made in February and April, and tax payments of $110,000 are to be made in January, March. As of Januray 1, there are no surpluses or deficits and the firm's cash balance is $83,000. The firm keeps a cash balance equal to 10% of the month's cost of sales. Generate a monthly cash forecast for the upcoming four months.

3.1. It is January and the XYZ Company wishes to prepare a monthly cash forecast over the next four months. Sales for December were $1,100,000. Expected sales for the next four months are: Month January February March April Expected Sales $600,000 $800,000 $1,100,000 $800.000 Thirty percent of the firm's sales are for cash; the remainder are collected in the month following the sale (there are no bad debts). Disbursements consist of payments for raw materials, direct labor, other operating expenses, purchases of fixed assets, and taxes. Costs of sales are 75 percent of sales. Of these costs of sales, 38 percent are raw material costs and 62 percent are direct labor costs. Direct labor costs are paid in the month incurred, while raw ma- terials are purchased on net 30-day terms. Other operating expenses total $150,000 per month. Expenditures for fixed assets of $75,000 are to be made in February and April, and tax payments of $110,000 are to be made in January and March. As of January 1, there are no-surpluses or deficits and the firm's cash balance is $83,000. The firm keeps a cash balance equal to 10 percent of the month's cost of sales. Generate a monthly cash forecast for the upcoming four months. butes these forecasts 3.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts