Question: This is a question from CFA level I. I was wondering why N=60 not N=61 since the payment is made immediately. Thanks! 24. A financial

This is a question from CFA level I.

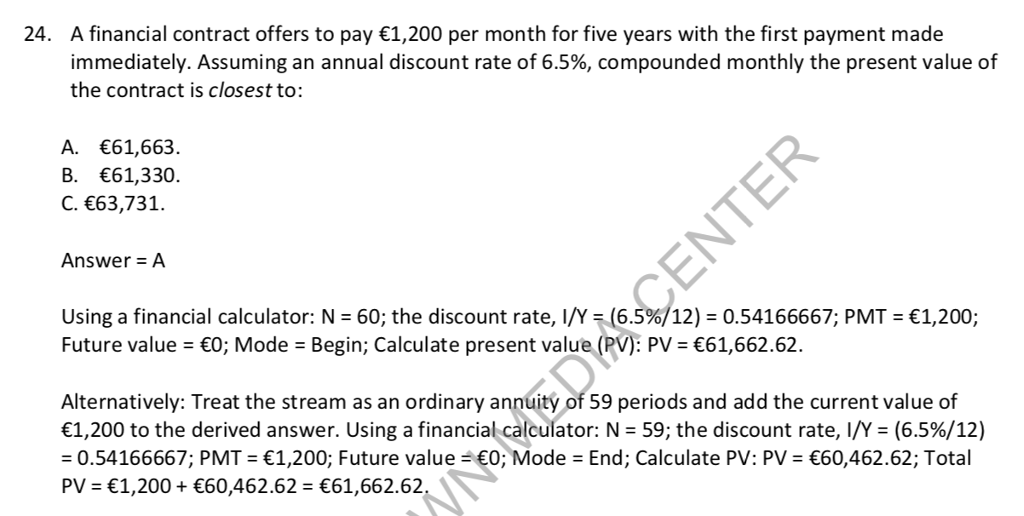

I was wondering why N=60 not N=61 since the payment is made immediately. Thanks!

24. A financial contract offers to pay 1,200 per month for five years with the first payment made immediately. Assuming an annual discount rate of 6.5%, compounded monthly the present value of the contract is closest to: A. 61,663 B. 61,330. C. 63,731. Answer Using a financial calculator: N-60; the discount rate, l/ys (6.5%/12)-0.54166667; PMT Future value 0; Mode - Begin; Calculate present value (PV) PV- 61,662.62 1,200; Alternatively: Treat the stream as an ordinary annuity of 59 periods and add the current value of 1.200 to the derived answer. Using a financial calculator: N = 59, the discount rate, I/Y = (6.596/12) = 0.54166667; PMT = 1,200; Future value =E0; Mode End: Calculate PV: PV 60,462.62; Total PV = 1,200 + 60,462.62 = 61,662.62

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts