Question: This is a question from my Accounting class, I need help figuring out the steps on how to work this out. The following information is

This is a question from my Accounting class, I need help figuring out the steps on how to work this out.

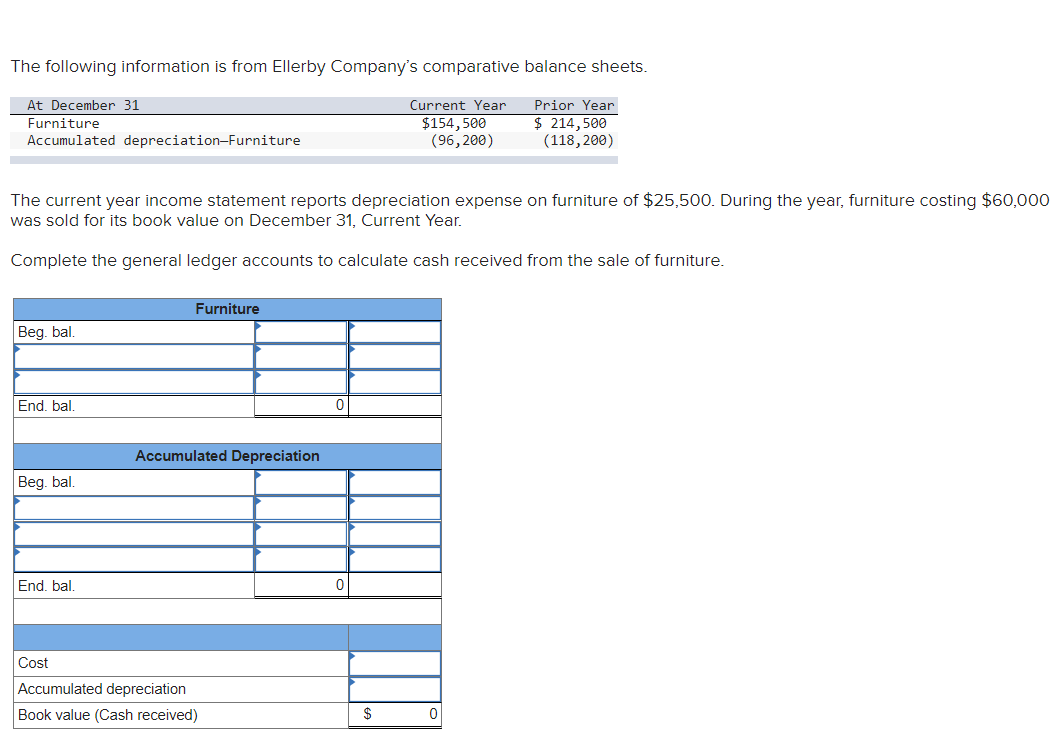

The following information is from Ellerby Company's comparative balance sheets. At December 31 Furniture Accumulated depreciation-Furniture Current Year $154,500 (96,200) Prior Year $ 214,500 (118,200) The current year income statement reports depreciation expense on furniture of $25,500. During the year, furniture costing $60,000 was sold for its book value on December 31, Current Year. Complete the general ledger accounts to calculate cash received from the sale of furniture. Furniture Beg. bal. End. bal. 0 Accumulated Depreciation Beg. bal. End. bal. Cost Accumulated depreciation Book value (Cash received) $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts