Question: This is a question on Management Accounting. Please solve for optimal transfer pricing. Show all work, please. Thank you. 2. The Sounds Division of Plasma

This is a question on Management Accounting.

Please solve for optimal transfer pricing.

Show all work, please.

Thank you.

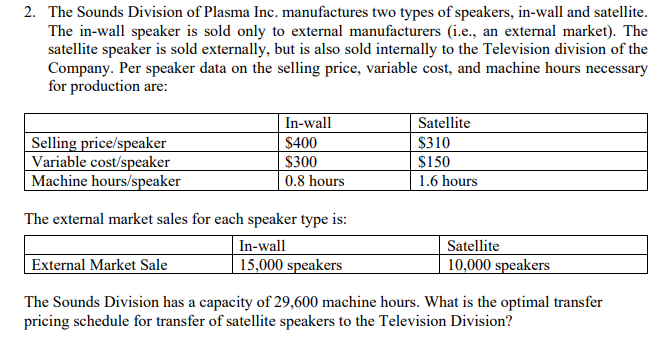

2. The Sounds Division of Plasma Inc. manufactures two types of speakers, in-wall and satellite The in-wall speaker is sold only to external manufacturers (i.e., an external market). The satellite speaker is sold externally, but is also sold internally to the Television division of the Company. Per speaker data on the selling price, variable cost, and machine hours necessary for production are: Selling price/speaker Variable cost/speaker Machine hours/speaker In-wall $400 S300 0.8 hours Satellite S310 $150 1.6 hours The external market sales for each speaker type is In-wall 15,000 speakers Satellite 10,000 speakers External Market Sale The Sounds Division has a capacity of 29,600 machine hours. What is the optimal transfer pricing schedule for transfer of satellite speakers to the Television Division

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts