Question: This is a separate question Prepare an aging schedule to determine the total estimated uncollectible accounts at September 30, 2017. (Round answers to 0 decimal

This is a separate question

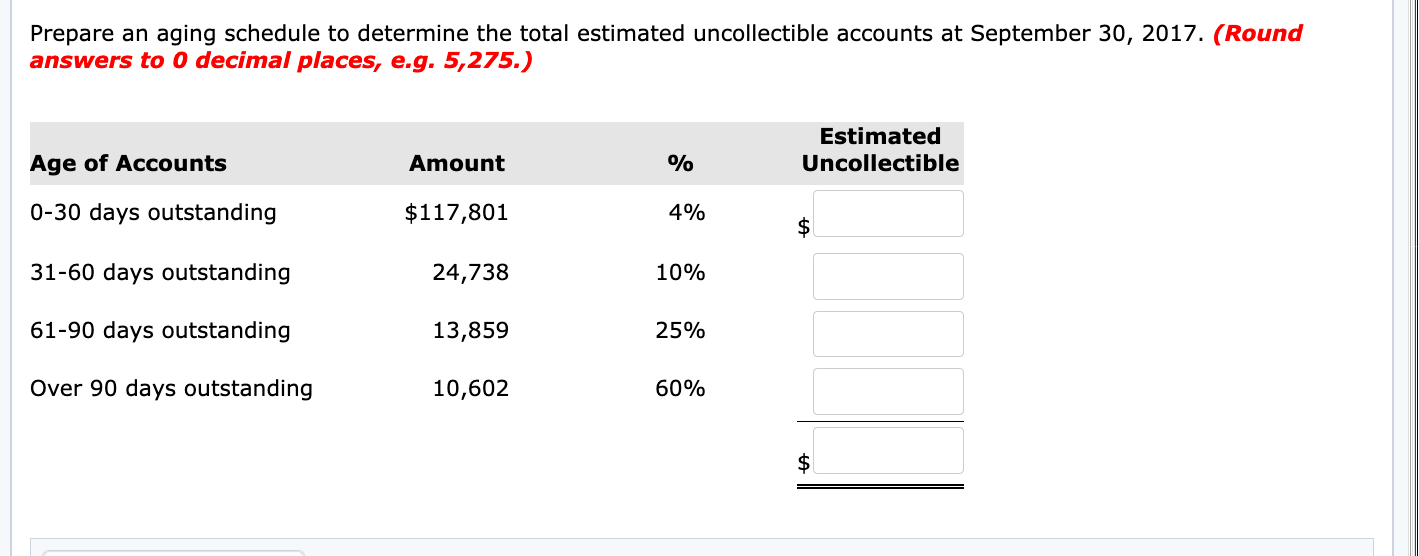

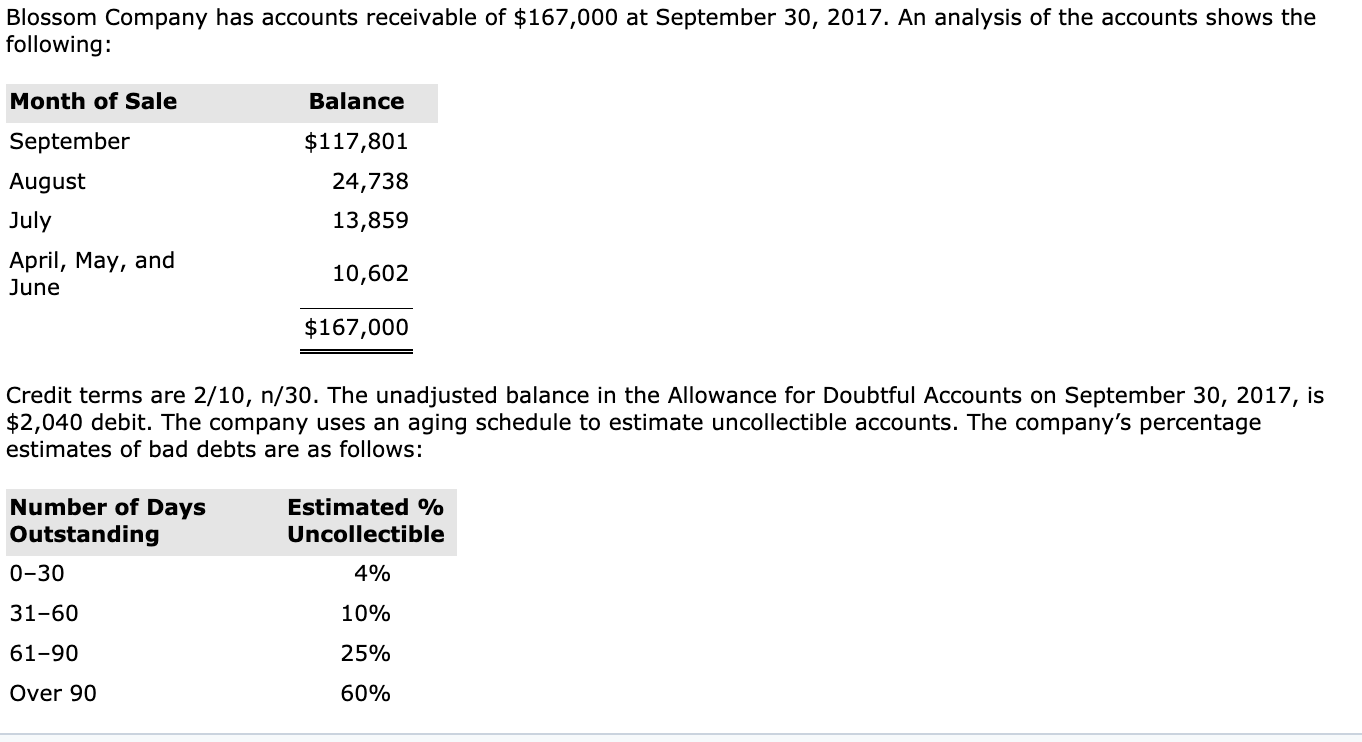

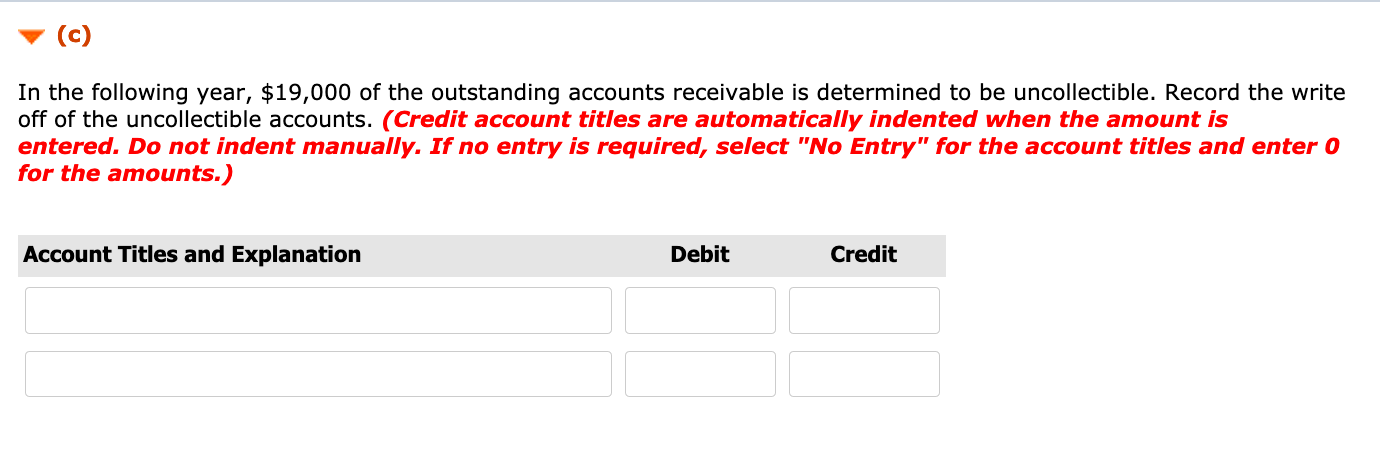

Prepare an aging schedule to determine the total estimated uncollectible accounts at September 30, 2017. (Round answers to 0 decimal places, e.g. 5,275.) Estimated Uncollectible Age of Accounts Amount % 0-30 days outstanding $117,801 4% $ 31-60 days outstanding 24,738 10% 61-90 days outstanding 13,859 25% Over 90 days outstanding 10,602 60% $ Blossom Company has accounts receivable of $167,000 at September 30, 2017. An analysis of the accounts shows the following: Month of Sale Balance September August July April, May, and June $117,801 24,738 13,859 10,602 $167,000 Credit terms are 2/10, n/30. The unadjusted balance in the Allowance for Doubtful Accounts on September 30, 2017, is $2,040 debit. The company uses an aging schedule to estimate uncollectible accounts. The company's percentage estimates of bad debts are as follows: Number of Days Outstanding 0-30 Estimated % Uncollectible 4% 10% 31-60 61-90 Over 90 25% 60% (c) In the following year, $19,000 of the outstanding accounts receivable is determined to be uncollectible. Record the write off of the uncollectible accounts. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts