Question: this is a short answer question, please post it in a way where I can copy and paste, please answer all parts because they are

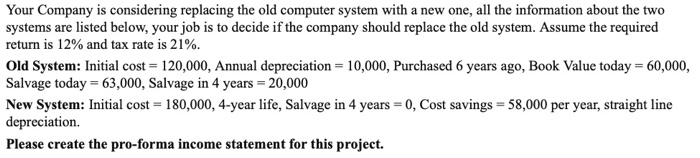

Your Company is considering replacing the old computer system with a new one, all the information about the two systems are listed below, your job is to decide if the company should replace the old system. Assume the required return is 12% and tax rate is 21%. Old System: Initial cost = 120,000, Annual depreciation = 10,000, Purchased 6 years ago, Book Value today = 60,000, Salvage today = 63,000, Salvage in 4 years = 20,000 New System: Initial cost = 180,000, 4-year life, Salvage in 4 years = 0, Cost savings = 58,000 per year, straight line depreciation. Please create the pro-forma income statement for this project. Based on the previous information from Comprehensive 1(a), what is the net capital spending at year and year TT T Arial 3 (12pt) T Based on previous information from Comprehensive 1 (a), what is the OCF each year? Create CFFA table based on the information you got from Comprehensive 1 (a) to (c). Compute NPV based on CFFA in Comprehensive 1d), and decide if the company should replace the old system with the new one. TTT Arial 3 (12pt) TE Efficient market hypothesis asserts that, in an efficient market all investments are zero NPV investments, does this mean that we cannot earn positive returns in efficient market? Please briefly explain. TTT Arial 3 (12pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts