Question: This is a Single Question so kindly help with the complete answer Q3. You have been hired as a financial analyst of a firm and

This is a Single Question so kindly help with the complete answer

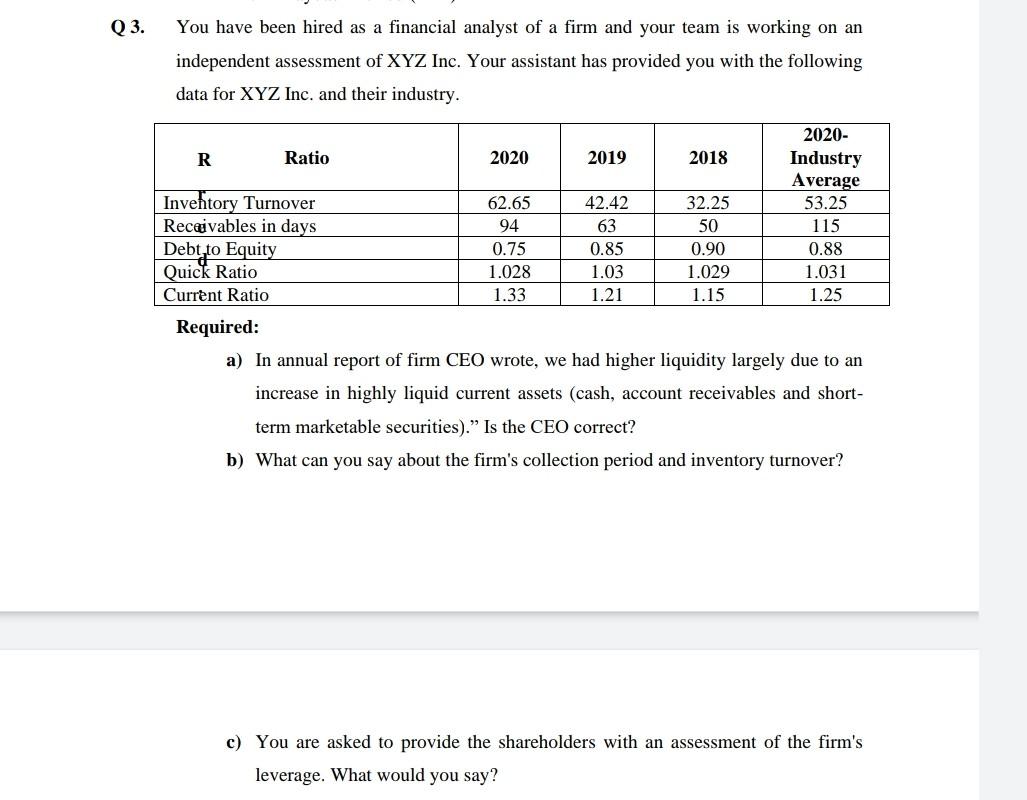

Q3. You have been hired as a financial analyst of a firm and your team is working on an independent assessment of XYZ Inc. Your assistant has provided you with the following data for XYZ Inc. and their industry. 1.029 2020- R Ratio 2020 2019 2018 Industry Average Inventory Turnover 62.65 42.42 32.25 53.25 Receivables in days 94 63 50 115 Debt,to Equity 0.75 0.85 0.90 0.88 Quick Ratio 1.028 1.03 1.031 Current Ratio 1.33 1.21 1.15 1.25 Required: a) In annual report of firm CEO wrote, we had higher liquidity largely due to an increase in highly liquid current assets (cash, account receivables and short- term marketable securities). Is the CEO correct? b) What can you say about the firm's collection period and inventory turnover? c) You are asked to provide the shareholders with an assessment of the firm's leverage. What would you say

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts