Question: This is a subjective question, hence you have to write your answer in the Text-Field given below. You have performed the common sizing and horizontal

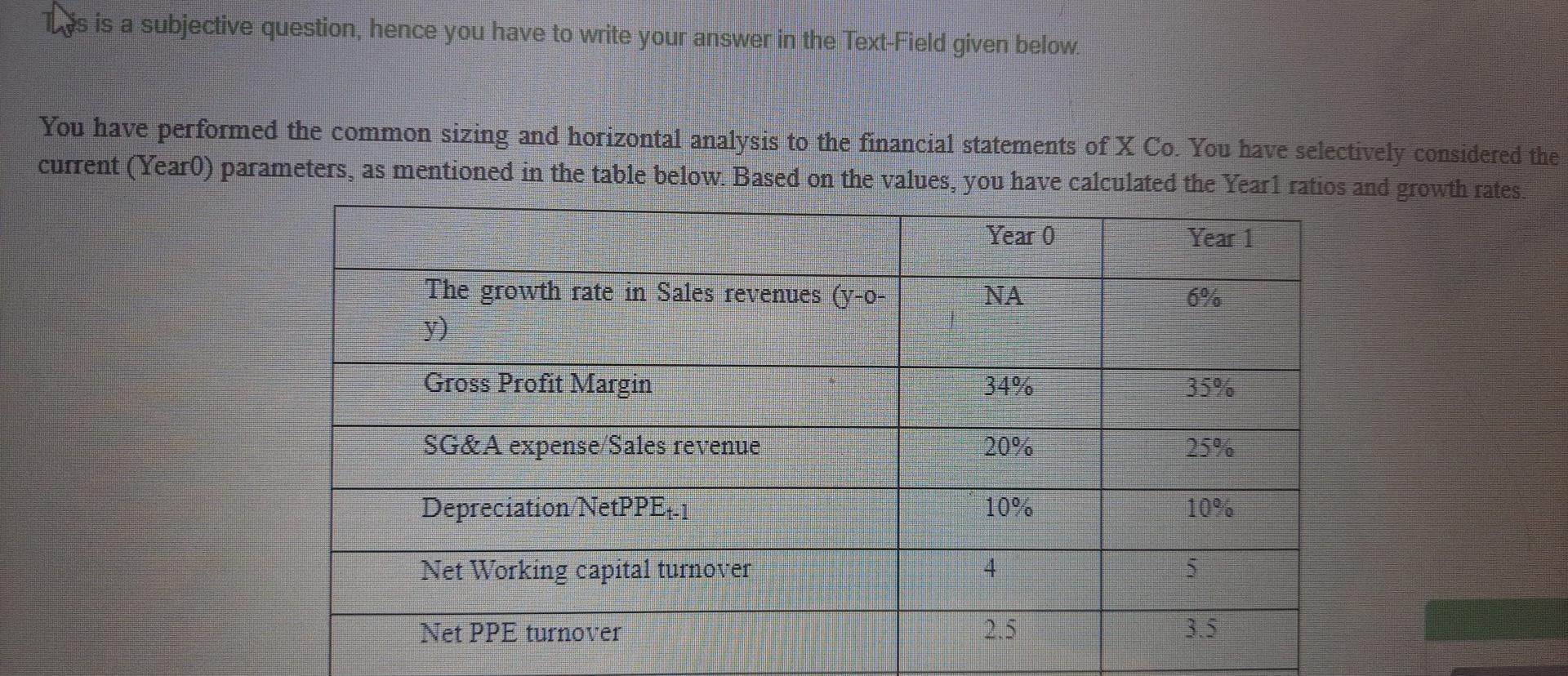

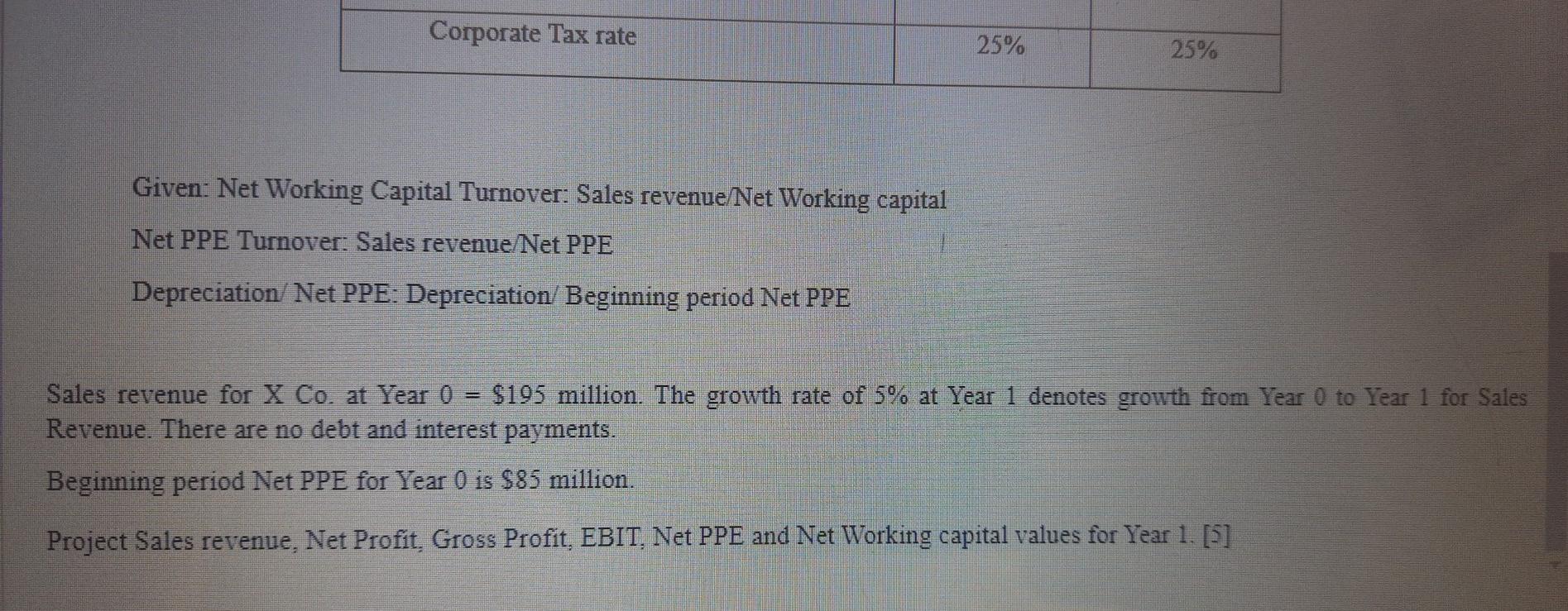

This is a subjective question, hence you have to write your answer in the Text-Field given below. You have performed the common sizing and horizontal analysis to the financial statements of X Co. You have selectively considered the current (Yearo) parameters, as mentioned in the table below. Based on the values, you have calculated the Year1 ratios and growth rates. Year 0 Year 1 The growth rate in Sales revenues (y-0- NA Gross Profit Margin 34% 35% SG&A expense Sales revenue 20% 25% Depreciation NetPPE:-1 10% Net Working capital turnover 5 Net PPE turnover Corporate Tax rate 25% 25% Given: Net Working Capital Turnover: Sales revenue Net Working capital Net PPE Turnover: Sales revenue Net PPE Depreciation Net PPE: Depreciation Beginning period Net PPE Sales revenue for X Co. at Year 0 $195 million. The growth rate of 5% at Year 1 denotes growth from Year 0 to Year 1 for Sales Revenue. There are no debt and interest payments. Beginning period Net PPE for Year 0 is $85 million. Project Sales revenue, Net Profit, Gross Profit, EBIT, Net PPE and Net Working capital values for Year 1. [5] This is a subjective question, hence you have to write your answer in the Text-Field given below. You have performed the common sizing and horizontal analysis to the financial statements of X Co. You have selectively considered the current (Yearo) parameters, as mentioned in the table below. Based on the values, you have calculated the Year1 ratios and growth rates. Year 0 Year 1 The growth rate in Sales revenues (y-0- NA Gross Profit Margin 34% 35% SG&A expense Sales revenue 20% 25% Depreciation NetPPE:-1 10% Net Working capital turnover 5 Net PPE turnover Corporate Tax rate 25% 25% Given: Net Working Capital Turnover: Sales revenue Net Working capital Net PPE Turnover: Sales revenue Net PPE Depreciation Net PPE: Depreciation Beginning period Net PPE Sales revenue for X Co. at Year 0 $195 million. The growth rate of 5% at Year 1 denotes growth from Year 0 to Year 1 for Sales Revenue. There are no debt and interest payments. Beginning period Net PPE for Year 0 is $85 million. Project Sales revenue, Net Profit, Gross Profit, EBIT, Net PPE and Net Working capital values for Year 1. [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts