Question: This is a subjective question, hence you have to write your 5. Green Tech corporation is considering a major investment proposal aimed at expanding its

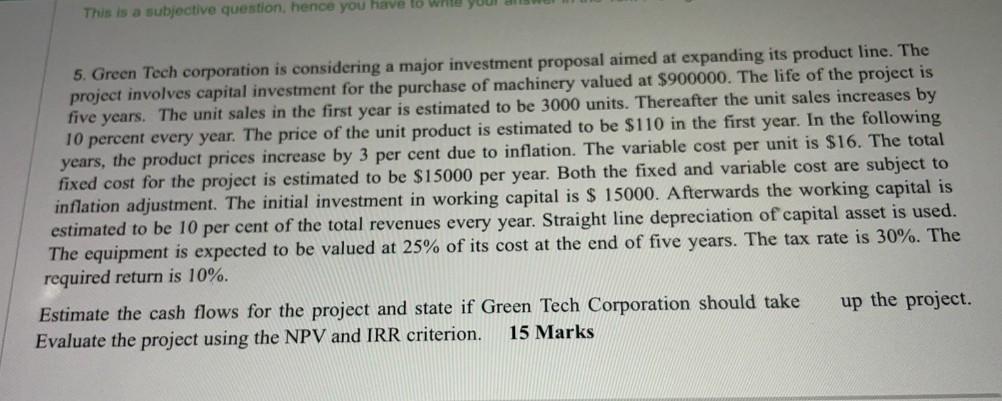

This is a subjective question, hence you have to write your 5. Green Tech corporation is considering a major investment proposal aimed at expanding its product line. The project involves capital investment for the purchase of machinery valued at $900000. The life of the project is five years. The unit sales in the first year is estimated to be 3000 units. Thereafter the unit sales increases by 10 percent every year. The price of the unit product is estimated to be $110 in the first year. In the following years, the product prices increase by 3 per cent due to inflation. The variable cost per unit is $16. The total fixed cost for the project is estimated to be $15000 per year. Both the fixed and variable cost are subject to inflation adjustment. The initial investment in working capital is $ 15000. Afterwards the working capital is estimated to be 10 per cent of the total revenues every year. Straight line depreciation of capital asset is used. The equipment is expected to be valued at 25% of its cost at the end of five years. The tax rate is 30%. The required return is 10%. up the project. Estimate the cash flows for the project and state if Green Tech Corporation should take Evaluate the project using the NPV and IRR criterion. 15 Marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock