Question: THIS IS A TAX QUESTION - NOT ACCOUNTING. PLEASE DO NOT USE STRAIGHT LINE DEPRECIATING. I WANT TO SEE TAX CONCEPTS IN THE ANSWER NOT

THIS IS A TAX QUESTION - NOT ACCOUNTING. PLEASE DO NOT USE STRAIGHT LINE DEPRECIATING. I WANT TO SEE TAX CONCEPTS IN THE ANSWER NOT SIMPLE DEPRECIATION. I WANT TO SEE APPLICATION OF S179, THE BONUS DEPRECIATION.

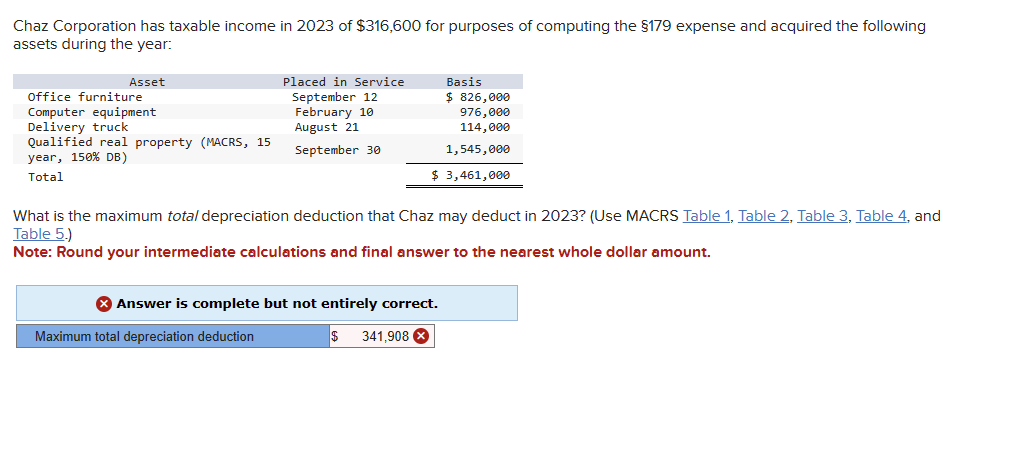

Chaz Corporation has taxable income in 2023 of $316,600 for purposes of computing the $179 expense and acquired the following assets during the year: What is the maximum total depreciation deduction that Chaz may deduct in 2023? (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Round your intermediate calculations and final answer to the nearest whole dollar amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts