Question: This is a timed question, just need answer as quickly as possible. Please and thanks Question 5 2 pts A parent sells inventory costing $90,000

This is a timed question, just need answer as quickly as possible. Please and thanks

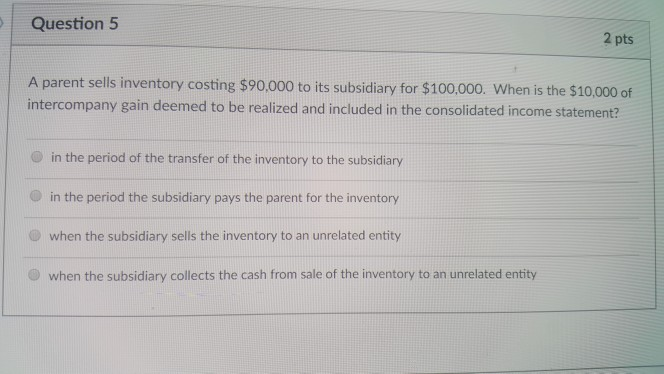

Question 5 2 pts A parent sells inventory costing $90,000 to its subsidiary for $100,000. When is the $10,000 of intercompany gain deemed to be realized and included in the consolidated income statement? O in the period of the transfer of the inventory to the subsidiary O in the period the subsidiary pays the parent for the inventory when the subsidiary sells the inventory to an unrelated entity O when the subsidiary collects the cash from sale of the inventory to an unrelated entity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts