Question: This is a two part question. PLEASE SHOW ALL WRITTEN WORK. Thank you! Part B: Calculation Problems. Please show your work carefully. Q1. (1) (8

This is a two part question. PLEASE SHOW ALL WRITTEN WORK. Thank you!

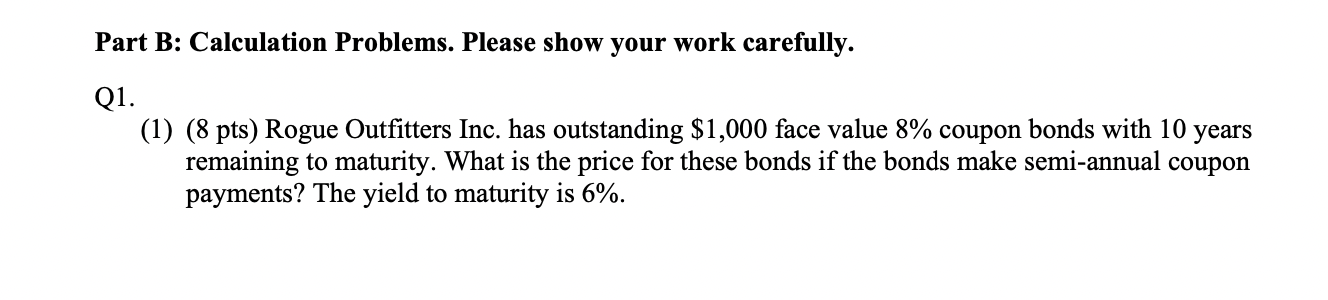

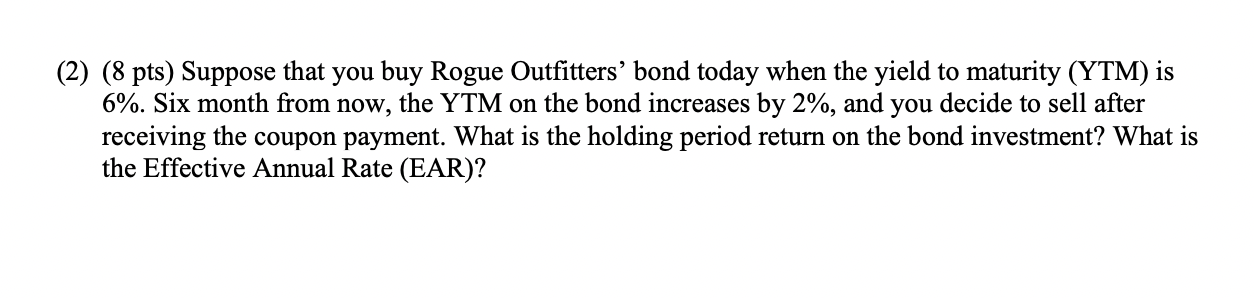

Part B: Calculation Problems. Please show your work carefully. Q1. (1) (8 pts) Rogue Outfitters Inc. has outstanding $1,000 face value 8% coupon bonds with 10 years remaining to maturity. What is the price for these bonds if the bonds make semi-annual coupon payments? The yield to maturity is 6%. (2) (8 pts) Suppose that you buy Rogue Outfitters' bond today when the yield to maturity (YTM) is 6%. Six month from now, the YTM on the bond increases by 2%, and you decide to sell after receiving the coupon payment. What is the holding period return on the bond investment? What is the Effective Annual Rate (EAR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts