Question: This is a two-part question. First, choose any three terms from the list of special provisions that can be found in an insurance contract (see

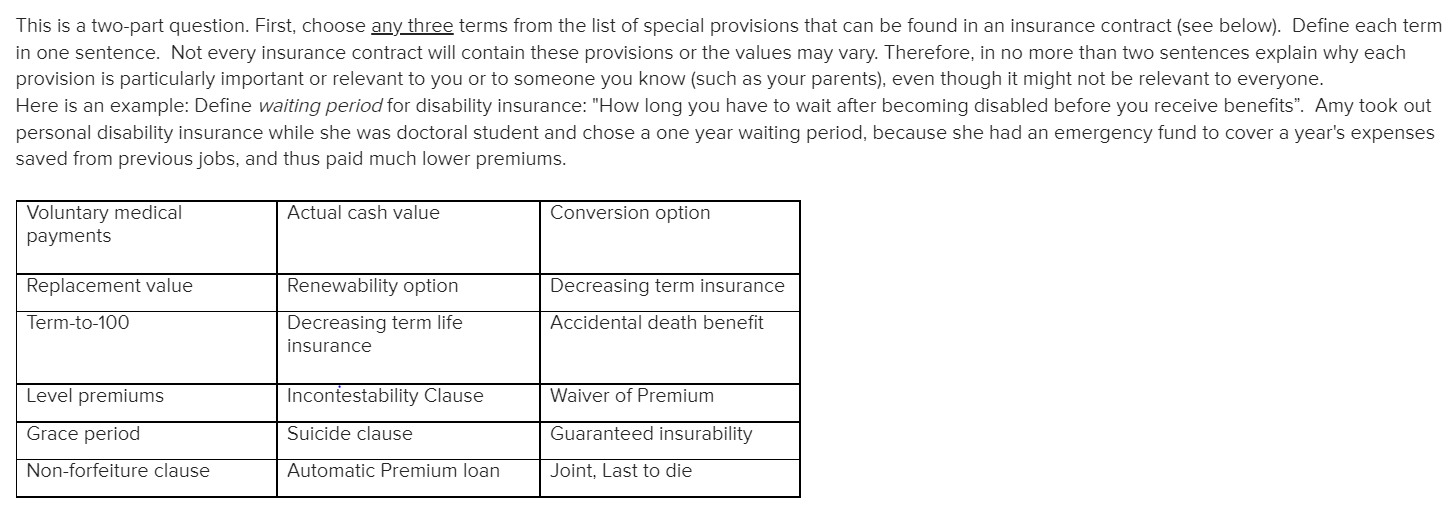

This is a two-part question. First, choose any three terms from the list of special provisions that can be found in an insurance contract (see below). Define each term in one sentence. Not every insurance contract will contain these provisions or the values may vary. Therefore, in no more than two sentences explain why each provision is particularly important or relevant to you or to someone you know (such as your parents), even though it might not be relevant to everyone. Here is an example: Define waiting period for disability insurance: "How long you have to wait after becoming disabled before you receive benefits". Amy took out personal disability insurance while she was doctoral student and chose a one year waiting period, because she had an emergency fund to cover a year's expenses saved from previous jobs, and thus paid much lower premiums. Actual cash value Conversion option Voluntary medical payments Replacement value Renewability option Decreasing term insurance Term-to-100 Accidental death benefit Decreasing term life insurance Level premiums Incontestability Clause Waiver of Premium Grace period Suicide clause Guaranteed insurability Non-forfeiture clause Automatic Premium loan Joint, Last to die

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts