Question: this is all apart of the same question Genera Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for

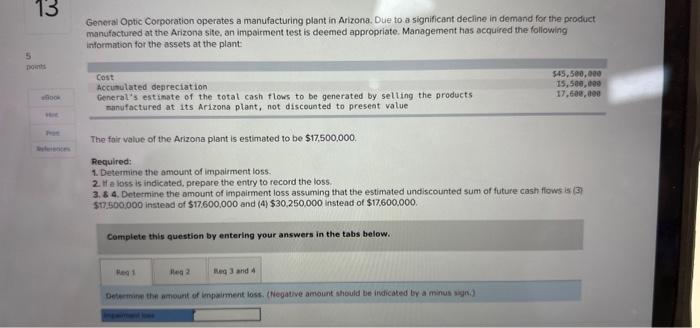

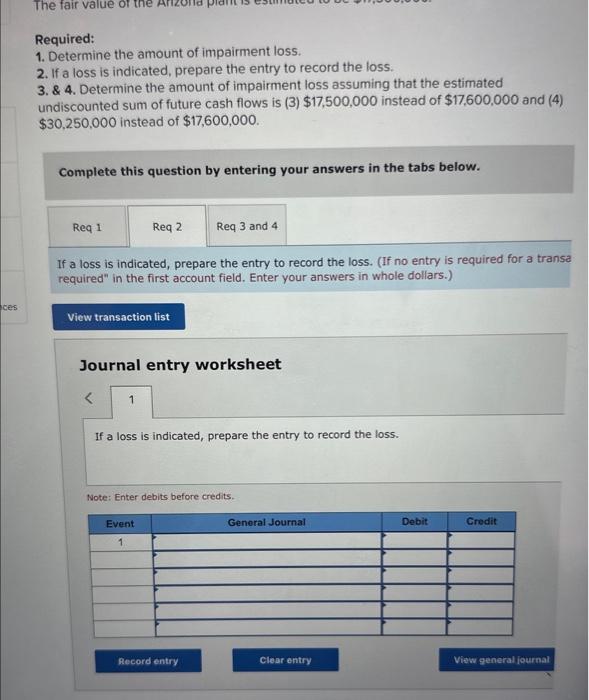

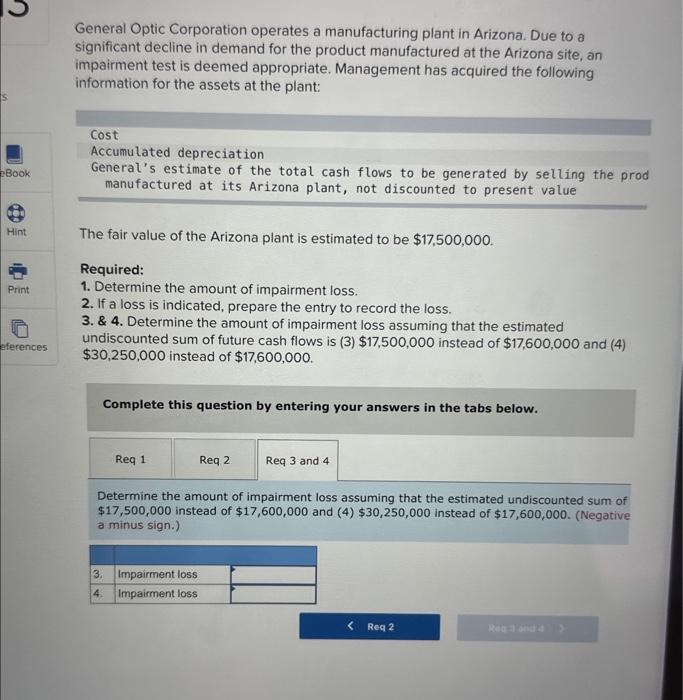

Genera Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufoctured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant: The foir value of the Arizona plant is estimated to be $17,500,000. Required: 1. Determine the amount of impairment loss. 2. He loss is indicated, prepare the entry to record the loss. 3. 8 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $13,500,000 instead of $17,600,000 and (4)$30,250,000 instead of $17,600,000. Complete this question by entering your answers in the tabs below. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $17,500,000 instead of $17,600,000 and (4) $30,250,000 instead of $17,600,000. Complete this question by entering your answers in the tabs below. If a loss is indicated, prepare the entry to record the loss. (If no entry is required for a transa required" in the first account field. Enter your answers in whole dollars.) Journal entry worksheet If a loss is indicated, prepare the entry to record the loss. Note: Enter debits before credits. General Optic Corporation operates a manufacturing plant in Arizona. Due to a significant decline in demand for the product manufactured at the Arizona site, an impairment test is deemed appropriate. Management has acquired the following information for the assets at the plant: The fair value of the Arizona plant is estimated to be $17,500,000. Required: 1. Determine the amount of impairment loss. 2. If a loss is indicated, prepare the entry to record the loss. 3. \& 4. Determine the amount of impairment loss assuming that the estimated undiscounted sum of future cash flows is (3) $17,500,000 instead of $17,600,000 and (4) $30,250,000 instead of $17,600,000. Complete this question by entering your answers in the tabs below. Determine the amount of impairment loss assuming that the estimated undiscounted sum of $17,500,000 instead of $17,600,000 and (4) $30,250,000 instead of $17,600,000. (Negative a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts