Question: This is all one problem and not individual questions. options for #1 are 200,000; 120,000; 80,000; (80,000) options for #2 are 255,000; 170,000; 85,000; (85,000)

This is all one problem and not individual questions.

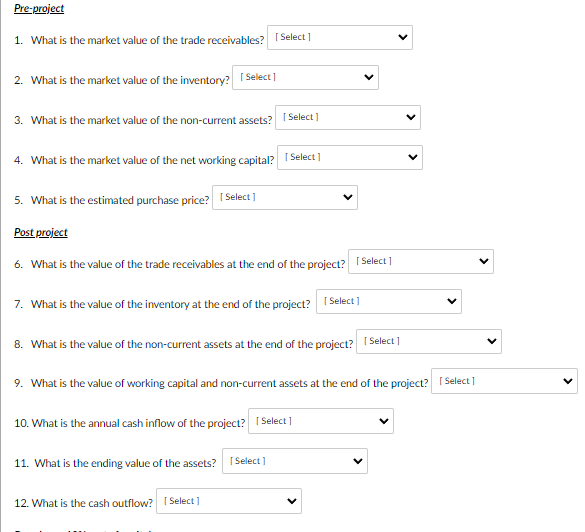

options for #1 are 200,000; 120,000; 80,000; (80,000)

options for #2 are 255,000; 170,000; 85,000; (85,000)

options for #3 are 2,000,000; 1,500,000; 1,380,000; 860,000

options for #4 are 180,000; 130,000; (180,000); (130,000)

options for #5 are 1,000,000; 600,000; 400,000; 200,000

options for #6 are 200,000; 120,000; 80,000; 72,000

options for #7 are 170,000; 102,000; 85,000; 68,000

options for #8 are 3,000,000; 1,920,000; 1,500,000; 960,000

options for #9 are 3,740,000; 3,140,000; 2,650,000; 1,180,000

options for #10 are 400,000; 300,000; 200,000; 100,000

options for #11 are 3,140,000; 2,030,000; 1,500,000; 750,000

options for #12 are 3,140,000; 3,000,000; 2,030,000; 1,380,000

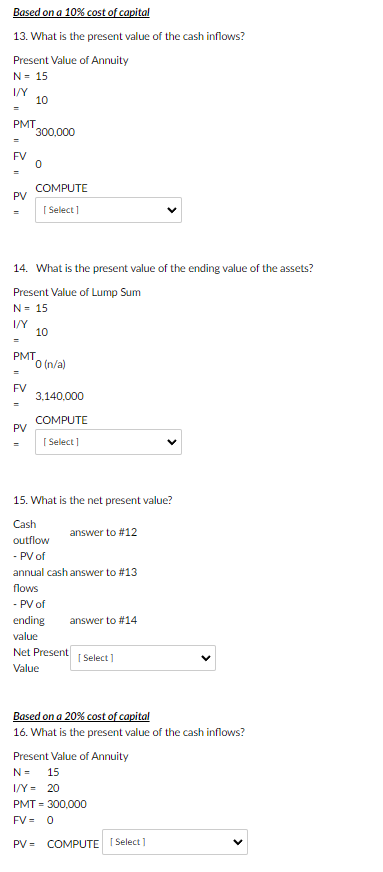

options for #13 are 4,500,000; 2,281,824; 1,253,174; 1,077,264

options for #14 are 3,140,000; 2,640,000; 751,691; 209,333

options for #15 are 3,003,515; 1,564,440; 1,003,515; 1,000,000

options for #16 are 4,500,000; 1,402,642; 900,000; 203,817

options for #17 are 573,666; 385,889; 203,803; 131,758

options for #18 are 1,003,515; 423,555; (423,555); (1,003,515)

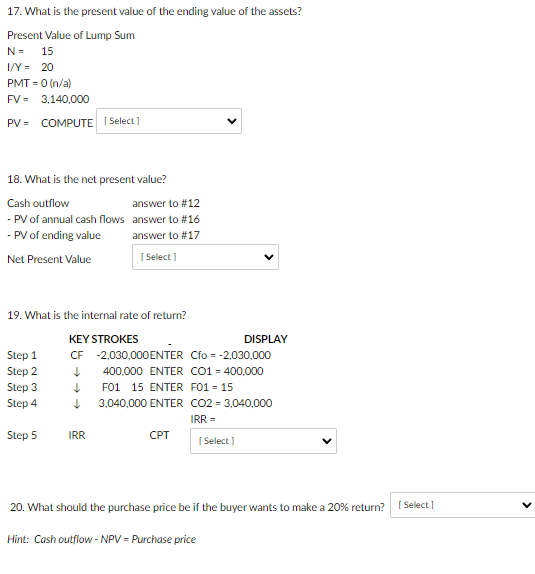

options for #19 are 20%; 15%; 12%; 12%; 10%

options for #20 are 3,140,000; 2,030,000; 1,606,467; 1,606,445;

Thank you

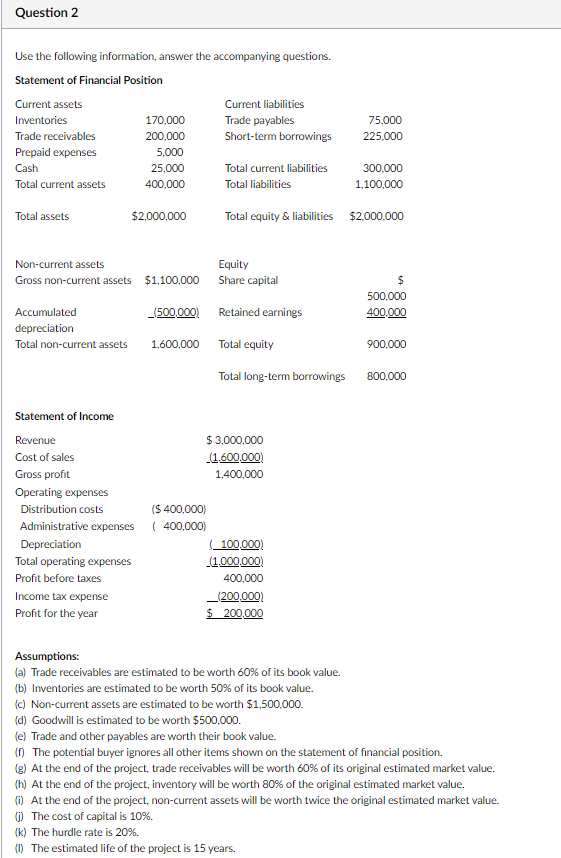

1. What is the market value of the trade receivables? 2. What is the market value of the inventory? 3. What is the market value of the non-current assets? 4. What is the market value of the net working capital? 5. What is the estimated purchase price? Post project 6. What is the value of the trade receivables at the end of the project? 7. What is the value of the inventory at the end of the project? 8. What is the value of the non-current assets at the end of the project? 9. What is the value of working capital and non-current assets at the end of the project? 10. What is the annual cash inflow of the project? 11. What is the ending value of the assets? 12. What is the cash outflow? 17. What is the present value of the ending value of the assets? Present Value of Lump Sum N=15I/Y=20PMT=0(n/a)FV=3,140,000PV=COMPUTE 18. What is the net present value? Cash outflow answer to \#12 - PV of annual cash flows answer to \#16 - PV of ending value answer to \#17 Net Present Value 19. What is the internal rate of return? 20. What should the purchase price be if the buyer wants to make a 20% return? Hint: Cash outflow - NPV = Purchase price Use the following information, answer the accompanying questions. Statement of Financial Position Assumptions: (a) Trade receivables are estimated to be worth 60% of its book value. (b) Inventories are estimated to be worth 50% of its book value. (c) Non-current assets are estimated to be worth $1,500,000. (d) Goodwill is estimated to be worth $500,000. (e) Trade and other payables are worth their book value. (f) The potential buyer ignores all other items shown on the statement of financial position. (g) At the end of the project, trade receivables will be worth 60% of its original estimated market value. (h) At the end of the project, inventory will be worth 80% of the original estimated market value. (i) At the end of the project, non-current assets will be worth twice the original estimated market value. (j) The cost of capital is 10%. (k) The hurdle rate is 20%. (I) The estimated life of the project is 15 years. Based on a 10% cost of capital 13. What is the present value of the cash inflows? Present Value of Annuity N=15I/Y10=10PMT300,000=FV=0PV= 14. What is the present value of the ending value of the assets? Present Value of Lump Sum N=15I/Y=10PMT0(n/a)=FVFV3,140,000=COMPUTEPV= 15. What is the net present value? Cash outflow - PV of annual cash answer to \#13 flows - PV of ending answer to \#14 value Net Present Value Based on a 20% cost of capital 16. What is the present value of the cash inflows? Present Value of Annuity N=15I/Y=20PMT=300,000FV=0PV=COMPUTE 1. What is the market value of the trade receivables? 2. What is the market value of the inventory? 3. What is the market value of the non-current assets? 4. What is the market value of the net working capital? 5. What is the estimated purchase price? Post project 6. What is the value of the trade receivables at the end of the project? 7. What is the value of the inventory at the end of the project? 8. What is the value of the non-current assets at the end of the project? 9. What is the value of working capital and non-current assets at the end of the project? 10. What is the annual cash inflow of the project? 11. What is the ending value of the assets? 12. What is the cash outflow? 17. What is the present value of the ending value of the assets? Present Value of Lump Sum N=15I/Y=20PMT=0(n/a)FV=3,140,000PV=COMPUTE 18. What is the net present value? Cash outflow answer to \#12 - PV of annual cash flows answer to \#16 - PV of ending value answer to \#17 Net Present Value 19. What is the internal rate of return? 20. What should the purchase price be if the buyer wants to make a 20% return? Hint: Cash outflow - NPV = Purchase price Use the following information, answer the accompanying questions. Statement of Financial Position Assumptions: (a) Trade receivables are estimated to be worth 60% of its book value. (b) Inventories are estimated to be worth 50% of its book value. (c) Non-current assets are estimated to be worth $1,500,000. (d) Goodwill is estimated to be worth $500,000. (e) Trade and other payables are worth their book value. (f) The potential buyer ignores all other items shown on the statement of financial position. (g) At the end of the project, trade receivables will be worth 60% of its original estimated market value. (h) At the end of the project, inventory will be worth 80% of the original estimated market value. (i) At the end of the project, non-current assets will be worth twice the original estimated market value. (j) The cost of capital is 10%. (k) The hurdle rate is 20%. (I) The estimated life of the project is 15 years. Based on a 10% cost of capital 13. What is the present value of the cash inflows? Present Value of Annuity N=15I/Y10=10PMT300,000=FV=0PV= 14. What is the present value of the ending value of the assets? Present Value of Lump Sum N=15I/Y=10PMT0(n/a)=FVFV3,140,000=COMPUTEPV= 15. What is the net present value? Cash outflow - PV of annual cash answer to \#13 flows - PV of ending answer to \#14 value Net Present Value Based on a 20% cost of capital 16. What is the present value of the cash inflows? Present Value of Annuity N=15I/Y=20PMT=300,000FV=0PV=COMPUTE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts