Question: this is all one problem but I just need help with part 6. please Estimated factory overhead costs for March: Indirect factory wages Depreciation of

this is all one problem but I just need help with part 6. please

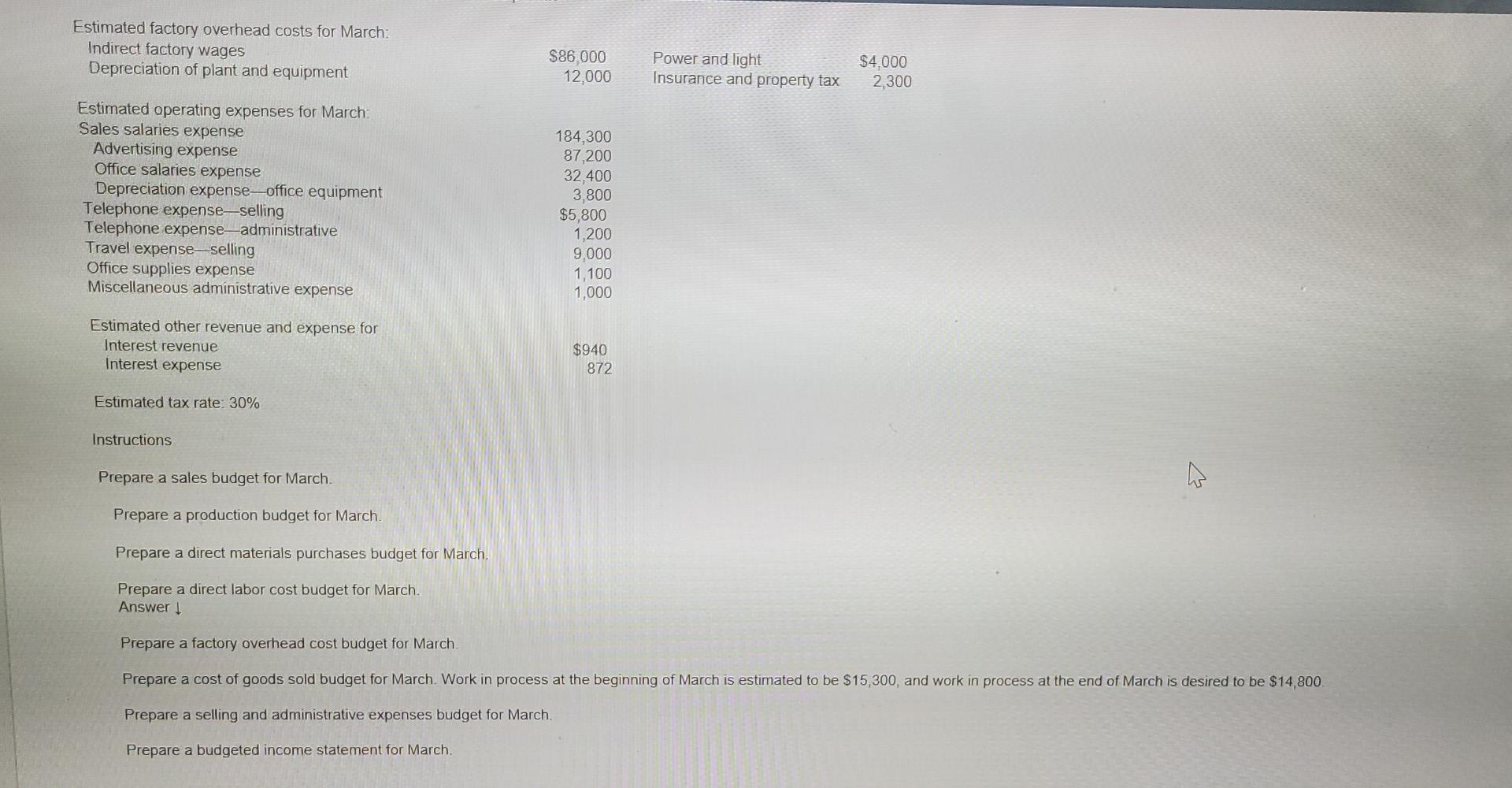

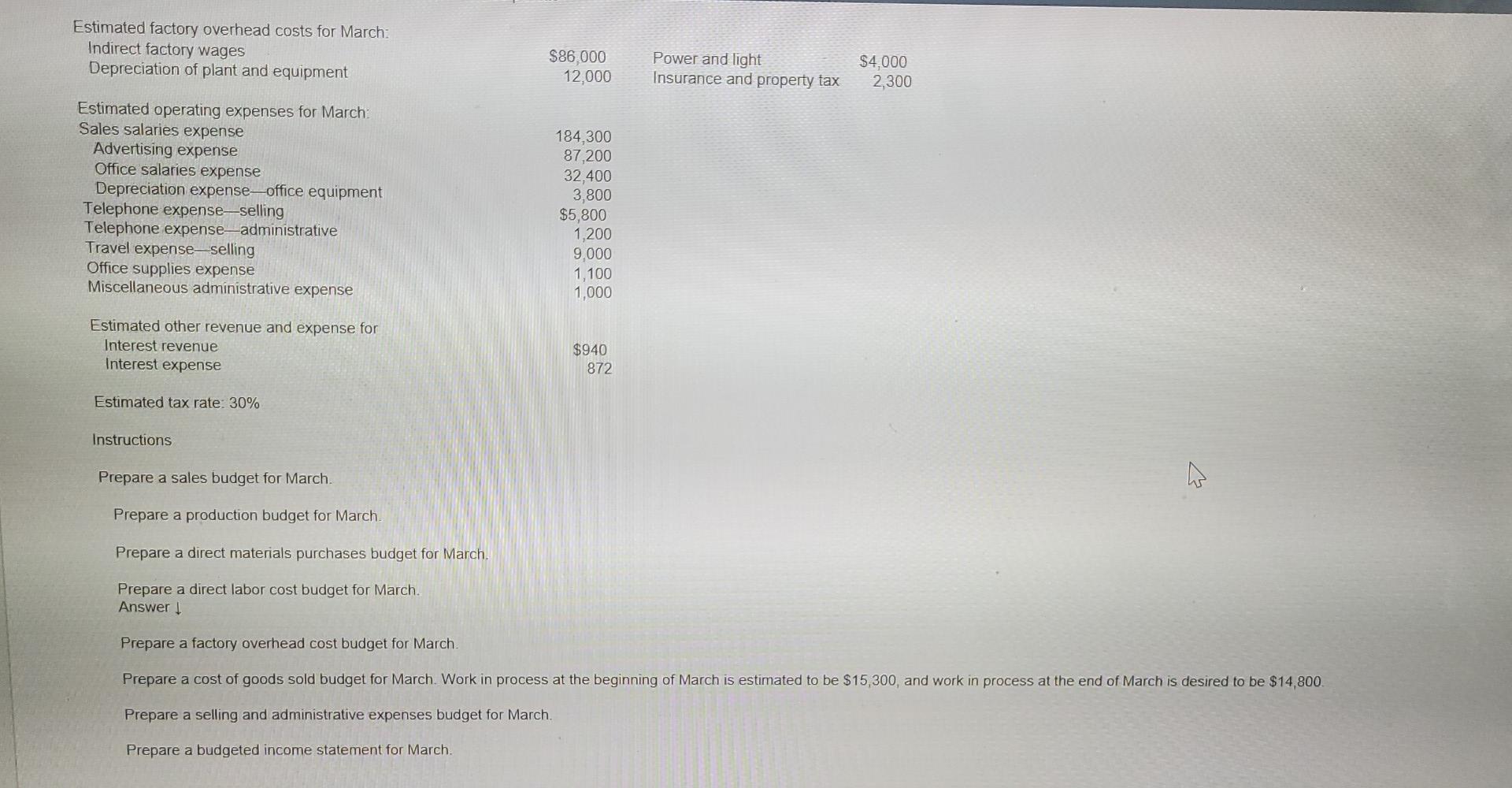

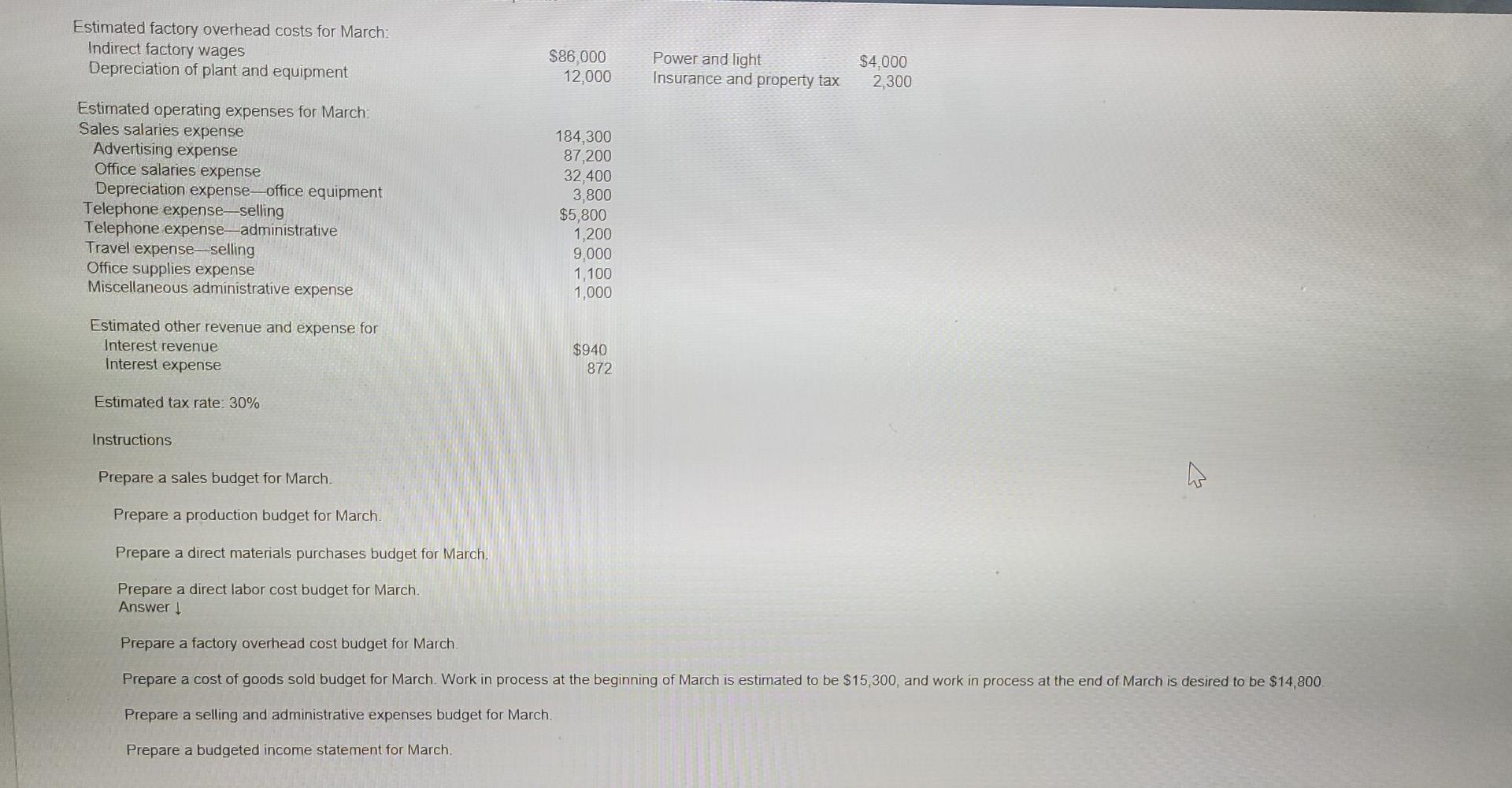

Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300 Estimated factory overhead costs for March: Indirect factory wages Depreciation of plant and equipment Estimated operating expenses for March: Sales salaries expense Advertising expense Office salaries expense Depreciation expense-office equipment Telephone expense-selling Telephone expense-administrative Travel expense-selling Office supplies expense Miscellaneous administrative expense Estimated other revenue and expense for Interest revenue Interest expense Estimated tax rate: 30% Instructions 4 Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Answer! Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be $15,300, and work in process at the end of March is desired to be $14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March. $86,000 12,000 184,300 87,200 32,400 3,800 $5,800 1,200 9,000 1,100 1,000 $940 872 Power and light $4,000 Insurance and property tax 2,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts