Question: this is all one problem. pleaee conplete all correctly and i will give a thumbs up! Required information [The following information applies to the questions

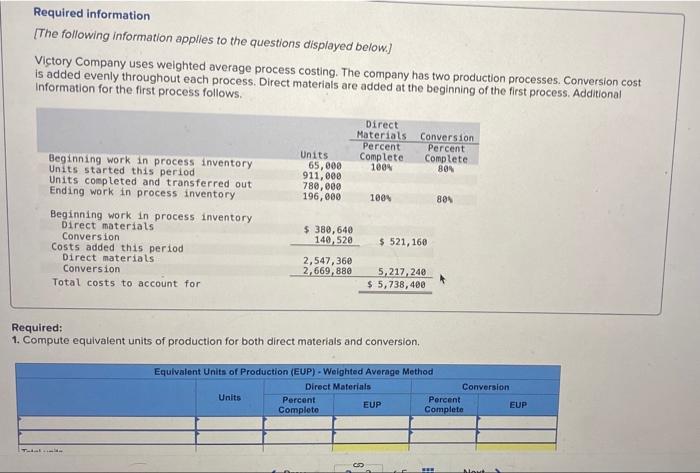

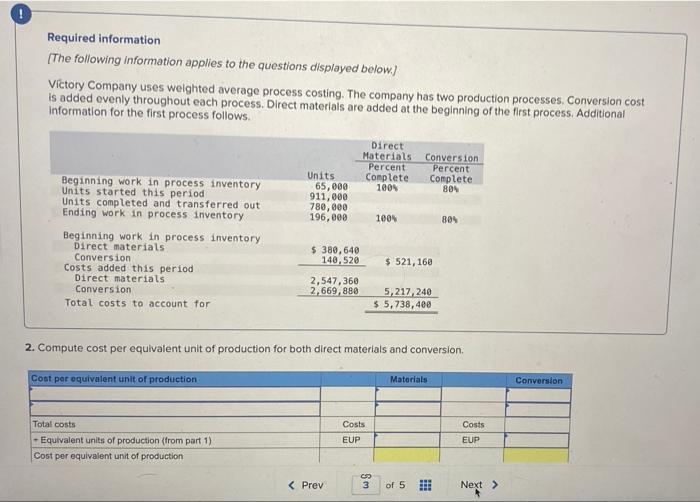

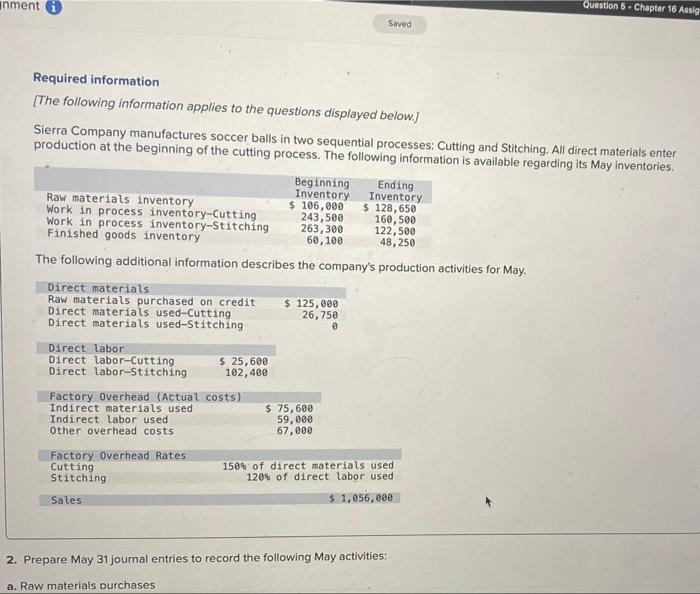

Required information [The following information applies to the questions displayed below.) Victory Company uses weighted average process costing. The company has two production processes. Conversion cost is added evenly throughout each process. Direct materials are added at the beginning of the first process. Additional Information for the first process follows Direct Materials Conversion Percent Percent Complete Complete 1004 809 Units 65,000 911,000 780,000 196,000 100 805 Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for $ 380,640 140,520 $ 521,160 2,547,36 2,669,880 5,217,240 $ 5,738, 400 Required: 1. Compute equivalent units of production for both direct materials and conversion, Equivalent Units of Production (EUP) - Weighted Average Method Direct Materials Conversion Units Percent EUP Percent EUP Complete Complete NAM Required information [The following information applies to the questions displayed below) Victory Company uses weighted average process costing. The company has two production processes. Conversion cost Is added evenly throughout each process. Direct materials are added at the beginning of the first process. Additional Information for the first process follows. Direct Materials Conversion Percent Percent Complete Complete 100% 804 Beginning work in process inventory Units started this period Units completed and transferred out Ending work in process inventory Units 65,000 911,000 780,000 196,000 100% 899 $ 380,640 148,520 $ 521, 160 Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for 2,547,360 2,669,880 5,217,240 55,738, 408 2. Compute cost per equivalent unit of production for both direct materials and conversion Cost per equivalent unit of production Materials Conversion Costs Total costs - Equivalent units of production (from part 1) Cost per equivalent unit of production Costs EUP EUP Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching. All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories. Beginning Ending Inventory Raw materials inventory Inventory $ 106,000 Work in process inventory-Cutting $ 128,650 243,500 160,500 Work in process inventory-stitching 263,300 122,500 Finished goods inventory 60,100 48,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit $ 125,000 Direct materials used-Cutting 26,750 Direct materials used-Stitching Direct labor Direct labor-cutting 25,600 Direct labor-Stitching 102,400 Factory Overhead (Actual costs) Indirect materials used $ 75,600 Indirect labor used 59,000 Other overhead costs 67,000 Factory Overhead Rates Cutting 150% of direct materials used Stitching 120% of direct labor used Sales $ 1,056,000 Required: 1. Compute the amount of (a) production costs transferred from Cutting to Stitching, (b) production costs transferred from Stitching to finished goods, and (c) cost of goods sold. Hint: Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department roul HI Next inment Question 5 - Chapter 16 Assig Saved Required information [The following information applies to the questions displayed below.) Sierra Company manufactures soccer balls in two sequential processes: Cutting and Stitching, All direct materials enter production at the beginning of the cutting process. The following information is available regarding its May inventories, Beginning Ending Inventory Inventory Raw materials inventory $ 106,000 $ 128,650 Work in process inventory-Cutting 243,500 160,500 Work in process inventory-Stitching 263,300 122, Finished goods inventory 60, 100 48,250 The following additional information describes the company's production activities for May. Direct materials Raw materials purchased on credit $ 125,000 Direct materials used-cutting 26,750 Direct materials used-stitching Direct labor Direct labor-Cutting $ 25,600 Direct labor-Stitching 102,400 Factory Overhead (Actual costs) Indirect materials used $ 75,600 Indirect labor used 59,000 other overhead costs 67,000 Factory Overhead Rates Cutting 150% of direct materials used Stitching 120% of direct labor used Sales $ 1,056,000 2. Prepare May 31 journal entries to record the following May activities: a. Raw materials purchases 2. Prepare May 31 journal entries to record the following May activities: a. Raw materials purchases b. Direct materials used c. Indirect materials used d. Direct labor used e. Indirect labor used f. Other overhead costs paid in cash g. Overhead applied h. Goods transferred from Cutting to Stitching i. Goods transferred from Stitching to finished goods j. Sales (on account) k. Cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts