Question: This is all one problem, please bold final answers here this is the coreect one, sorry the last update was wrong Required information Problem 8-47

![below ] Whitney received $75,700 of taxable income in 2022 . All](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f704c64bfeb_64566f704c5dc980.jpg)

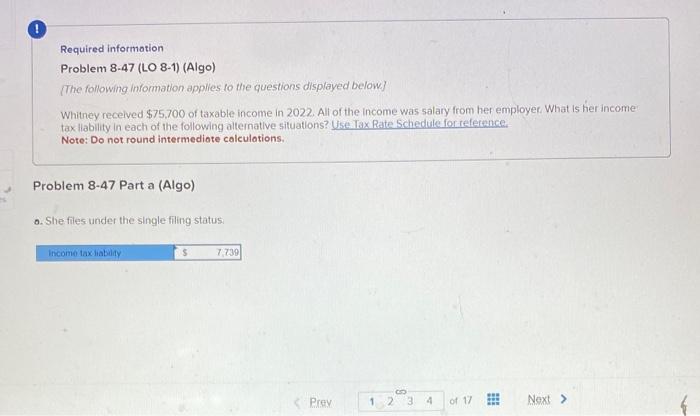

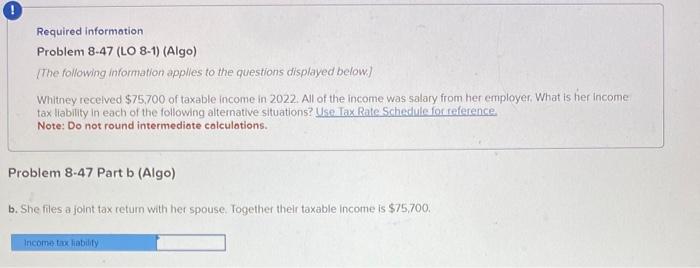

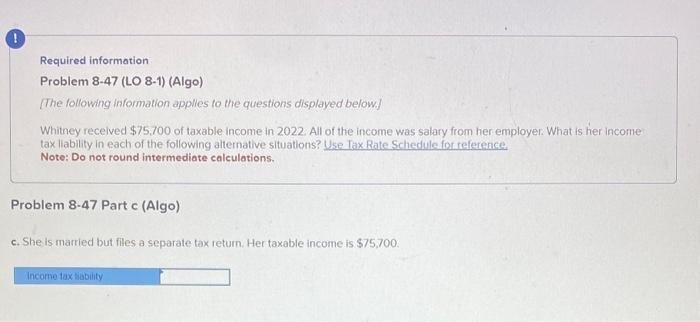

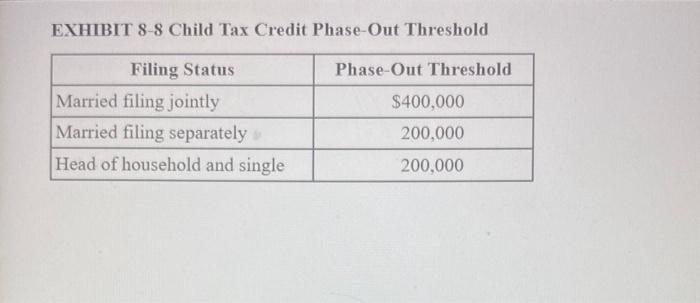

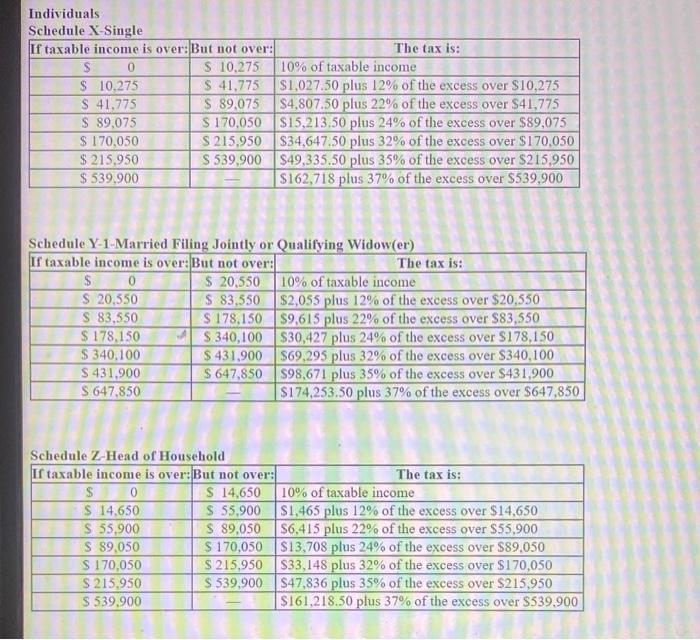

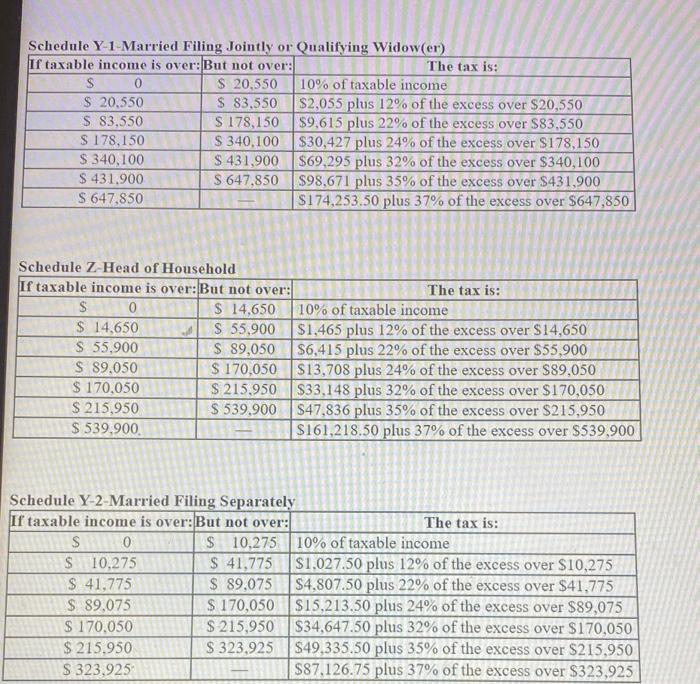

Required information Problem 8-47 (LO 8-1) (Algo) [The following information applies to the questions displayed below ] Whitney received $75,700 of taxable income in 2022 . All of the income was salary from her employer. What is her income: tax liability in each of the following alternative situations? Use Tax Rate Schedule for refertance. Note: Do not round intermediote calculations. Problem 8-47 Part a (Algo) o. She files under the single filing status Required information Problem 8-47 (LO 8-1) (Algo) The following information applies to the questions displayed below. Whitney recelved $75.700 of taxable income in 2022 . All of the income was salary from her employer, What is her income tax liability in each of the following alternative situations? Use Tax Rate Schedule for reference. Note: Do not round intermediate calculations. Problem 8-47 Part b (Algo) b. She files a joint tax return with her spouse. Together their taxable income is $75,700. Required information Problem 8-47 (LO 8-1) (Algo) [The following information applies to the questions displayed be/ow.] Whitney recelved $75.700 of taxable income in 2022 . All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations? Use Tax Rate Sichedule for reference. Note: Do not round intermediate calculations. Problem 8-47 Part c (Algo) c. She is married but files a separate tax return. Her taxable income is $75,700. Required information Problem 8-47 (LO 8-1) (Algo) [The following information applies to the questions displayed belowi] Whitney recelved $75,700 of taxable income in 2022. All of the income was salary from her employer What is her income tax liability in each of the following alternative situations? Use Tax Rote Schedule for reference. Note: Do not round intermediate calculations. Problem 8-47 Part d (Algo) d. She files as a head of household. EXHIBIT 8-8 Child Tax Credit Phase-Out Threshold Individuals oul......1 v ot..nt. Schernla Y-1-Marriad Filino Inintly nu Culifvine Widnw(an)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts