Question: *THIS IS ALL ONE QUESTION* During 2021, its first year of operations, Pave Construction provides services on account of $148,000. By the end of 2021,

*THIS IS ALL ONE QUESTION*

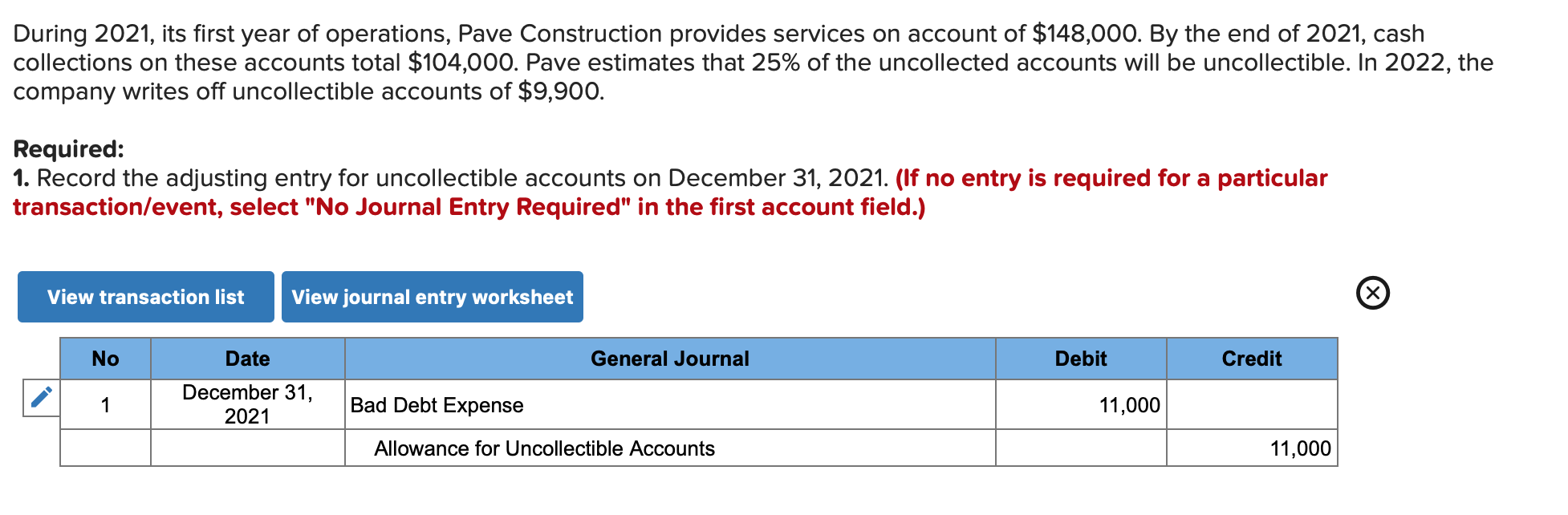

During 2021, its first year of operations, Pave Construction provides services on account of $148,000. By the end of 2021, cash collections on these accounts total $104,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2022, the company writes off uncollectible accounts of $9,900.

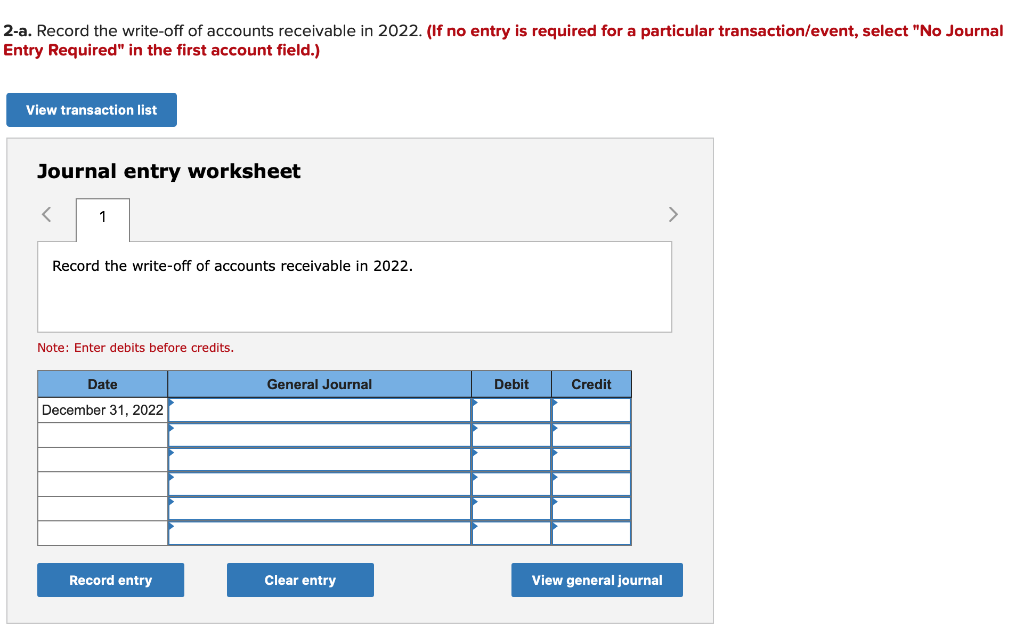

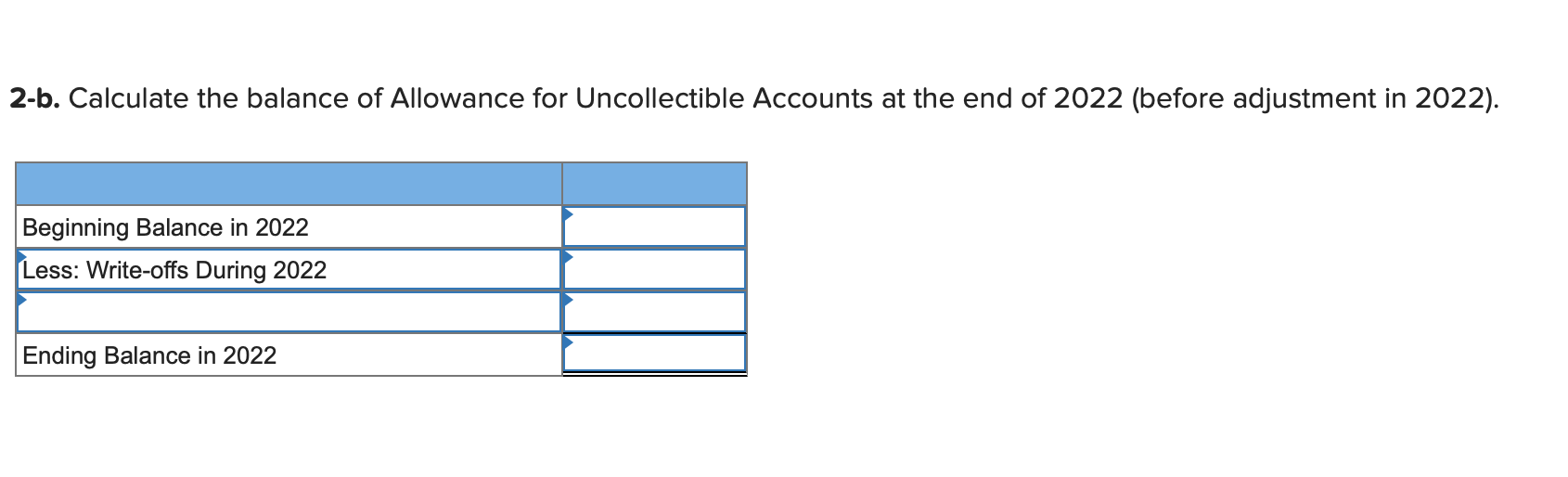

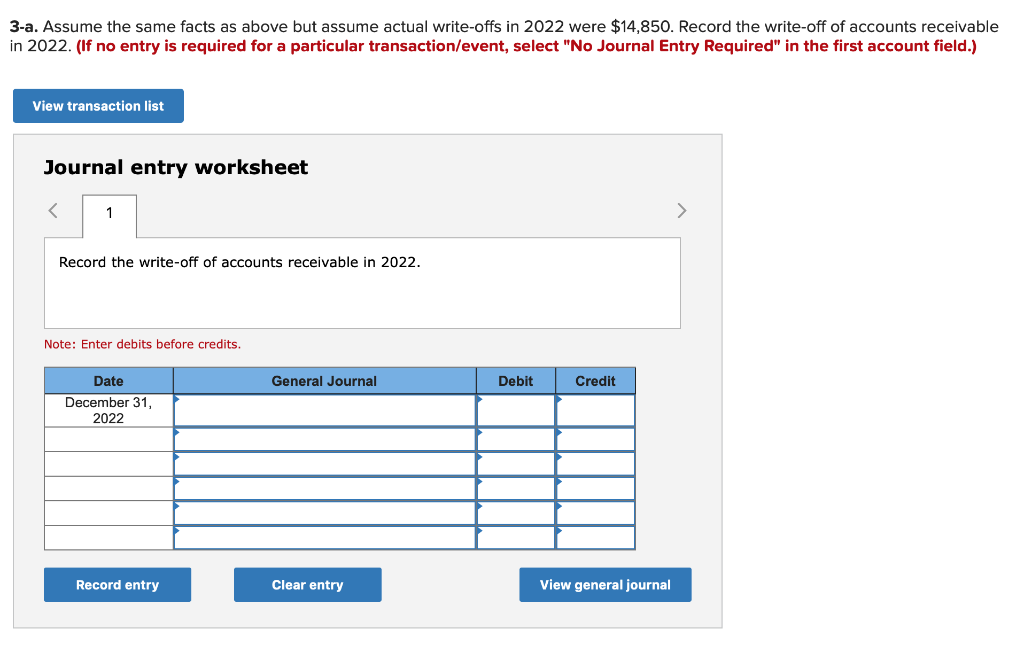

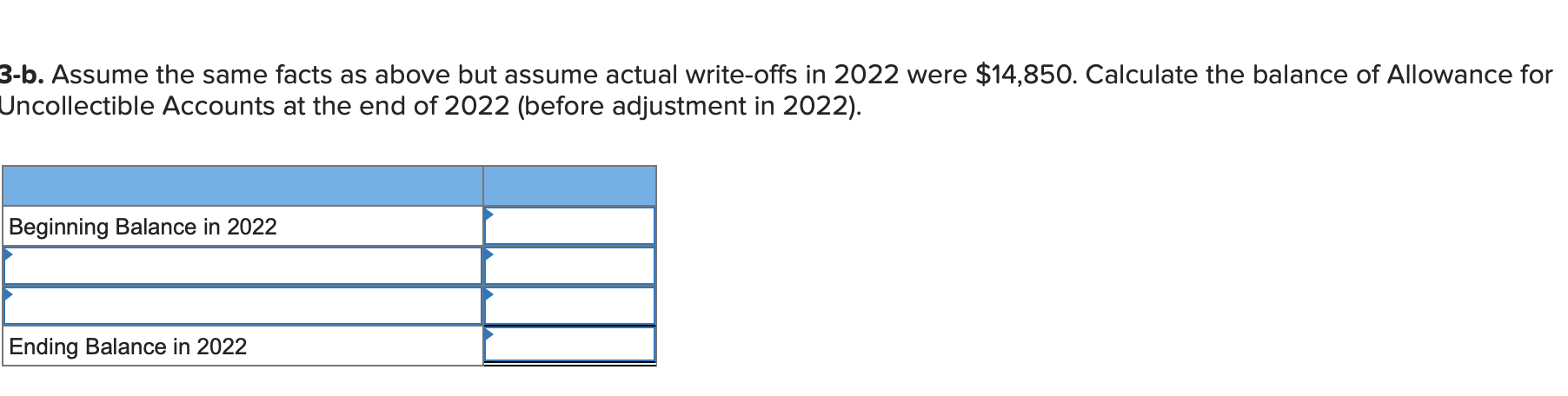

During 2021, its first year of operations, Pave Construction provides services on account of $148,000. By the end of 2021, cash collections on these accounts total $104,000. Pave estimates that 25% of the uncollected accounts will be uncollectible. In 2022, the company writes off uncollectible accounts of $9,900. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 December 31, 2021 Bad Debt Expense 11,000 Allowance for Uncollectible Accounts 11,000 2-a. Record the write-off of accounts receivable in 2022. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the write-off of accounts receivable in 2022. Note: Enter debits before credits. Date General Journal Debit Credit December 31, 2022 Record entry Clear entry View general journal 2-b. Calculate the balance of Allowance for Uncollectible Accounts at the end of 2022 (before adjustment in 2022). Beginning Balance in 2022 Less: Write-offs During 2022 Ending Balance in 2022 3-a. Assume the same facts as above but assume actual write-offs in 2022 were $14,850. Record the write-off of accounts receivable in 2022. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts