Question: this is all one question i need help with the calculatation on the first part 1. & 2. Prepare the journal entries to adjust the

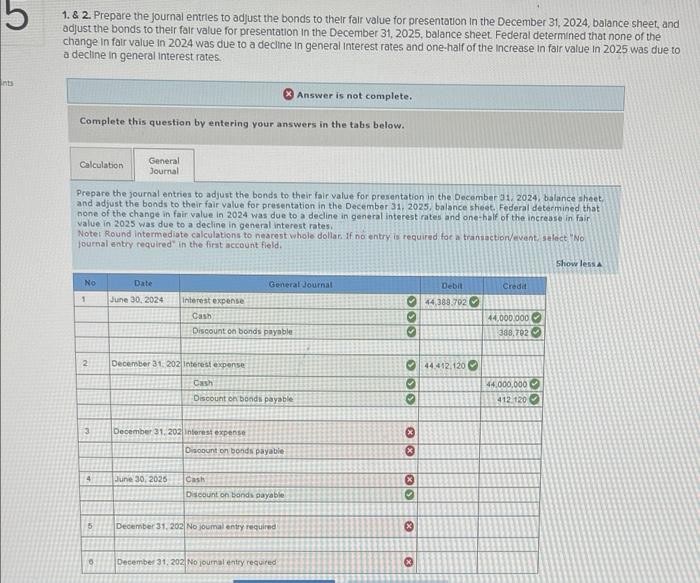

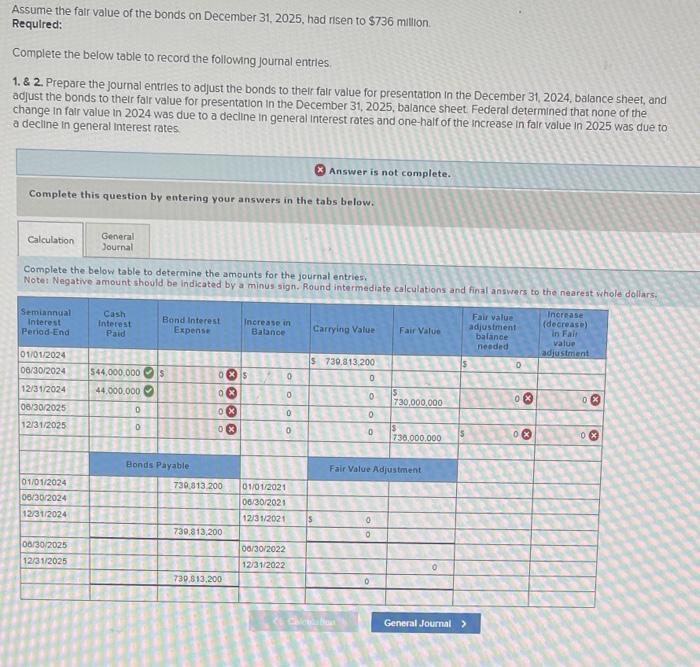

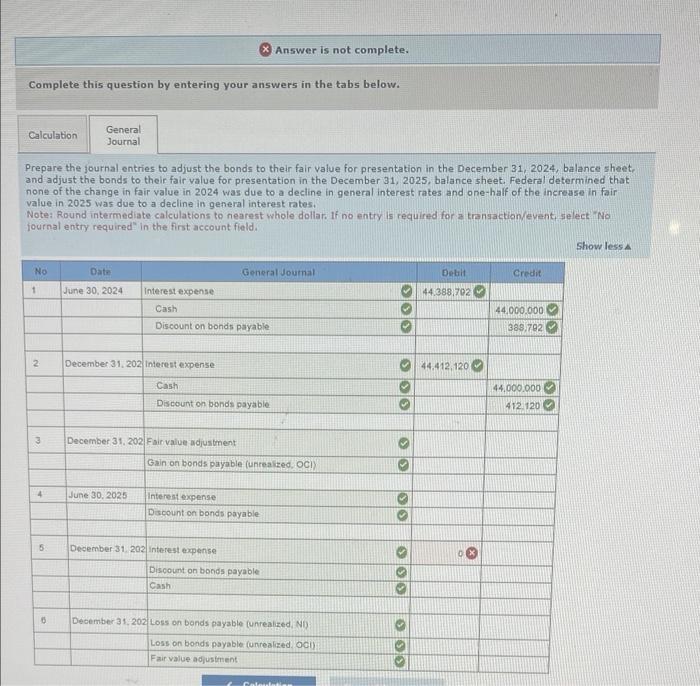

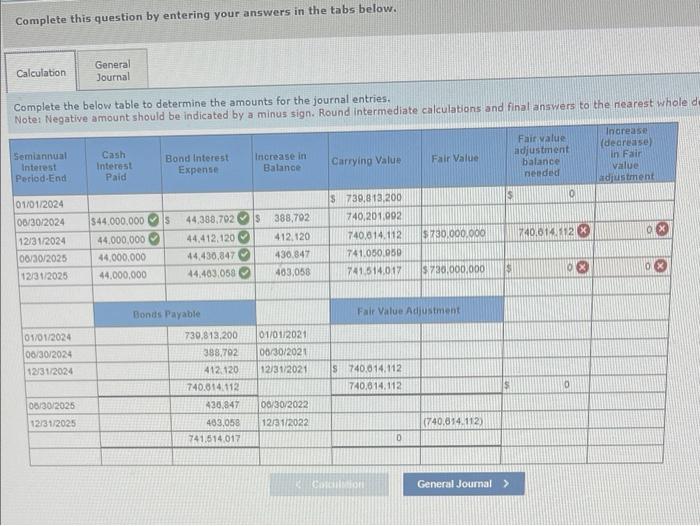

1. \& 2. Prepare the journal entries to adjust the bonds to their fair value for presentation in the December 31,2024 , balance sheet, and adjust the bonds to thetr fair value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increase in far value in 2025 was due to a decline in general interest rates. ( Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entries to adjust the bonds to their fair value for presentation in the Decomber 31, 2024, balance sheet and adjust the bonds to their fair value for presentation in the December 31,2025 , balance sheec. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increaso in fair. value in 2025 was due to a decline in general interest rates. Noter Round intermediate calculations to nearest whole dollar. If no entry is required foc a traniaction/event, salact "ivo fournal antry required" in the first account fleld, Assume the fair value of the bonds on December 31,2025 , had risen to $736 million. Required: Complete the below table to record the following joumal entrles, 1. \& 2. Prepare the joumal entrles to adjust the bonds to their falr value for presentation in the December 31,2024 , balance sheet, and adjust the bonds to their falr value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increase in fair value in 2025 was due to a decline in general interest rates. (x) Answer is not complete. Complete this question by entering your answers in the tabs below. Complete the below table to determine the amounts for the journal entries. Notei Negative amount should be indicated by a minus sign. Round intermediate calculations and final answers to the nearest whole dolliars. Complete this question by entering your answers in the tabs below. Prepare the journal entries to adjust the bonds to their fair value for presentation in the December 31,2024 , balance sheet. and adjust the bonds to their fair value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increase in fair value in 2025 was due to a decline in general interest rates. Note: Round intermediate calculations to nearest whole dollar. If no entry is required for a transaction/event, select. No fournal entry required" in the first account fleld. Complete this question by entering your answers in the tabs below. Complete the below table to determine the amounts for the journal entries. Notel Neative amount should be indicated by a minus sign. Round intermediate calculations and final answers to the nearest whole 1. \& 2. Prepare the journal entries to adjust the bonds to their fair value for presentation in the December 31,2024 , balance sheet, and adjust the bonds to thetr fair value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increase in far value in 2025 was due to a decline in general interest rates. ( Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare the journal entries to adjust the bonds to their fair value for presentation in the Decomber 31, 2024, balance sheet and adjust the bonds to their fair value for presentation in the December 31,2025 , balance sheec. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increaso in fair. value in 2025 was due to a decline in general interest rates. Noter Round intermediate calculations to nearest whole dollar. If no entry is required foc a traniaction/event, salact "ivo fournal antry required" in the first account fleld, Assume the fair value of the bonds on December 31,2025 , had risen to $736 million. Required: Complete the below table to record the following joumal entrles, 1. \& 2. Prepare the joumal entrles to adjust the bonds to their falr value for presentation in the December 31,2024 , balance sheet, and adjust the bonds to their falr value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increase in fair value in 2025 was due to a decline in general interest rates. (x) Answer is not complete. Complete this question by entering your answers in the tabs below. Complete the below table to determine the amounts for the journal entries. Notei Negative amount should be indicated by a minus sign. Round intermediate calculations and final answers to the nearest whole dolliars. Complete this question by entering your answers in the tabs below. Prepare the journal entries to adjust the bonds to their fair value for presentation in the December 31,2024 , balance sheet. and adjust the bonds to their fair value for presentation in the December 31,2025 , balance sheet. Federal determined that none of the change in fair value in 2024 was due to a decline in general interest rates and one-half of the increase in fair value in 2025 was due to a decline in general interest rates. Note: Round intermediate calculations to nearest whole dollar. If no entry is required for a transaction/event, select. No fournal entry required" in the first account fleld. Complete this question by entering your answers in the tabs below. Complete the below table to determine the amounts for the journal entries. Notel Neative amount should be indicated by a minus sign. Round intermediate calculations and final answers to the nearest whole

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts