Question: This is all one question. I'm having an issue with College Coasters is a San Diego-based merchandiser specializing in logo-adorned drink coasters. The company reported

This is all one question. I'm having an issue with

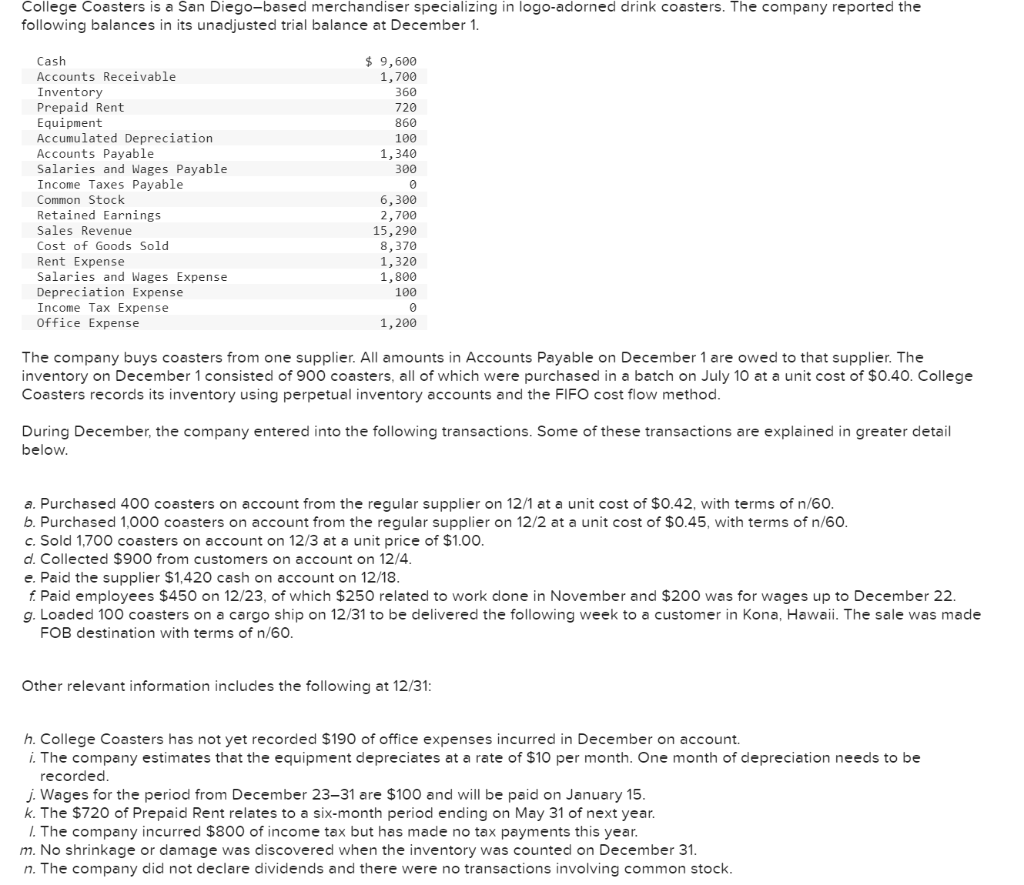

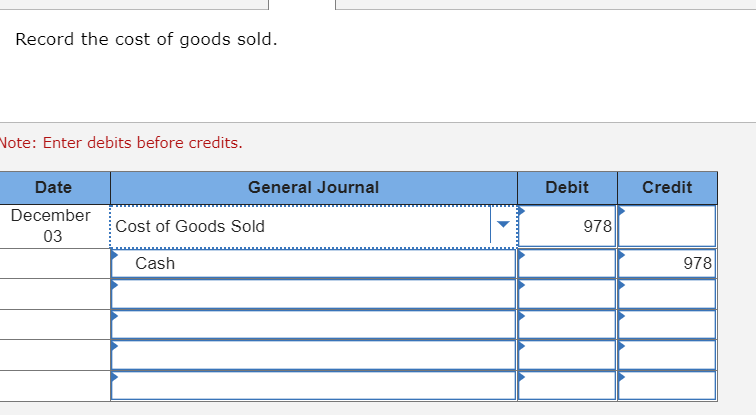

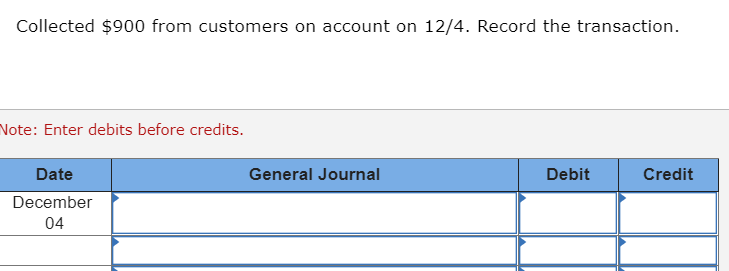

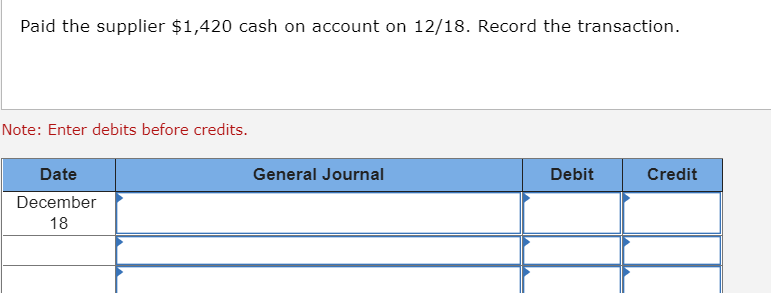

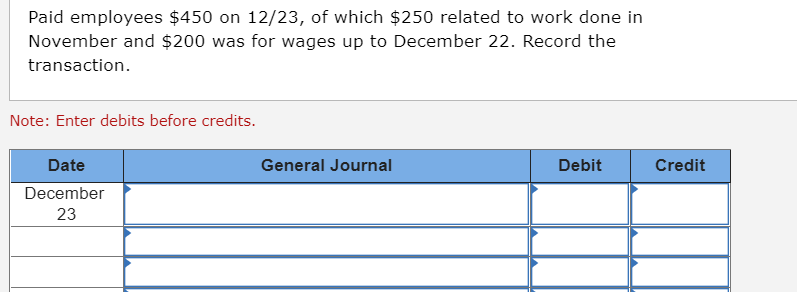

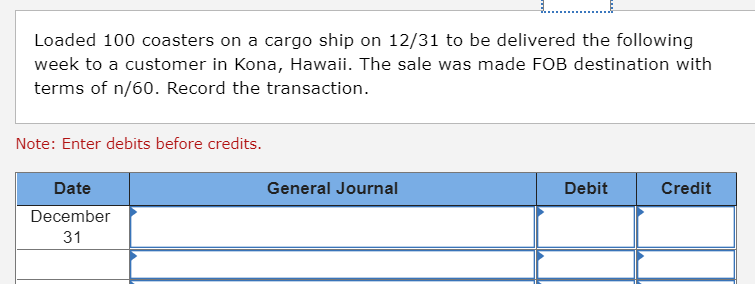

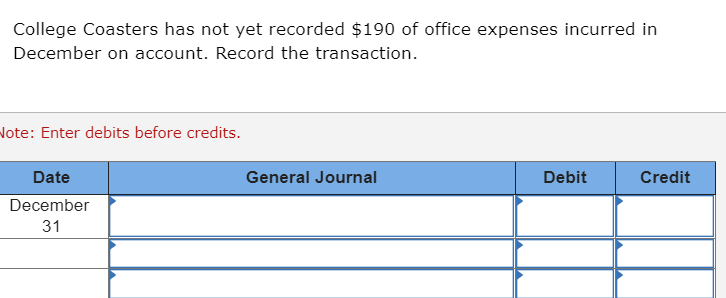

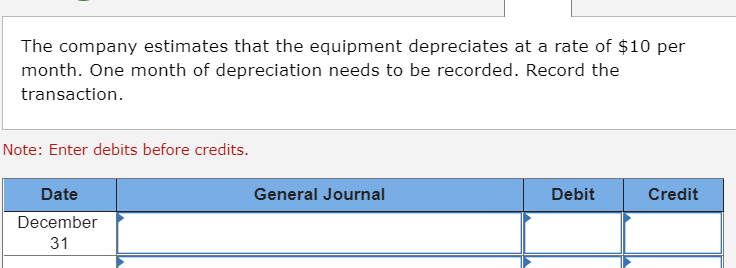

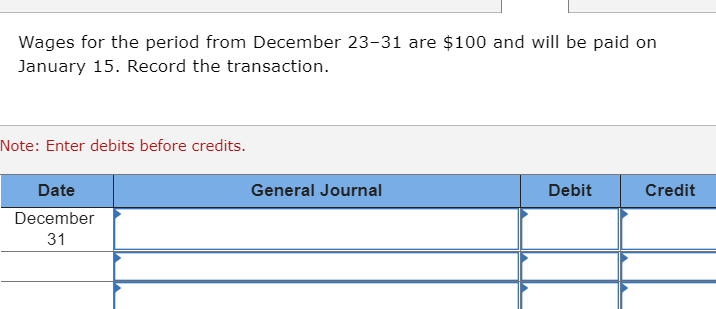

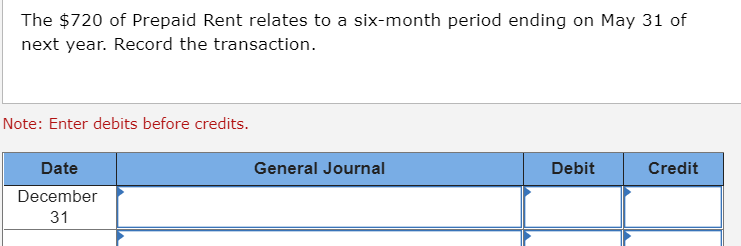

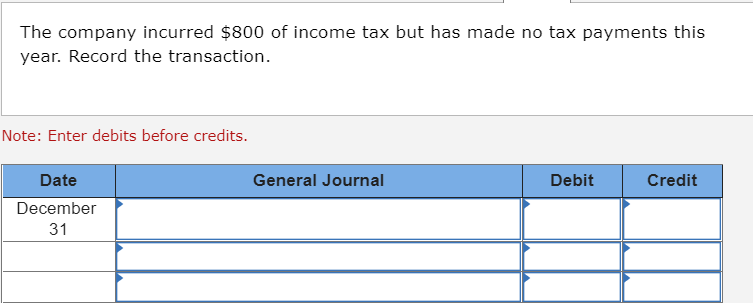

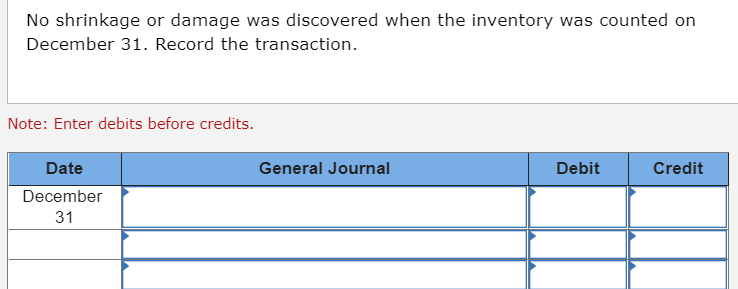

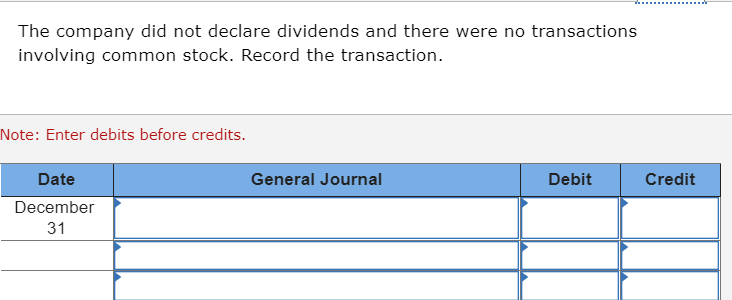

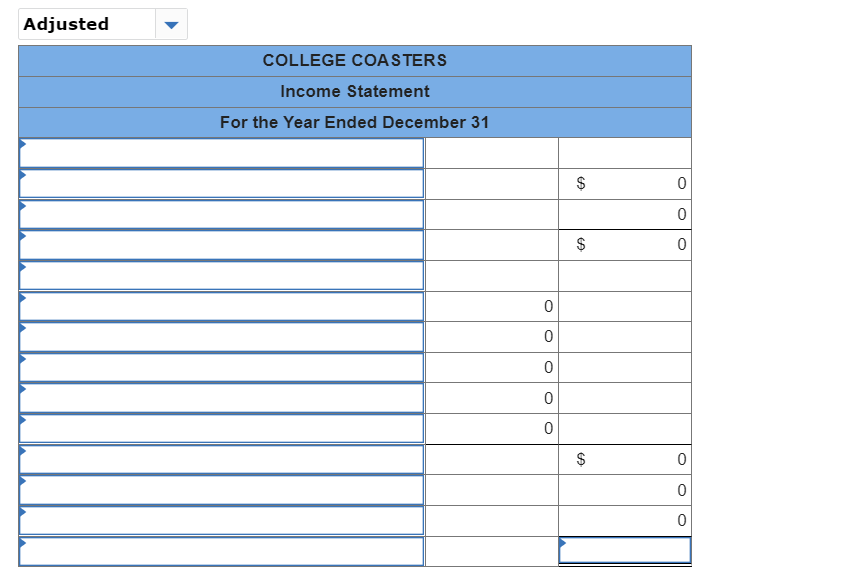

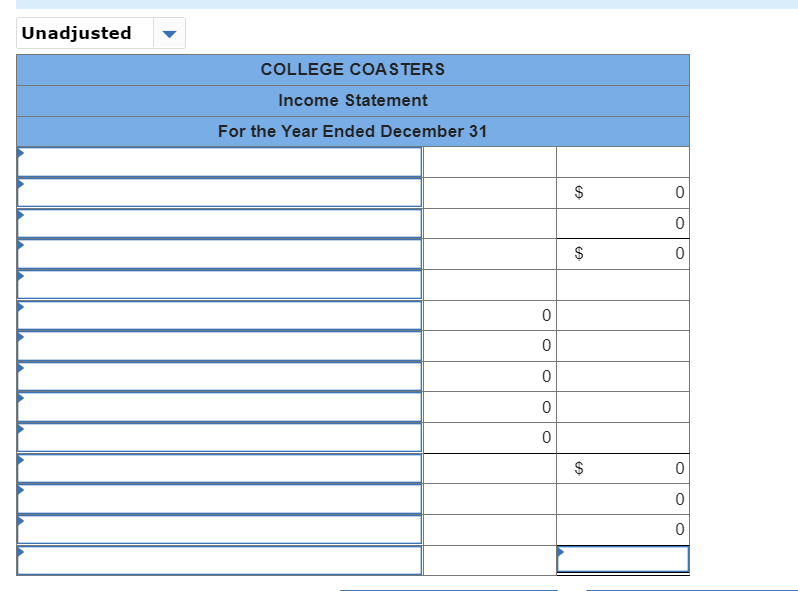

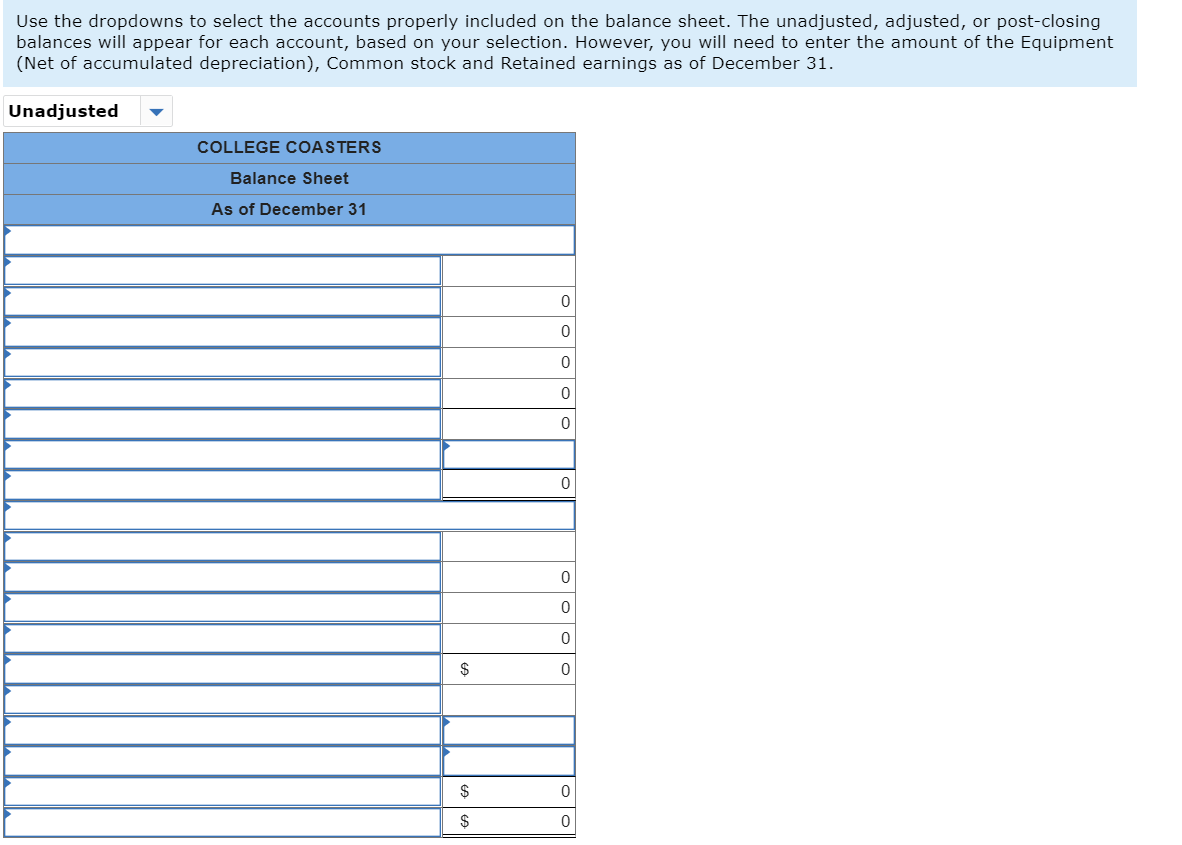

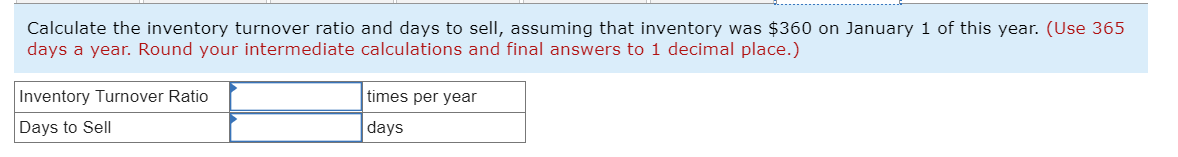

College Coasters is a San Diego-based merchandiser specializing in logo-adorned drink coasters. The company reported the following balances in its unadjusted trial balance at December 1. Cash Accounts Receivable Inventory Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Salaries and Wages Expense Depreciation Expense Income Tax Expense Office Expense $ 9,600 1,700 360 720 860 100 1,340 300 a 6,300 2,700 15,290 8,370 1,320 1,800 100 1,200 The company buys coasters from one supplier. All amounts in Accounts Payable on December 1 are owed to that supplier. The inventory on December 1 consisted of 900 coasters, all of which were purchased in a batch on July 10 at a unit cost of $0.40. College Coasters records its inventory using perpetual inventory accounts and the FIFO cost flow method. During December, the company entered into the following transactions. Some of these transactions are explained in greater detail below. a. Purchased 400 coasters on account from the regular supplier on 12/1 at a unit cost of $0.42, with terms of n/60. b. Purchased 1,000 coasters on account from the regular supplier on 12/2 at a unit cost of $0.45, with terms of n/60. c. Sold 1,700 coasters on account on 12/3 at a unit price of $1.00. d. Collected $900 from customers on account on 12/4. e. Paid the supplier $1,420 cash on account on 12/18 f. Paid employees $450 on 12/23, of which $250 related to work done in November and $200 was for wages up to December 22. g. Loaded 100 coasters on a cargo ship on 12/31 to be delivered the following week to a customer in Kona, Hawaii. The sale was made FOB destination with terms of n/60. Other relevant information includes the following at 12/31: h. College Coasters has not yet recorded $190 of office expenses incurred in December on account. i. The company estimates that the equipment depreciates at a rate of $10 per month. One month of depreciation needs to be recorded. j. Wages for the period from December 23-31 are $100 and will be paid on January 15. k. The $720 of Prepaid Rent relates to a six-month period ending on May 31 of next year. 1. The company incurred $800 of income tax but has made no tax payments this year. m. No shrinkage or damage was discovered when the inventory was counted on December 31. n. The company did not declare dividends and there were no transactions involving common stock. Record the cost of goods sold. Note: Enter debits before credits. General Journal Debit Credit Date December 03 Cost of Goods Sold 978 Cash 978 Collected $900 from customers on account on 12/4. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 04 Paid the supplier $1,420 cash on account on 12/18. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 18 Loaded 100 coasters on a cargo ship on 12/31 to be delivered the following week to a customer in Kona, Hawaii. The sale was made FOB destination with terms of n/60. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 College Coasters has not yet recorded $190 of office expenses incurred in December on account. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 The company estimates that the equipment depreciates at a rate of $10 per month. One month of depreciation needs to be recorded. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 Wages for the period from December 23-31 are $100 and will be paid on January 15. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 The $720 of Prepaid Rent relates to a six-month period ending on May 31 of next year. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 The company incurred $800 of income tax but has made no tax payments this year. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 No shrinkage or damage was discovered when the inventory was counted on December 31. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 The company did not declare dividends and there were no transactions involving common stock. Record the transaction. Note: Enter debits before credits. General Journal Debit Credit Date December 31 Adjusted COLLEGE COASTERS Income Statement For the Year Ended December 31 $ 0 0 $ 0 0 0 0 0 0 0 0 $ 0 0 0 0 Unadjusted COLLEGE COASTERS Income Statement For the Year Ended December 31 $ 0 0 $ 0 0 O 0 0 0 0 $ 0 0 0 Use the dropdowns to select the accounts properly included on the balance sheet. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. However, you will need to enter the amount of the Equipment (Net of accumulated depreciation), Common stock and Retained earnings as of December 31. Unadjusted COLLEGE COASTERS Balance Sheet As of December 31 0 0 11 0 0 0 0 $ 0 $ 0 $ 0 Calculate the inventory turnover ratio and days to sell, assuming that inventory was $360 on January 1 of this year. (Use 365 days a year. Round your intermediate calculations and final answers to 1 decimal place.) times per year Inventory Turnover Ratio Days to Sell days

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts