Question: THIS IS ALL ONE QUESTION. just has multiple parts. a portion of it is already completed. if the answer is completed then no need to

THIS IS ALL ONE QUESTION. just has multiple parts. a portion of it is already completed. if the answer is completed then no need to solve. It is a comprehensive problem, hence you need one part to solve another.

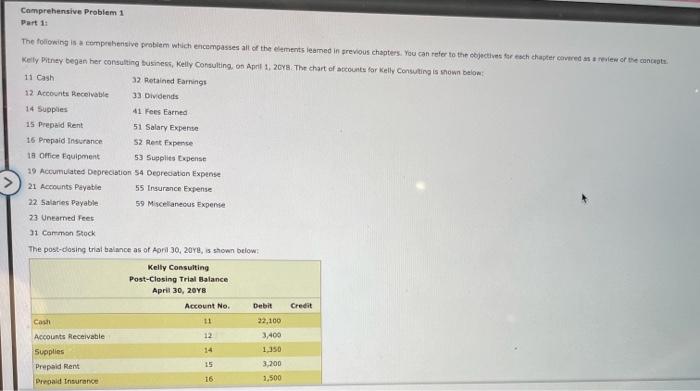

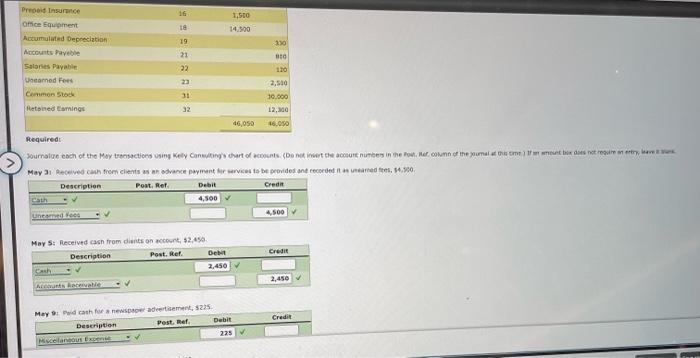

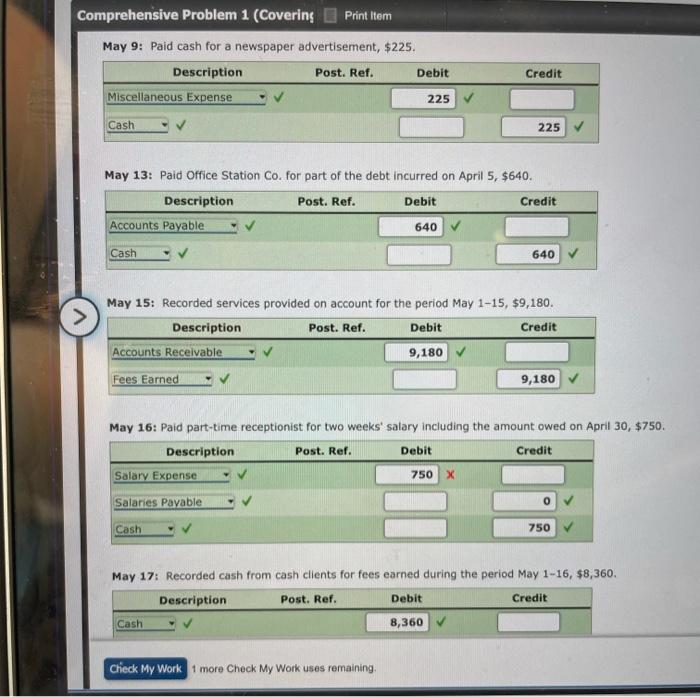

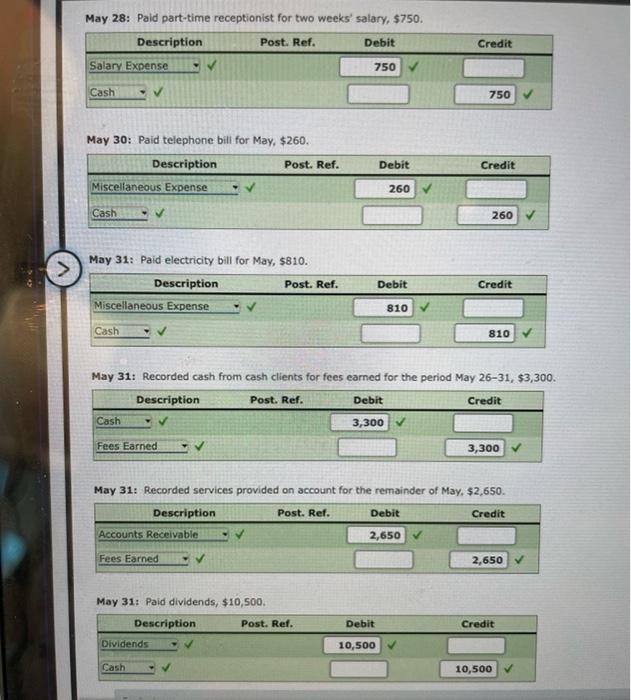

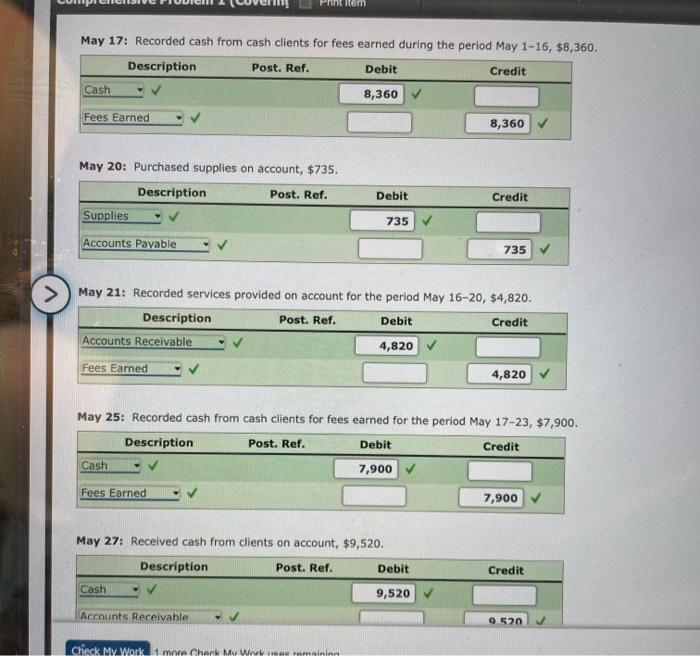

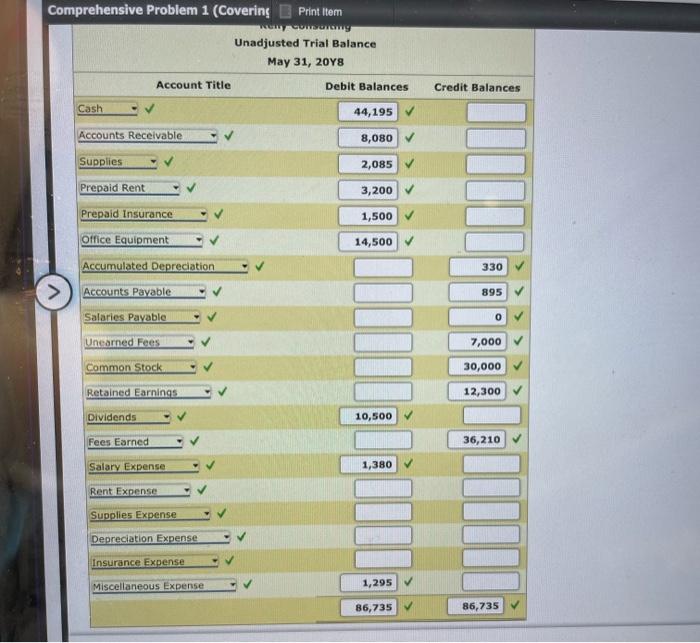

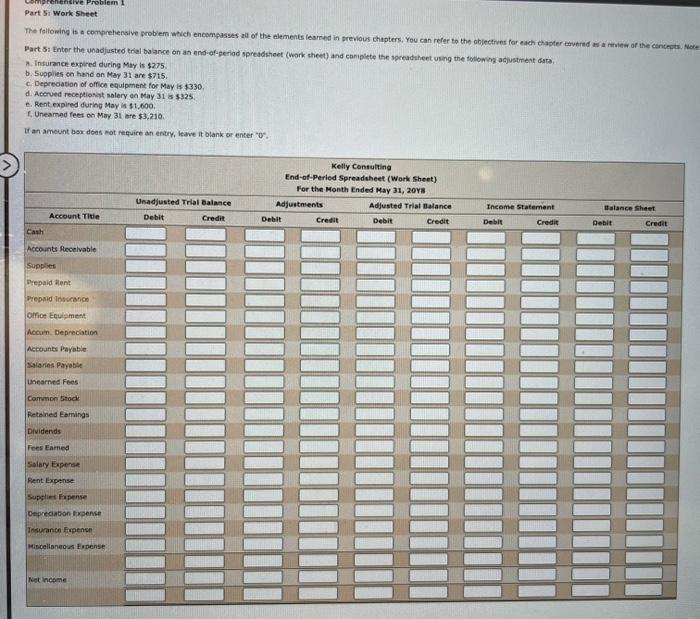

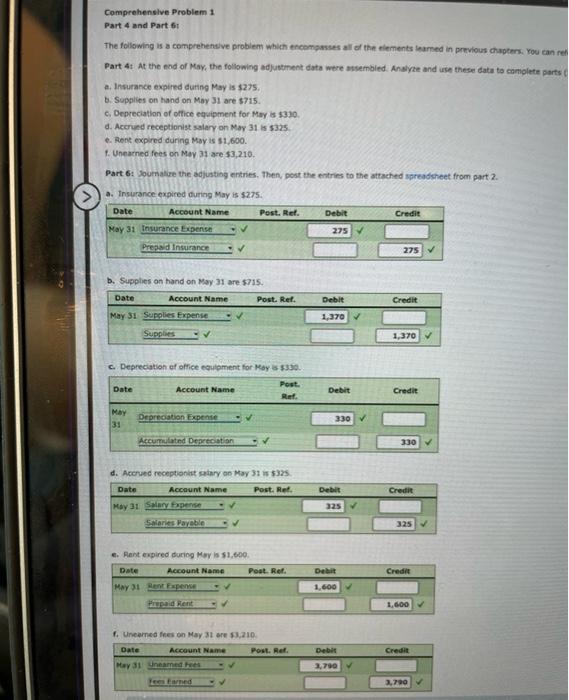

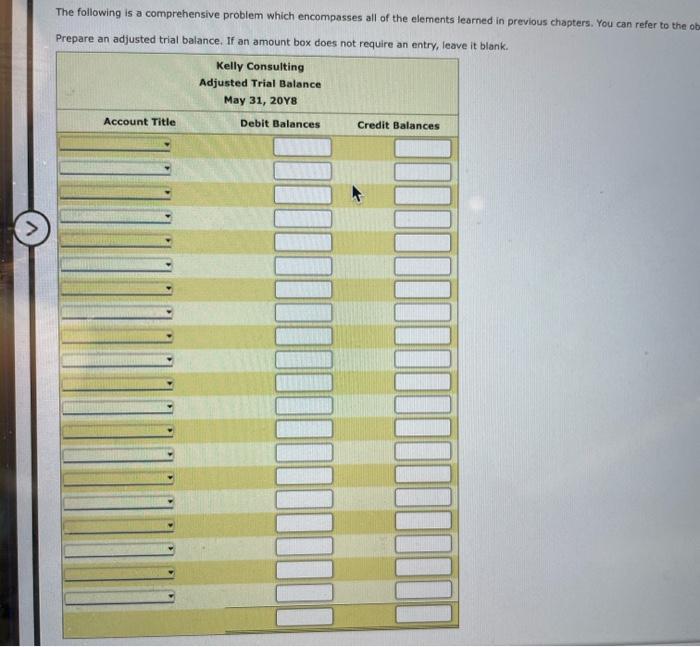

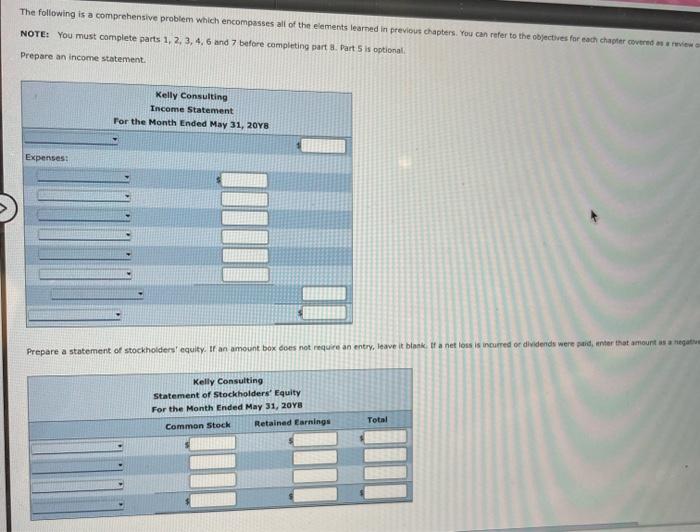

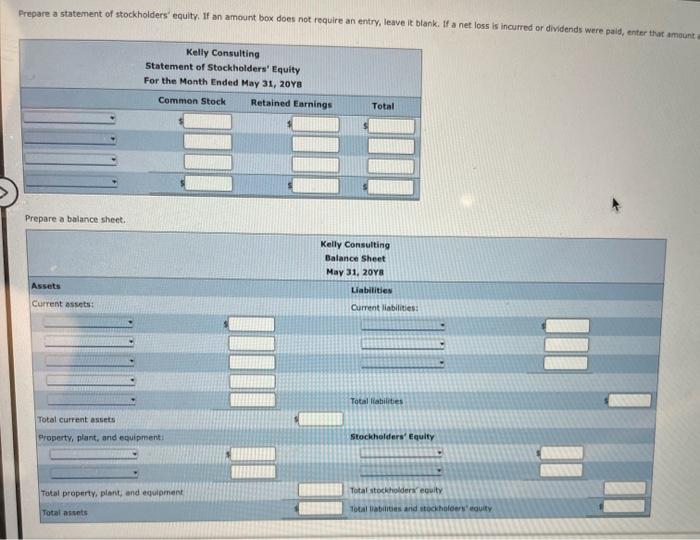

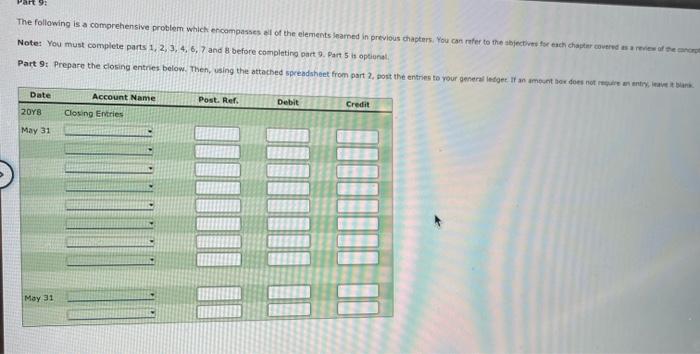

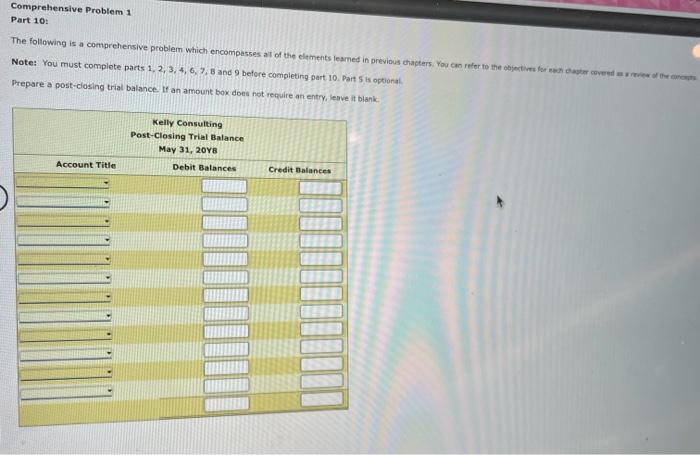

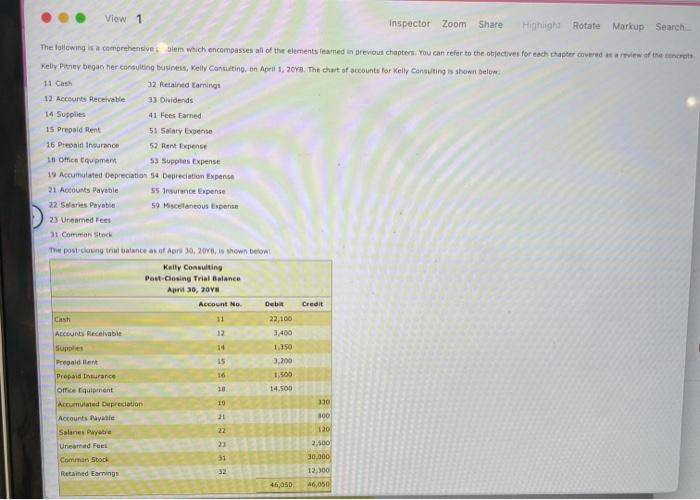

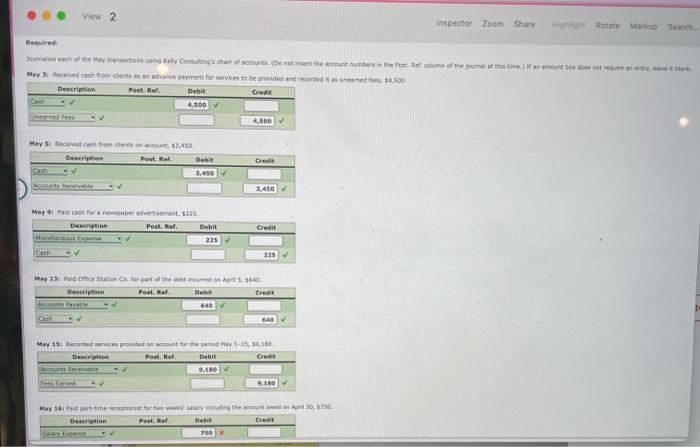

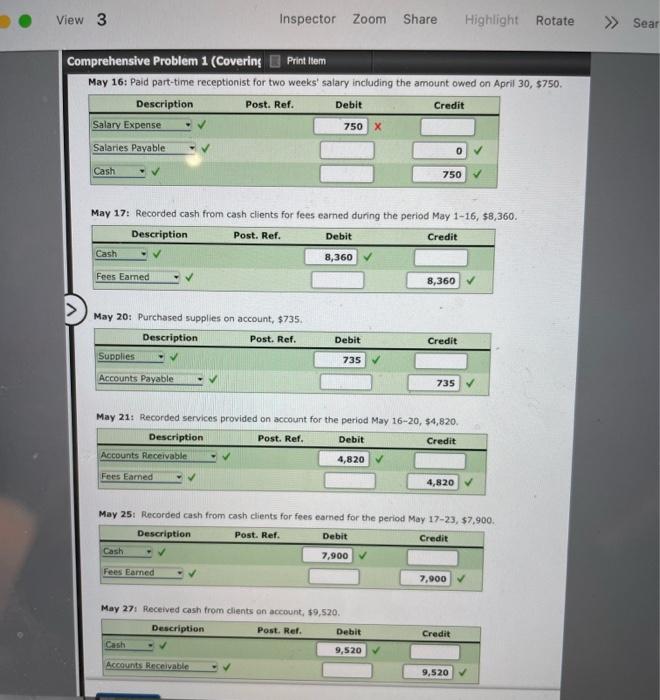

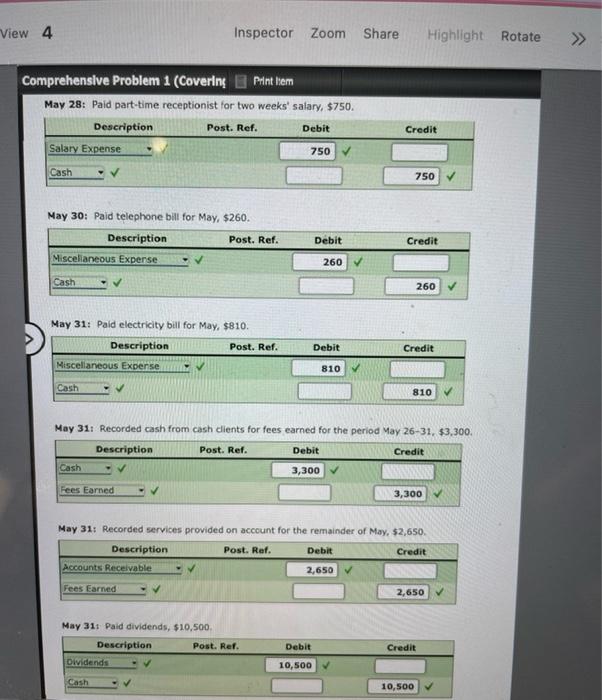

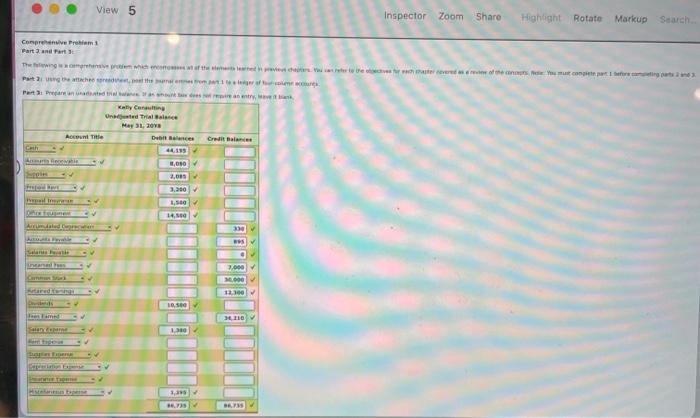

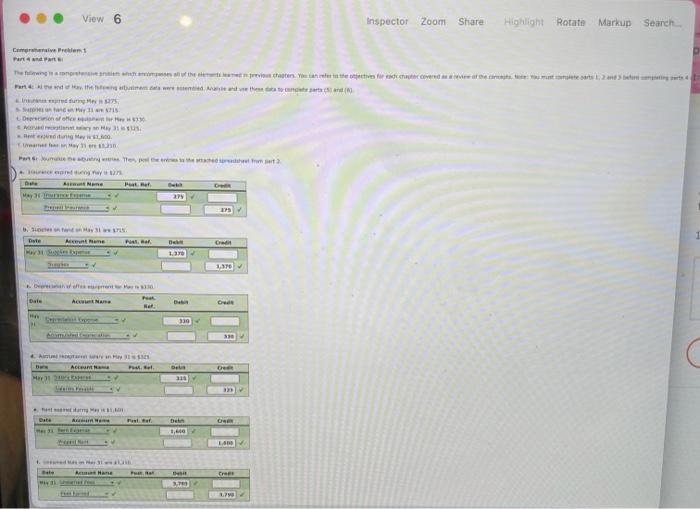

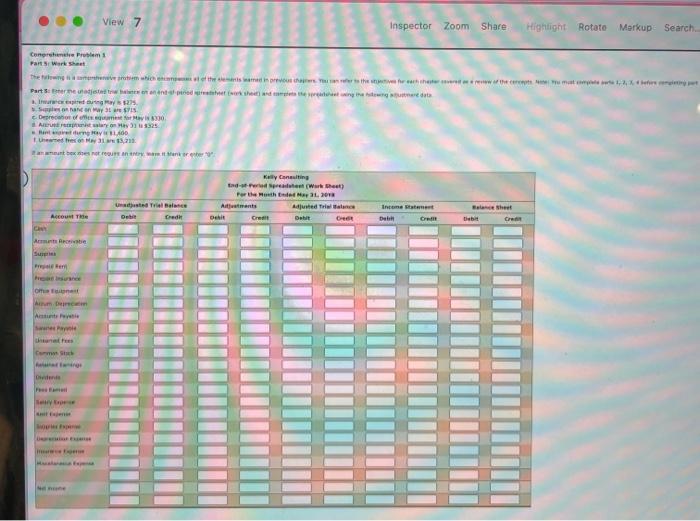

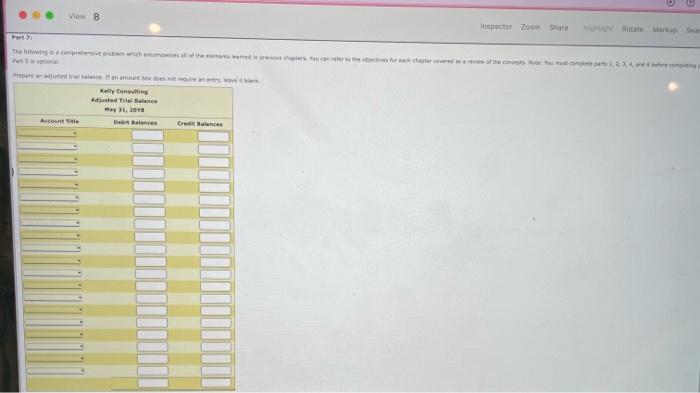

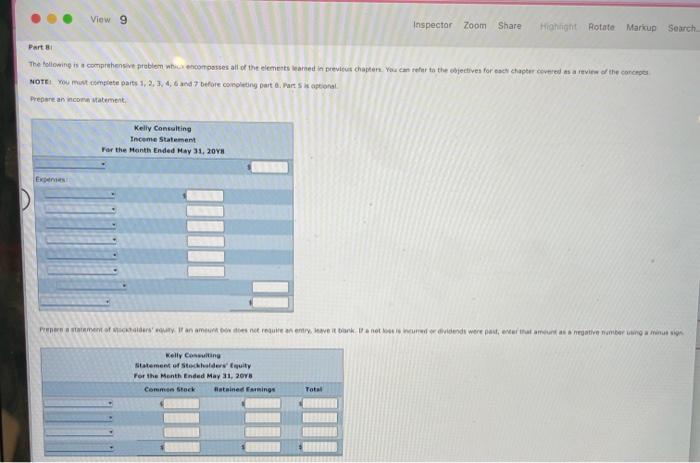

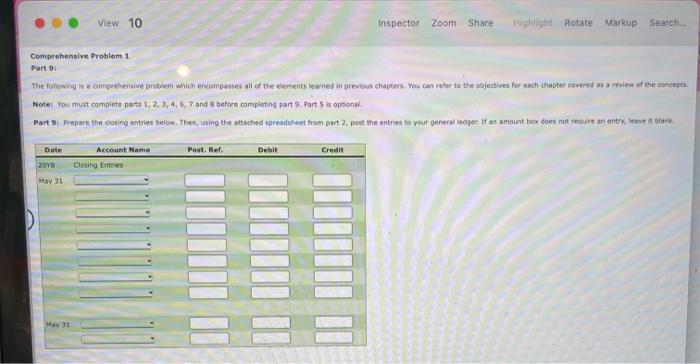

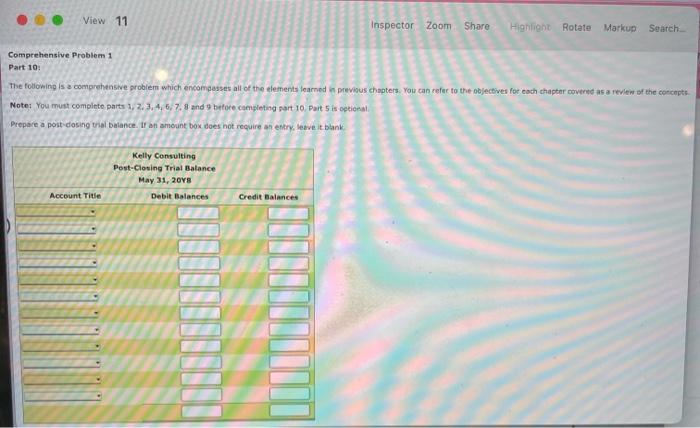

Comprehensive Problem 1 Part 1: The following is a comprehensive problem which encompasses all of the elements leamed in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 20Y8. The chart of accounts for Kelly Consulting is shown below: 11 Cash 32 Retained Earnings 33 Dividends 12 Accounts Receivable 14 Supplies 41 Fees Earned 15 Prepaid Rent 51 Salary Expense 16 Prepaid Insurance 52 Rent Expense 18 Office Equipment 53 Supplies Expense 19 Accumulated Depreciation 54 Depreciation Expense 21 Accounts Payable 55 Insurance Expense 22 Salaries Payable 59 Miscellaneous Expense 23 Unearned Fees 31 Common Stock The post-closing trial balance as of April 30, 2018, is shown below: Kelly Consulting Post-Closing Trial Balance April 30, 2018 Account No. Debit 11 Cash 12 Accounts Receivable Supplies 15 Prepaid Rent 16 Prepaid Insurance 22,100 3,400 1,350 3,200 1,500 Credit Prepaid Insurance Office Equipment Accumulated Depreciation 330 Accounts Payable B00 Salaries Payable 120 Unearned Fees 2,500 Common Stock 31 10,000 Retained Camings 32 12,300 46,050 46,050 Required: Journalaze each of the May transactions using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the Post. Rer. column of the journal at this time) If an amount box does not require an entry, May 31 Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees. $4,500 Description Post. Ref. Debit Credit Cath 4,500 Unearned Fees 4,500 May 5: Received cash from dients on account, $2,450. Description. Post. Ref. Credit Debit Cash 2,450 2,450 Accounts Receivable May 9: Paid cash for a newspaper advertisement, $225. Credit Description Post. Ref. Miscellaneous Expense 16 18 19 21 22 23 1,500 14,300 Debit 225 Comprehensive Problem 1 (Covering Print Item May 9: Paid cash for a newspaper advertisement, $225. Description Post. Ref. Debit Credit Miscellaneous Expense 225 Cash 225 May 13: Paid Office Station Co. for part of the debt incurred on April 5, $640. Description Post. Ref. Debit Credit Accounts Payable 640 Cash 640 May 15: Recorded services provided on account for the period May 1-15, $9,180. Description Post. Ref. Debit Credit Accounts Receivable 9,180 Fees Earned 9,180 May 16: Paid part-time receptionist for two weeks' salary including the amount owed on April 30, $750. Description Post. Ref. Debit Credit Salary Expense 750 X Salaries Payable 0 Cash 750 May 17: Recorded cash from cash clients for fees earned during the period May 1-16, $8,360. Description Post. Ref. Debit Credit Cash 8,360 Check My Work 1 more Check My Work uses remaining. May 28: Paid part-time receptionist for two weeks' salary, $750. Description Post. Ref. Debit Salary Expense 750 Cash May 30: Paid telephone bill for May, $260.. Description Debit Miscellaneous Expense 260 Cash May 31: Paid electricity bill for May, $810. Description Post. Ref. Debit Credit Miscellaneous Expense 810 Cash 810 May 31: Recorded cash from cash clients for fees earned for the period May 26-31, $3,300. Description Post. Ref. Debit Credit Cash 3,300 Fees Earned 3,300 May 31: Recorded services provided on account for the remainder of May, $2,650. Description Post. Ref. Debit Credit Accounts Receivable 2,650 Fees Earned 2,650 May 31: Paid dividends, $10,500. Description Dividends Cash Post. Ref. Post. Ref. Debit 10,500 Credit 750 Credit 260 Credit 10,500 Item May 17: Recorded cash from cash clients for fees earned during the period May 1-16, $8,360. Description Post. Ref. Debit Credit Cash 8,360 Fees Earned 8,360 May 20: Purchased supplies on account, $735. Description Post. Ref. Debit Credit Supplies 735 Accounts Payable 735 > May 21: Recorded services provided on account for the period May 16-20, $4,820. Description Post. Ref. Debit Credit Accounts Receivable 4,820 Fees Earned 4,820 May 25: Recorded cash from cash clients for fees earned for the period May 17-23, $7,900. Description Post. Ref. Debit Credit Cash 7,900 Fees Earned 7,900 May 27: Received cash from clients on account, $9,520. Description Post. Ref. Debit Cash 9,520 Accounts Receivable Check My Work 1 more Check My Works remaining Credit 9.520 Comprehensive Problem 1 (Covering Account Title Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accumulated Depreciation > Accounts Payable Salaries Payable Unearned Fees Common Stock Retained Earnings Dividends Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense Print Item Reny consoring Unadjusted Trial Balance May 31, 2018 Debit Balances 44,195 8,080 2,085 3,200 1,500 14,500 10,500 1,380 1,295 86,735 Credit Balances 330 895 0 7,000 30,000 12,300 36,210 86,735 sive Problem 1 Part 5: Work Sheet The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note Part 5: Enter the unadjusted trial balance on an end-of-period spreadsheet (work sheet) and complete the spreadsheet using the following adjustment data. a. Insurance expired during May is $275. b. Supplies on hand on May 31 are $715. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $325. e. Rent expired during May is $1,600. f. Uneamed fees on May 31 are $3,210. If an amount box does not require an entry, leave it blank or enter "0". Kelly Consulting End-of-Period Spreadsheet (Work Sheet) For the Month Ended May 31, 2018 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Credit Balance Sheet Debit Account Title Debit Credit Credit Debit Credit Debit Cash Accounts Receivable Supplies Prepaid Rent Prepaid Insurance Office Equipment Accum. Depreciation Accounts Payable Salaries Payable Unearned Fees Common Stock Retained Earnings Dividends Fees Earned Salary Expense Rent Expense Supplies Expense Depreciation Expense Insurance Expense Miscellaneous Expense Net income Debit Credit Comprehensive Problem 1 Part 4 and Part 6: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can ref Part 4: At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts ( a. Insurance expired during May is $275, b. Supplies on hand on May 31 are $715. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $325. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $3,210. Part 6: Journalize the adjusting entries. Then, post the entries to the attached spreadsheet from part 2. a. Insurance expired during May is $275. Date Account Name Post. Ref. Debit Credit May 31 Insurance Expense Prepaid Insurance b. Supplies on hand on May 31 are $715. Date Account Name Post. Ref. May 31 Supplies Expense Supplies c. Depreciation of office equipment for May is $330. Date Account Name Post. Ref. May Depreciation Expense 31 Accumulated Depreciation d. Accrued receptionist salary on May 31 is $325. Date Account Name Post. Ref. May 31 Salary Expense Salaries Payable e. Rent expired during May is $1,600. Date Account Name May 31 Rent Expense Prepaid Rent f. Unearned fees on May 31 are $3,210 Date Account Name May 31 Sneamed Fees Fees Farned Post. Ref. Post. Ref. 275 V Debit 1,370 Debit 330 Debit 325 Debit 1,600 Debit 3,790 V 275 Credit 1,370 V Credit 330 Credit 325 Credit 1,600 Credit 3,790 The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the ob Prepare an adjusted trial balance. If an amount box does not require an entry, leave it blank. Kelly Consulting Adjusted Trial Balance May 31, 2018 Account Title Debit Balances Credit Balances The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review an NOTE: You must complete parts 1, 2, 3, 4, 6 and 7 before completing part 8. Part 5 is optional. Prepare an income statement. Kelly Consulting Income Statement For the Month Ended May 31, 2018 Expenses: Prepare a statement of stockholders' equity. If an amount box does not require an entry, leave it blank. If a net loss is incurred or dividends were paid, enter that amount as a negative Kelly Consulting Statement of Stockholders' Equity For the Month Ended May 31, 2018 Total Common Stock Retained Earnings Prepare a statement of stockholders' equity. If an amount box does not require an entry, leave it blank. If a net loss is incurred or dividends were paid, enter that amount a Kelly Consulting Statement of Stockholders' Equity For the Month Ended May 31, 2018 Common Stock Retained Earnings Total Prepare a balance sheet. Kelly Consulting Balance Sheet May 31, 20YS Assets Current assets: E Total current assets Property, plant, and equipment: Total property, plant, and equipment Total assets Liabilities Current liabilities: Total liabilites Stockholders' Equity Total stockholders equity Total liabilities and stockholders' equity The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concept Note: You must complete parts 1, 2, 3, 4, 6, 7 and 8 before completing part 9. Part 5 is optional Part 9: Prepare the closing entries below. Then, using the attached spreadsheet from part 2, post the entries to your general ledger If an amount box does not require an entry, leave it blank Date Account Name Post. Ref. Debit Credit Closing Entries 2018 May 31 May 31 Comprehensive Problem 1 Part 10: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts Note: You must complete parts 1, 2, 3, 4, 6, 7, 8 and 9 before completing pert 10. Part 5 is optional Prepare a post-closing trial balance. If an amount box does not require an entry, leave it blank Kelly Consulting Post-Closing Trial Balance May 31, 2018 Account Title Debit Balances Credit Balances View 1 Inspector Zoom Share Highlight Rotate Markup Search... The following is a comprehensive blem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2018. The chart of accounts for Kelly Consulting is shown below: 11 Cash 32 Retained Earnings 33 Dividends 12 Accounts Receivable 14 Supplies 41 Fees Earned 15 Prepaid Rent 51 Salary Expense 16 Prepaid Insurance 52 Rent Expense 18 Office Equipment 53 Supplies Expense 19 Accumulated Depreciation 54 Depreciation Expense 21 Accounts Payable 55 Insurance Expense 22 Selaries Payable 59 Miscellaneous Expense 23 Uneemned Fees 31 Common Stock The post closing trial balance as of Aprs 30, 2018, is shown below: Kelly Consulting Post-Closing Trial Balance April 30, 2018 Account No. Debit Cash 11 Accounts Receivable 12 Supplies Prepaid lent 15 Prepaid Insurance 16 10 Office Equipment 19 Accumulated Depreciation Accounts Payable 21 22 Salanes Payable 23 Uneamed Fee 31 Comman Stock 32 Retained Earnings 22,100 3,400 1,350 3,200 1,500 14,500 46,050 Credit 330 800 120 2,500 30,000 12,300 46,050 View 2 Inspector Zoom Share Highlight Rotate Markup Search Required Journalize each of the May transactions using Kelly Consulting's chart of accounts (De not insert the account numbers in the Post Ref column of the journal at this time) If an amount box does not require an entry, leave it bank May 31 Received cash from cients as an advance payment for services to be provided and recorded it as uneemed fees $4.500 Description Post Ref. Debit Credit 4,500 4,500 May St Received cash from certs on acut, $2,450. Description Post. Ref. Credit Christ Accounts Receivable 2,450 V May 9: Paid cash for a newspaper advertisement, $225. Description Post. Ref. Debit Credit 225 225 May 13 Paid Office Station Co. for part of the dest incurred on Apr 5, 1640 Description Post. Ref. Credit Debit 640 Accounts Favatie 640 May 15: Recorded services provided on account for the period May 1-15, 58,180. Description Post. Ref. Debit Accounts Receivable 9,180 V Fees Earned 9,180 May 16: Faid part-time receptionist for two weeks saary including the amount ewed on April 30, 1750 Debit Description Post. Ref. Credit Salary Excense 750 X Debit 2,450 View 3 Inspector Zoom Share Highlight Rotate Comprehensive Problem 1 (Covering Print Item May 16: Paid part-time receptionist for two weeks' salary including the amount owed on April 30, $750. Description Post. Ref. Debit Credit Salary Expense 750 X Salaries Payable 0 Cash 750 May 17: Recorded cash from cash clients for fees earned during the period May 1-16, $8,360. Description Post. Ref. Debit Credit Cash 8,360 Fees Earned 8,360 May 20: Purchased supplies on account, $735. Description Post. Ref. Credit Supplies 735 Accounts Payable 735 May 21: Recorded services provided on account for the period May 16-20, $4,820. Description Post. Ref. Debit Credit Accounts Receivable 4,820 Fees Earned 4,820 May 25: Recorded cash from cash clients for fees earned for the period May 17-23, $7,900. Description Post. Ref. Debit Credit Cash 7,900 Fees Earned 7,900 May 27: Received cash from clients on account, $9,520. Description Post. Ref. Debit Cash 9,520 Accounts Receivable Debit Credit 9,520 Sear View 4 Inspector Zoom Comprehensive Problem 1 (Covering Print tem May 28: Paid part-time receptionist for two weeks' salary, $750. Description Post. Ref. Debit Salary Expense 750 Cash May 30: Paid telephone bill for May, $260. Description Miscellaneous Expense Cash May 31: Paid electricity bill for May, $810. Description Post. Ref. Debit Credit Miscellaneous Expense 810 Cash 810 May 31: Recorded cash from cash clients for fees earned for the period May 26-31, $3,300. Description Post. Ref. Debit Credit Cash 3,300 Fees Earned -V 3,300 May 31: Recorded services provided on account for the remainder of May, $2,650. Description Post. Ref. Debit Credit Accounts Receivable 2,650 Fees Earned 2,650 May 31: Paid dividends, $10,500, Description Dividends Cash Post. Ref. Post. Ref. Debit Share Highlight Rotate Credit 260 Debit 10,500 750 Credit 260 Credit 10,500 >>> View 5 Comprehensive Problem 1 Part 2 and Part 3: The flewing comprehensive problem which encorosses at of the elements learned in preves chapters Your Part 2: Using the attachee spreadsheet, post the parenes from 1 to a leiger of accus Part 3: Prepare an unadanted the balance announ des repre an entry Kally Consulting Unajted Trial Balance May 31, 2018 Account Title Debt Balances Credit Balance Cath 44.395 Anments Recevahis 8,000 Eppin 2,005 Prepaid Kert 3,300 Penal Inver 1,500 Offer Exames 14,500 Arcumdated proton 330 WYS Accounts Payable ineared Yes 7,000 30,000 Stared Koning 12,300 Dividends 34,210 96,735 een Famed Satery Experne plan Trene Depreciation Eng Paneve Tigene Hytalanen tapere 10,500 1,300 3,395 #64.735 Inspector Zoom Share Highlight Rotate Markup Search. ces for each taster revered as a revine of the concepts fee You must congiste part 1 Sefore competing parts 2 and 3 View 6 Comprehensive Problem 1 Part and Part The flewing is a compreene antien tasses all of the elements leaned previous chapters. You can refer to the otjectives for ad chapter covered as eve of the cou Part the end of a the teeng abutine data were sented. Anaise and use these data to come parts and (8) Inexed during my $275 Spes hand on May 11 5715 Deprecion of office pen for $330 sedienst Rexed dig Mey Tamer aan May 31 ere $1,21 Parture the abuting Then, pol the envies to the attached spread from 2 Date Peat Ref Deft May from 379 Propell b. Supetes on hand on May 31 a Date Account Rame Past. Haf May 31, Sogies Expans 1,370 Oh of offes surement M8330 Date Account Name Ref. Ma Atasay any 31 $35 Ban Account Name P Mar 31 200 pers Sains Fond Pastaf une end dung may 27 Account Name 1 tury j Ex Date A Pored Not 4. Masina Sele My e are TE HOW siss 75. BOFY PUTH WIL P 330 ento STE Den 1,600 De 3,799 175/ Credit 1,376 ONR 330 Dest LEE LADD Cres 3.790 Inspector Zoom Share Highlight Rotate Markup Search... View 7 Inspector Zoom Share Highlight Rotate Markup Search... Comprehensive Problem S Part 5: Work Sheet the flowing seve protem which empat of the elements named in previous chapers. You can refer to the statives for each chester severed of the cercepts Note: Tu must compte a 1, 2, 3, 4 befes competing Part 3: Enter the utatjested to be on an end-s-period spreadsheet (work shet) and comes the spreadsheeting the sewing and data Inace expired during May $275 Se on hand on May 31 are $15. Depreciation of office equamest for Mayis $330. Arnist salary on May 335325 Rated during a $1,00 Uneamed freon May 31 a 13,215 anamentbex es not reques an entry wamit tank or enter Kelly Consulting tad-at-Period Spreadsheet (Work Sheet) For the Moth Ended May 31, 201 Unadjusted Trial Balance Autitments Adjusted Trial Income Statement Balance Sheet Debit Account Te Debit Credit Credit Debit Cedt Deb Credit CHY Acts Receivable Suppres Pre Prinsurance Of Finest Acum Deprec Actunts Peyebie Ses Papie Common Stck Dividends Setry Expe Exp Ex ce Exper nings Ne pesa Debit Credit View 8 The following is a comprehensive pratiem which encompas all of the elements med previous chapters. You can refer Pats comen Prepare an adjusted trial balance of an amount tox dies not require an entry b Kelly Consulting Adjusted Trial Balance May 31, 2018 Account Title De Balances Credit Balances inspector Zoom Share Hight Rotate Markup Seam ces for chapter covered as a review of the concepts Rote: You must complete parts 1.21., netg View 9 Inspector Zoom Share Highlight Rotate Markup Search... Part B The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts NOTE: You must complete parts 1, 2, 3, 4, 6 and 7 before completing part 8. Part 5 is optional Prepare an income statement Kelly Consulting Income Statement For the Month Ended May 31, 2018 Expenses Prepare a statement of stickbaiders' equity If an amount box does not require an entry, leave it blank a not loss is incurred or dividends were past, enter that amount as a negative number using a minus sign Kelly Consulting Statement of Stockholders' Equity For the Menth Ended May 31, 2018 Commen Stock Retained Earnings Total Inspector Zoom Share Highlight Rotate Markup Search... Comprehensive Problem 1 Part 9: The fohowing is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts 1, 2, 3, 4, 6, 7 and 8 before completing part 9, Part 5 is optional. Part 9: Prepare the closing entries below. Then, using the attached spreadsheet from part 2, post the entries to your general ledger. If an amount box does not require an entry, leave it blank Post. Ref. Debit Credit Date Account Name 2016 Closing Entries May 31 May 31 View 10 100 View 11 Inspector Zoom Share Highlight Rotate Markup Search Comprehensive Problem 1 Part 10: The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. Note: You must complete parts 1, 2, 3, 4, 6, 7, 8 and 9 before completing part 10, Part 5 is optional. Prepare a post-dosing trial balance. If an amount box does not require an entry, leave it blank Kelly Consulting Post-Closing Trial Balance May 31, 2018 Account Title Debit Balances Credit Balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts