Question: This is all one question, just separated out into sections. You are given the following information concerning Around Town Tours: Debt: 8,500, 7.1 percent coupon

This is all one question, just separated out into sections.

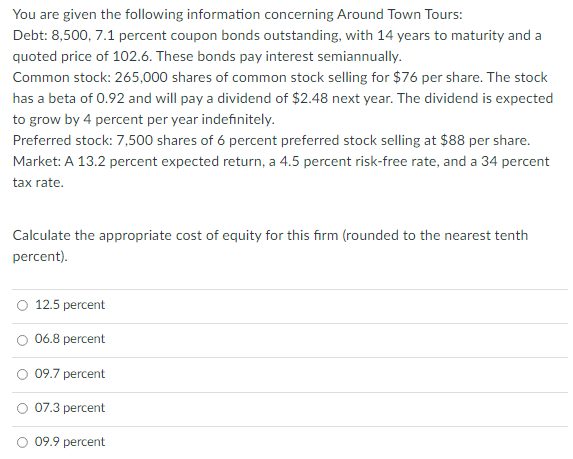

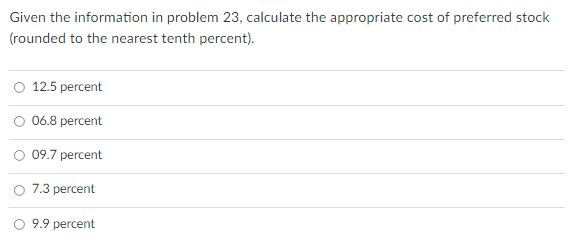

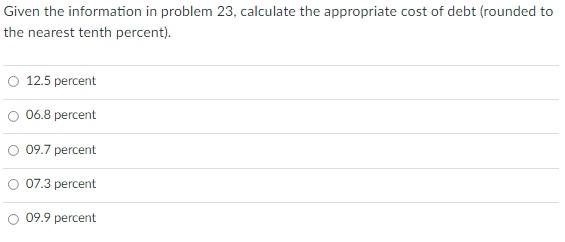

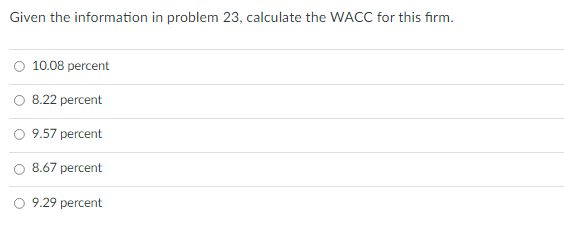

You are given the following information concerning Around Town Tours: Debt: 8,500, 7.1 percent coupon bonds outstanding, with 14 years to maturity and a quoted price of 102.6. These bonds pay interest semiannually. Common stock: 265,000 shares of common stock selling for $76 per share. The stock has a beta of 0.92 and will pay a dividend of $2.48 next year. The dividend is expected to grow by 4 percent per year indefinitely. Preferred stock: 7,500 shares of 6 percent preferred stock selling at $88 per share. Market: A 13.2 percent expected return, a 4.5 percent risk-free rate, and a 34 percent tax rate. Calculate the appropriate cost of equity for this form (rounded to the nearest tenth percent). O 12.5 percent O 06.8 percent 09.7 percent O 07.3 percent 09.9 percent Given the information in problem 23, calculate the appropriate cost of preferred stock (rounded to the nearest tenth percent). O 12.5 percent 06.8 percent 09.7 percent o 7.3 percent 9.9 percent Given the information in problem 23, calculate the appropriate cost of debt (rounded to the nearest tenth percent). O 12.5 percent 06.8 percent 09.7 percent 07.3 percent 09.9 percent Given the information in problem 23, calculate the WACC for this firm. 10.08 percent 8.22 percent O 9.57 percent 8.67 percent 9.29 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts