Question: this is all one question please help and explain Wollogong Group Limited of New South Wales, Australia, acquired its factory building 10 years ago. For

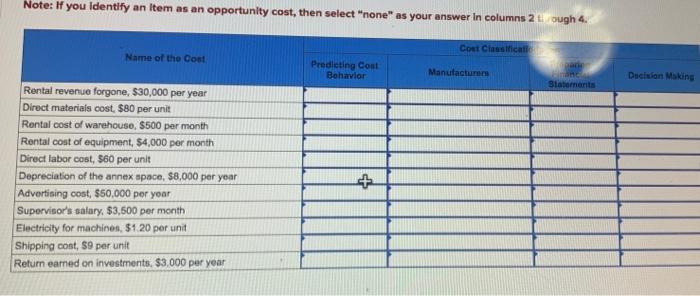

Wollogong Group Limited of New South Wales, Australia, acquired its factory building 10 years ago. For several yes's, the co pany has rented out a small annex attached to the rear of the bullding for $30,000 per year. The renter's lease will expire soon, and rather than renewing the lease, the company has decided to use the annex to manufacture a new product. Direct materials cost for the new product will total $80 per unit. To have a place to store its finished goods, the compainy will rent a small warehouse for $500 per month. In addition, the company must rent equ'pment for $4,000 per month to produce the new product. Direct laborers will be hired and paid $60 per unit to manufacture the new product. As in prior years, the space in the annex will continue to be depreciated at $8,000 per year. The annual advertising cost for the new product will be $50,000. A supervisor will be hired and paid $3,500 per month to oversee production. Electricity for operating machines will be $1.20 per unit. The cost of shipping the new product to customers will be $9 per unit. To provide funds to purchase materials, meet payrolls, and so forth, the company will have to liquidate some temporary investments. These investments are presently yielding a return of $3,000 per year. Required: Using the table shown below, describe each of the costs assoclated with the new product decision in four ways. - In terms of cost classifications for predicting cost behavior, indicate whether the cost is fixed or variable. - With respect to cost classifications for manufacturers if the itdn is a manufacturing cost, indicate whether it is direct materials, direc labor, or manufacturing overhead. If it is a nonmanufacturing cost, then select "none" as your answer. - With respect to cost classifications for preparing financial statements, indicate whether the item is a product cost or period cost. - In terms of cost classifications for decision making. identify any items that are sunk costs or opportunity costs. Select "none" if neither category applies. Note: If you identify an item as an opportunity cost, then select "none" as your answer in columns 2 through 4. Note: If you identify an Item as an opportunity cost, then select "none" as your answer in columns 2 ti rough 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts