Question: This is all one question Precision Construction entered into the fojlowing transactions during a recent year Danuary 2 Purchased a bulldozer for $264,00e by paying

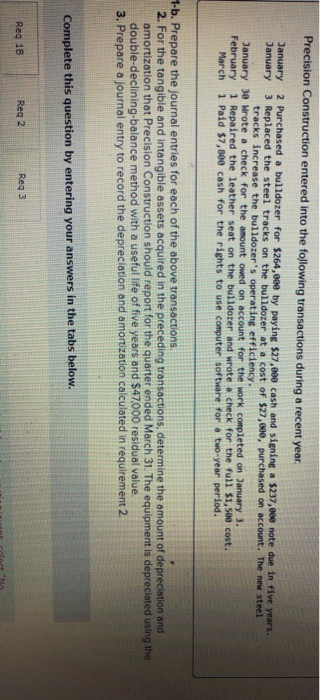

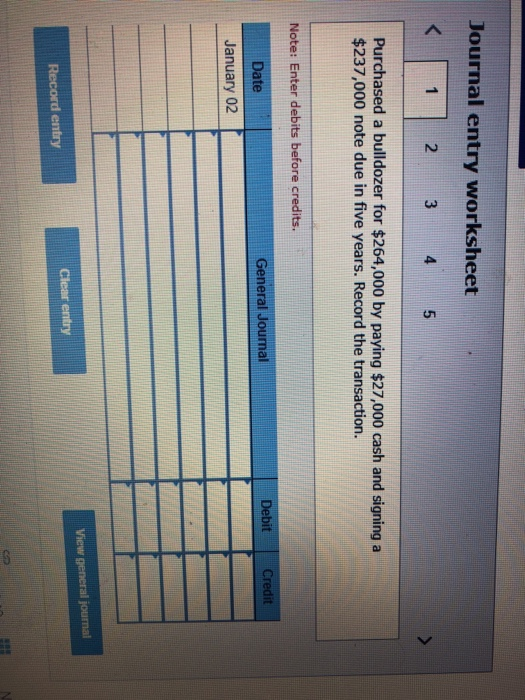

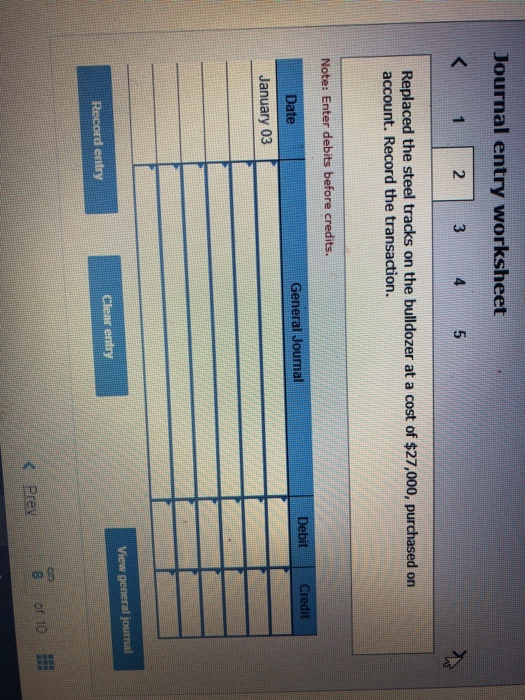

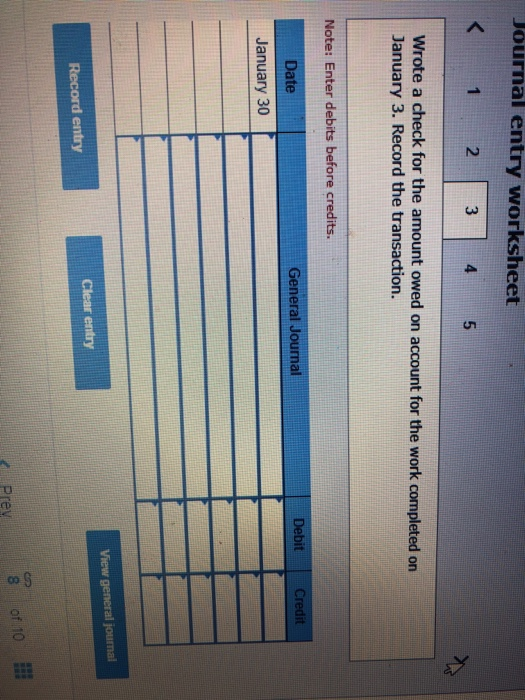

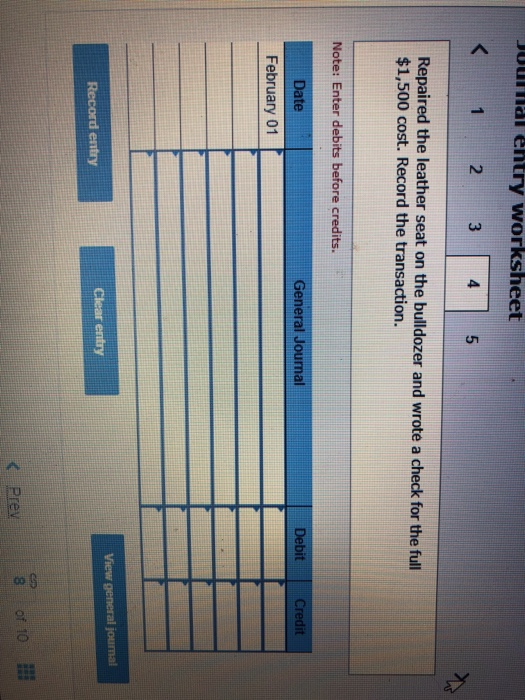

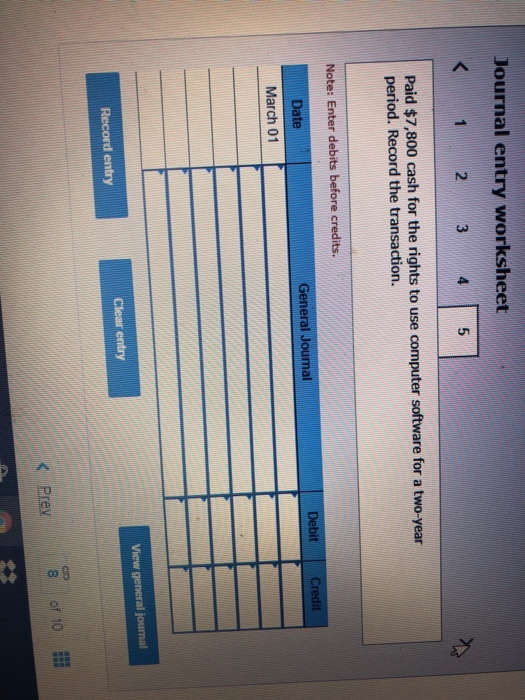

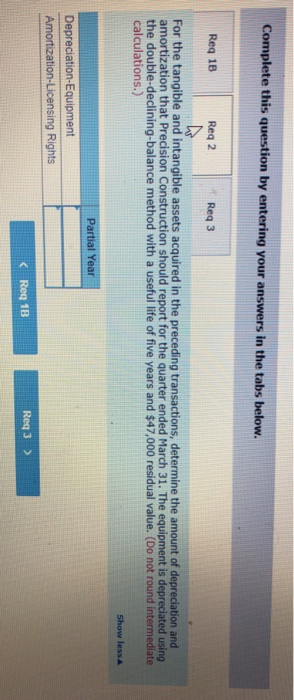

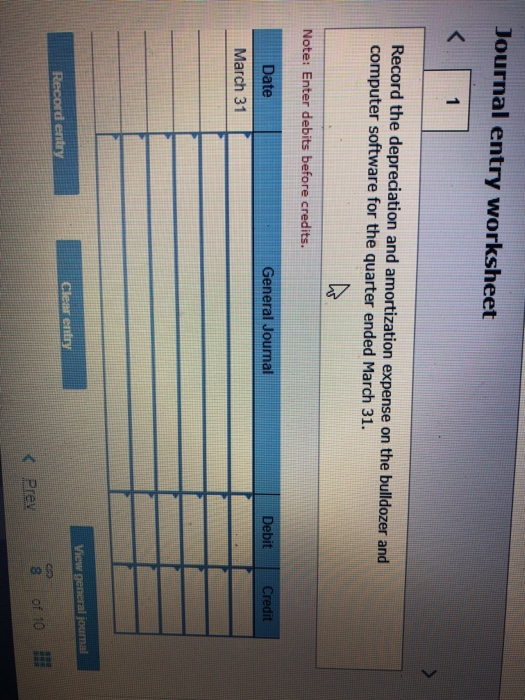

Precision Construction entered into the fojlowing transactions during a recent year Danuary 2 Purchased a bulldozer for $264,00e by paying s27,000 cash and signing a $237,00 note due in five years. January 3 Replaced the steel tracks on the bulldozer at a cost of $27,080, purchased on account. The new s tracks increase the bulldozer's operating efficiency, Danuary 30 wrote a check for the amount owed on account for the work completed on January 3. February 1 Repaired the leather seat on the buildozer and wrote a check for the full $1,500 cost March 1 Paid $7,800 cash for the rights to use computer software for a two-year period. -b. Prepare the journal entries for each of the above transactions 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Precision Construction should report for the quarter ended March 31. The equipment is depreciated using the double-declining-balance method with a useful life of five years and $47000 residual value. 3. Prepare a journal entry to record the depreciation and amortization calculated in requirement 2 Complete this question by entering your answers in the tabs below Req 18 Req 2 Req 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts