Question: THIS IS ALL ONE QUESTION Question 38 1 pts 9. You are going to buy a house for $400,000. You have enough cash that you

THIS IS ALL ONE QUESTION

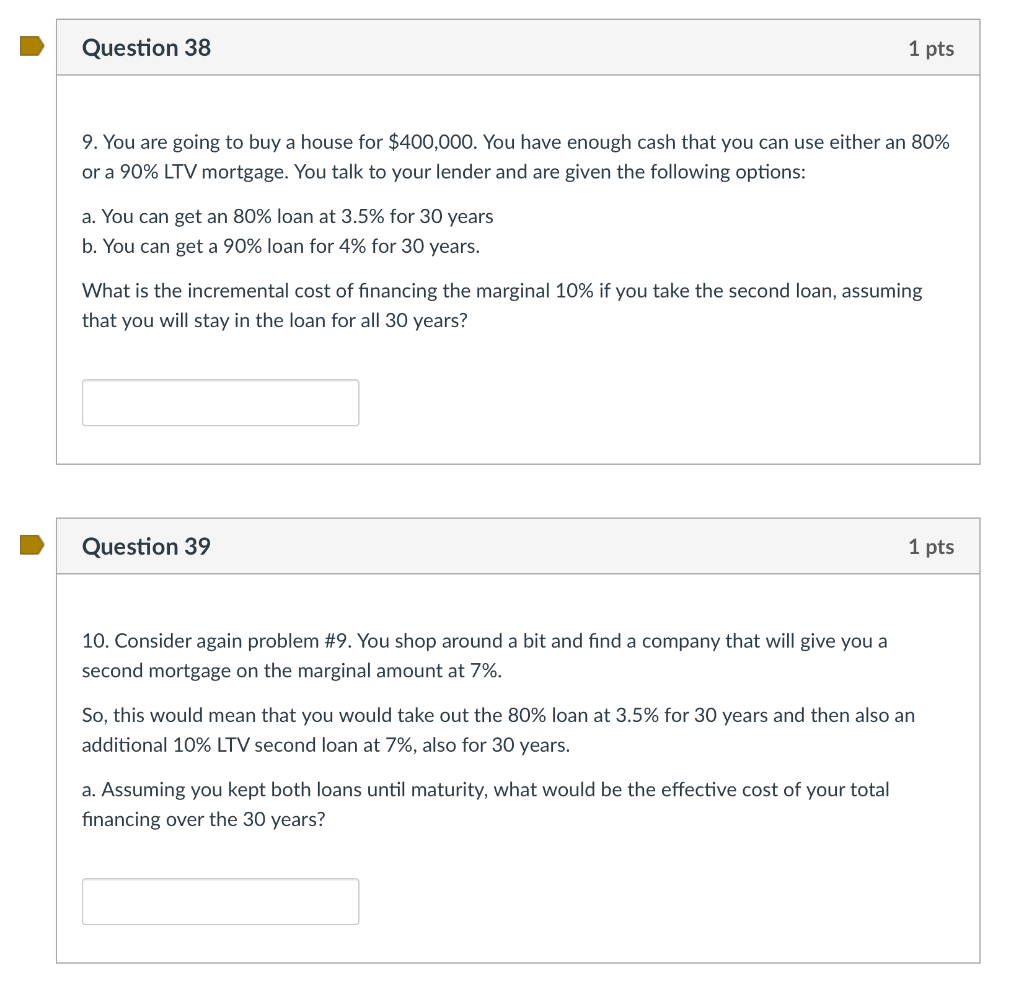

Question 38 1 pts 9. You are going to buy a house for $400,000. You have enough cash that you can use either an 80% or a 90% LTV mortgage. You talk to your lender and are given the following options: a. You can get an 80% loan at 3.5% for 30 years b. You can get a 90% loan for 4% for 30 years. What is the incremental cost of financing the marginal 10% if you take the second loan, assuming that you will stay in the loan for all 30 years? Question 39 1 pts 10. Consider again problem #9. You shop around a bit and find a company that will give you a second mortgage on the marginal amount at 7%. So, this would mean that you would take out the 80% loan at 3.5% for 30 years and then also an additional 10% LTV second loan at 7%, also for 30 years. a. Assuming you kept both loans until maturity, what would be the effective cost of your total financing over the 30 years? Question 38 1 pts 9. You are going to buy a house for $400,000. You have enough cash that you can use either an 80% or a 90% LTV mortgage. You talk to your lender and are given the following options: a. You can get an 80% loan at 3.5% for 30 years b. You can get a 90% loan for 4% for 30 years. What is the incremental cost of financing the marginal 10% if you take the second loan, assuming that you will stay in the loan for all 30 years? Question 39 1 pts 10. Consider again problem #9. You shop around a bit and find a company that will give you a second mortgage on the marginal amount at 7%. So, this would mean that you would take out the 80% loan at 3.5% for 30 years and then also an additional 10% LTV second loan at 7%, also for 30 years. a. Assuming you kept both loans until maturity, what would be the effective cost of your total financing over the 30 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts