Question: this is all one question Required information Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1

![5-1 [The following information applies to the questions displayed below.] The following](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718e6924addf_1376718e691dcea3.jpg)

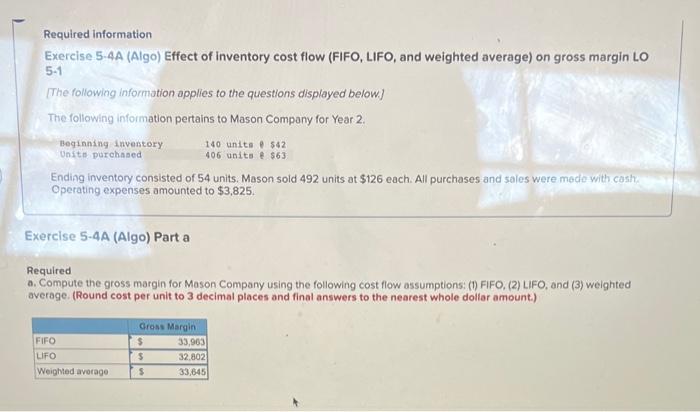

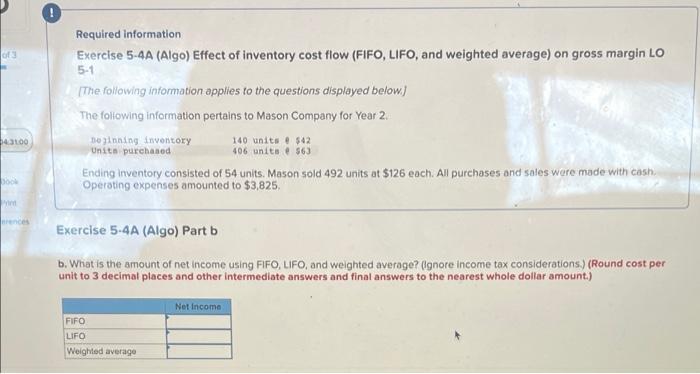

Required information Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to Mason Company for Year 2. Beginning inventory Units purchased 140 units $42 406 units @ $63 Ending inventory consisted of 54 units. Mason sold 492 units at $126 each. All purchases and sales were made with cash. Operating expenses amounted to $3,825. Exercise 5-4A (Algo) Part a Required a. Compute the gross margin for Mason Company using the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round cost per unit to 3 decimal places and final answers to the nearest whole dollar amount.) Gross Margin $ FIFO LIFO $ Weighted average $ 33,963 32,802 33,645 of 3 43100 Dook Print erences ! Required information Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to Mason Company for Year 2. Deginning inventory Units purchased 140 units @ $42 406 units $63 Ending inventory consisted of 54 units. Mason sold 492 units at $126 each. All purchases and sales were made with cash. Operating expenses amounted to $3,825. Exercise 5-4A (Algo) Part b b. What is the amount of net income using FIFO, LIFO, and weighted average? (Ignore income tax considerations.) (Round cost per unit to 3 decimal places and other intermediate answers and final answers to the nearest whole dollar amount.) Net Income: FIFO LIFO Weighted average ! Required information Exercise 5-4A (Algo) Effect of inventory cost flow (FIFO, LIFO, and weighted average) on gross margin LO 5-1 [The following information applies to the questions displayed below.] The following information pertains to Mason Company for Year 2. Beginning inventory 140 units @ $42 406 units @ $63 Units purchased Ending inventory consisted of 54 units. Mason sold 492 units at $126 each. All purchases and sales were made with cash. Operating expenses amounted to $3,825. Exercise 5-4A (Algo) Part c c. Compute the amount of ending inventory using (1) FIFO, (2) LIFO, and (3) weighted average. (Round cost per unit to 3 decimal places and final answers to the nearest whole dollar amount.) Ending Inventory FIFO LIFO Weighted average S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts