Question: This is all one question Statement of Cash Flows-Indirect Method The comparative balance sheet of olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, is

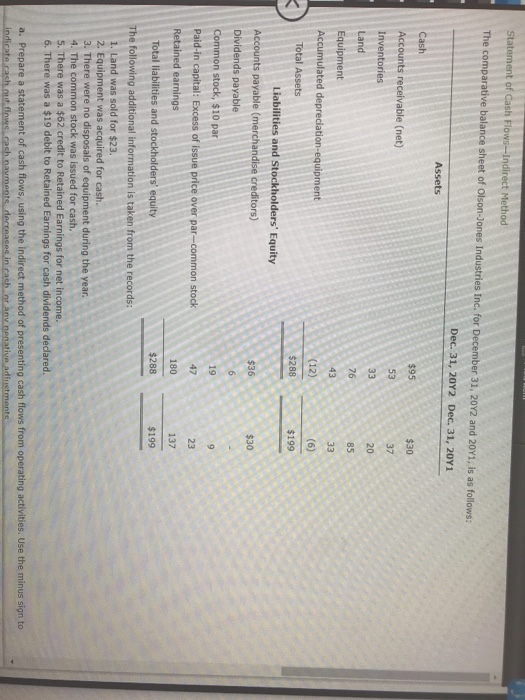

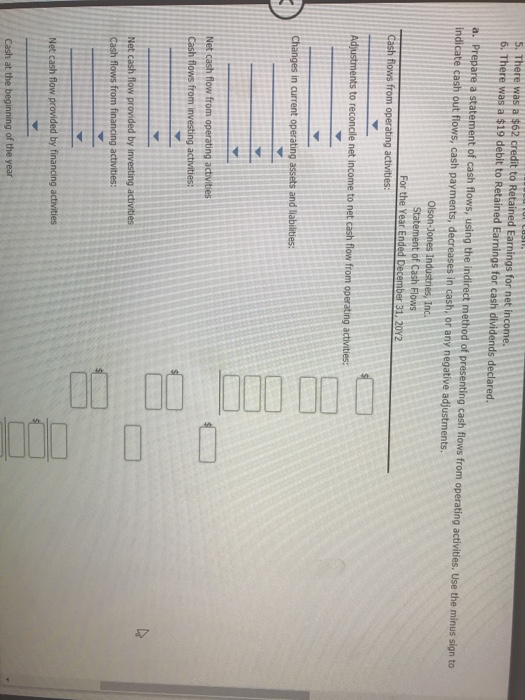

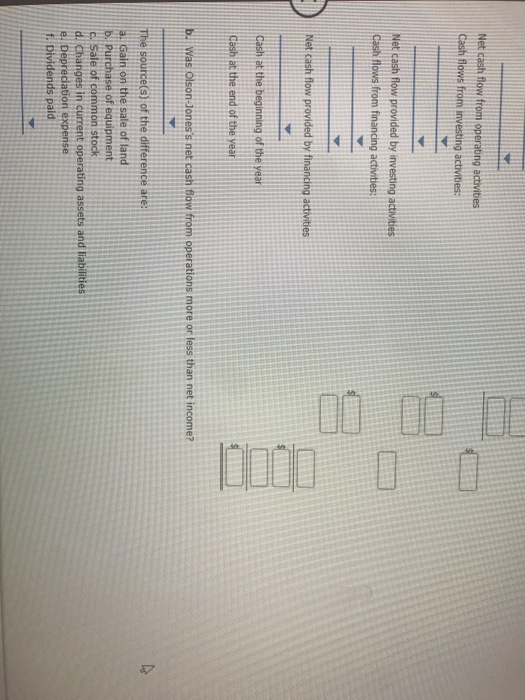

Statement of Cash Flows-Indirect Method The comparative balance sheet of olson-Jones Industries Inc. for December 31, 20Y2 and 20Y1, is as follows: Dec. 31, 20Y2 Dec. 31, 20Y1 $95 $30 Accounts receivable (net) Inventories Land Equipment Accumulated depreciation-equipment 37 76 85 (12) $288 $199 Liabilities and Stockholders' Equity Accounts payable (merchandise creditors) Dividends payable Common stock, $10 par Paid-in capital: Excess of issue price over par-common stock Retained earnings $36 19 47 180 $288 137 Total liabilities and stockholders' equity $199 The following additional information is taken from the records 1. Land was sold for $223. 2. Equipment was acquired for cash. 3. There were no disposals of equipment during the year 4. The common stock was issued for cash. 5. There was a $62 credit to Retained Earnings for net income. a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts