Question: this is all one question, they all go together. please bold final answer and show work Problem 10-47 (LO 10-2) (Algo) [The following information applies

![information applies to the questions displayed below.] DLW Corporation acquired and placed](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fe7b978ddac_81566fe7b9710ae0.jpg)

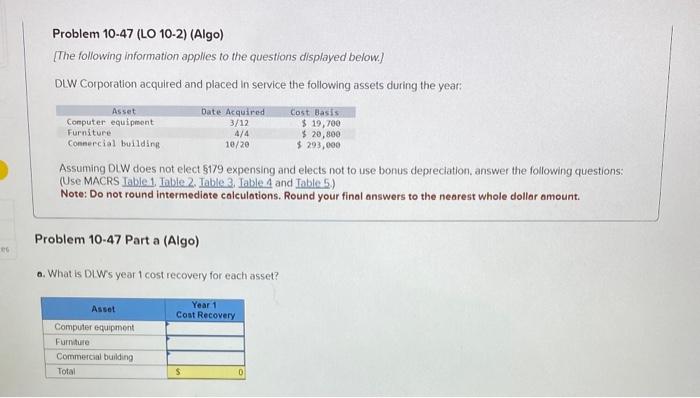

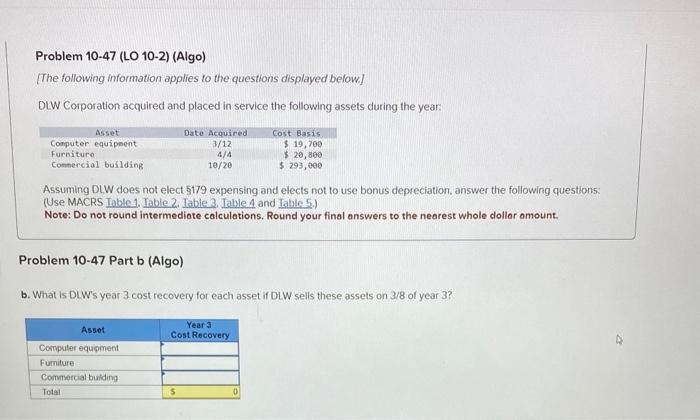

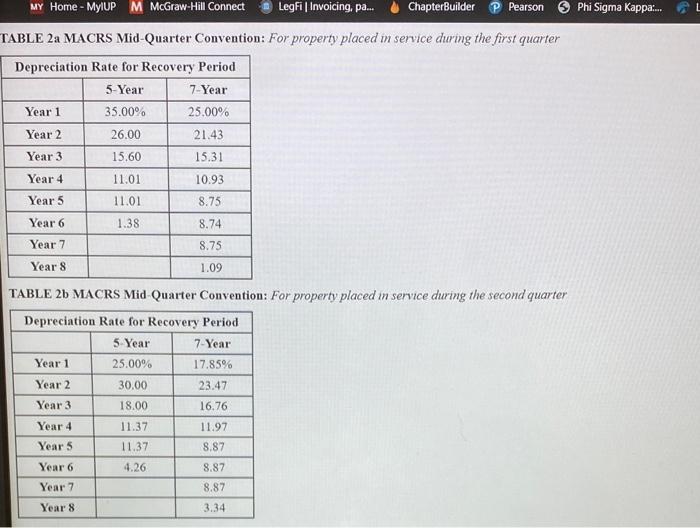

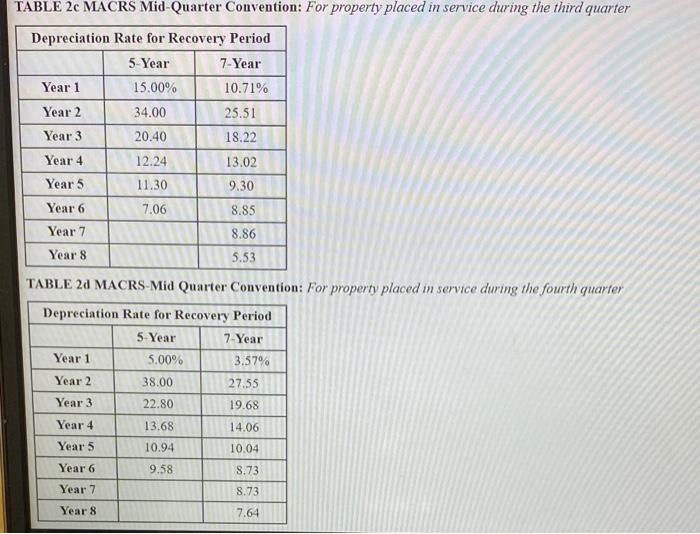

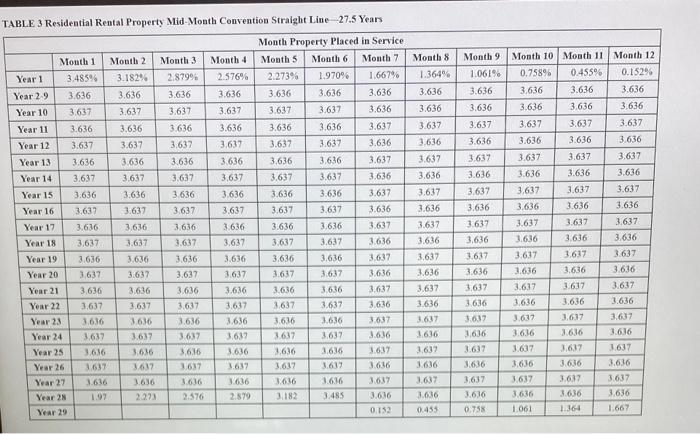

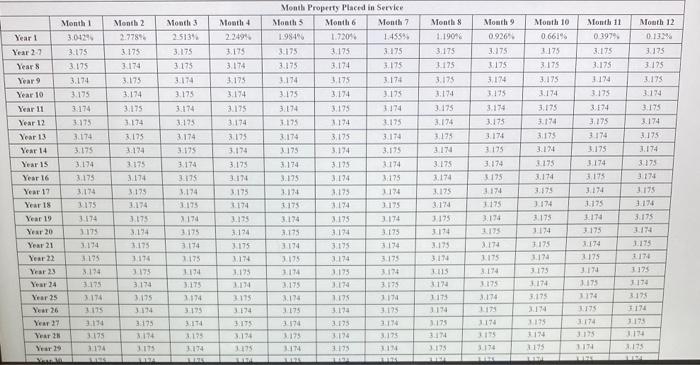

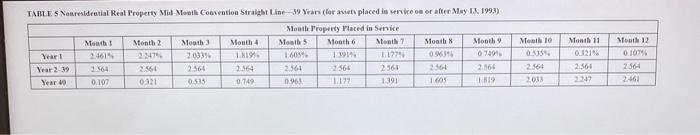

Problem 10-47 (LO 10-2) (Algo) [The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Assuming DIW does not elect \$179 expensing and elects not to use bonus depreciation, answer the following questions (Use MACRS Iable 1. Table 2, Table 3, Table 4 and Iable 5) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Problem 10-47 Part a (Algo) 0. What is DIWs year 1 cost recovery for each asset? Problem 10-47 (LO 10-2) (Algo) [The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Assuming DLW does not elect 5179 expensing and elects not to use bonus depreciation, answer the following question: (Use MACRS Table 1, Table 2, Iable 3, Jable 4 and Iable 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Problem 10-47 Part b (Algo) b. What is DLW's year 3 cost recovery for each asset if DLW sells these assets on 3/8 of year 3 ? Table 1 MACRS Half-Year Convention ABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line 27.5 Years Month Property Placed in Service Problem 10-47 (LO 10-2) (Algo) [The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Assuming DIW does not elect \$179 expensing and elects not to use bonus depreciation, answer the following questions (Use MACRS Iable 1. Table 2, Table 3, Table 4 and Iable 5) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Problem 10-47 Part a (Algo) 0. What is DIWs year 1 cost recovery for each asset? Problem 10-47 (LO 10-2) (Algo) [The following information applies to the questions displayed below.] DLW Corporation acquired and placed in service the following assets during the year: Assuming DLW does not elect 5179 expensing and elects not to use bonus depreciation, answer the following question: (Use MACRS Table 1, Table 2, Iable 3, Jable 4 and Iable 5.) Note: Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Problem 10-47 Part b (Algo) b. What is DLW's year 3 cost recovery for each asset if DLW sells these assets on 3/8 of year 3 ? Table 1 MACRS Half-Year Convention ABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 3 Residential Rental Property Mid-Month Convention Straight Line 27.5 Years Month Property Placed in Service

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts