Question: This is all part of ONE problem, I need help with part a) and b) for both the European call AND the American Put option.

This is all part of ONE problem, I need help with part a) and b) for both the European call AND the American Put option. Thank you.

This is all part of ONE problem, I need help with part a) and b) for both the European call AND the American Put option. Thank you.

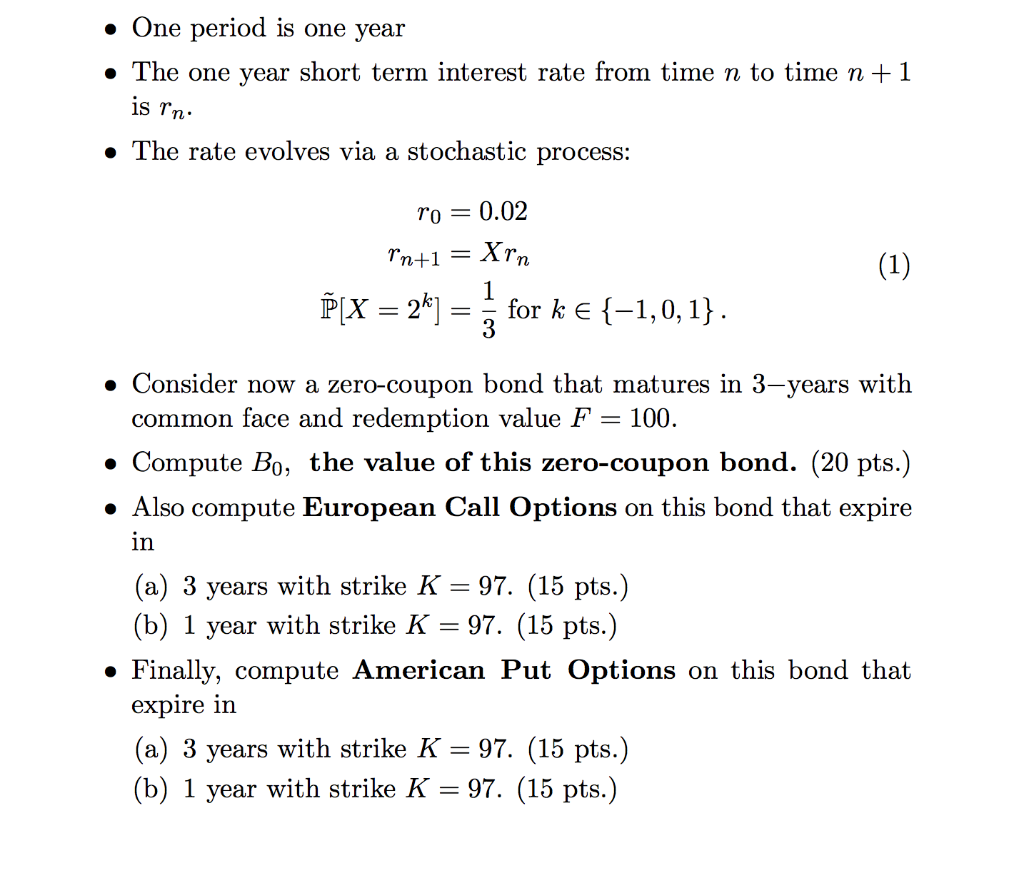

One period is one year The one year short term interest rate from time n to time n +1 is in. The rate evolves via a stochastic process: To = 0.02 Pn+1 = Xrn PX = 2k] = = for k (-1,0,1}. (1) Consider now a zero-coupon bond that matures in 3-years with common face and redemption value F = 100. Compute Bo, the value of this zero-coupon bond. (20 pts.) Also compute European Call Options on this bond that expire in (a) 3 years with strike K = 97. (15 pts.) (b) 1 year with strike K = 97. (15 pts.) Finally, compute American Put Options on this bond that expire in (a) 3 years with strike K = 97. (15 pts.) (b) 1 year with strike K = 97. (15 pts.) One period is one year The one year short term interest rate from time n to time n +1 is in. The rate evolves via a stochastic process: To = 0.02 Pn+1 = Xrn PX = 2k] = = for k (-1,0,1}. (1) Consider now a zero-coupon bond that matures in 3-years with common face and redemption value F = 100. Compute Bo, the value of this zero-coupon bond. (20 pts.) Also compute European Call Options on this bond that expire in (a) 3 years with strike K = 97. (15 pts.) (b) 1 year with strike K = 97. (15 pts.) Finally, compute American Put Options on this bond that expire in (a) 3 years with strike K = 97. (15 pts.) (b) 1 year with strike K = 97. (15 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts