Question: This is all that the question provided Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger

![information applies to the questions displayed below.] On January 1, 2021, the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716605e11ea0_7096716605d99c40.jpg)

This is all that the question provided

This is all that the question provided

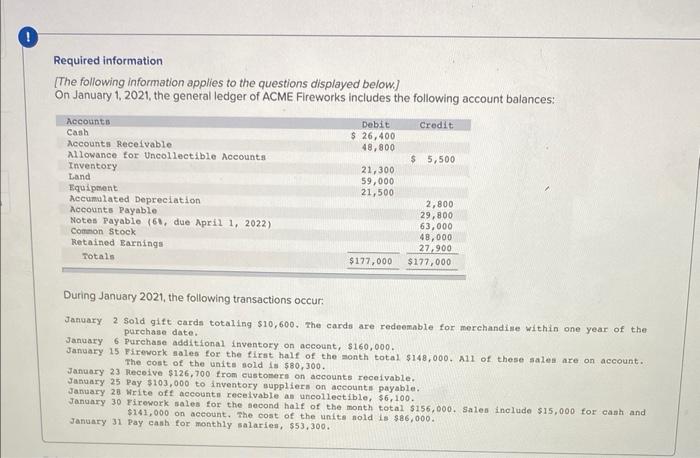

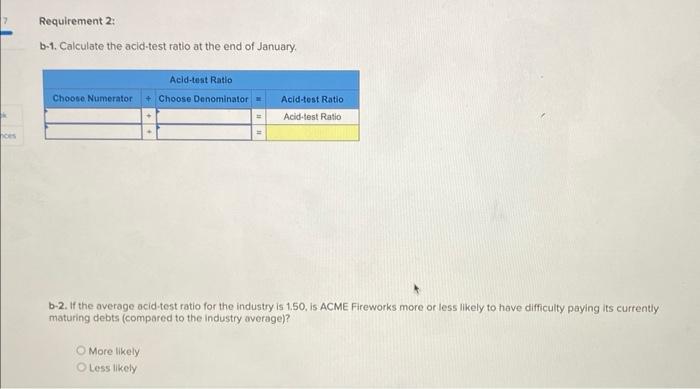

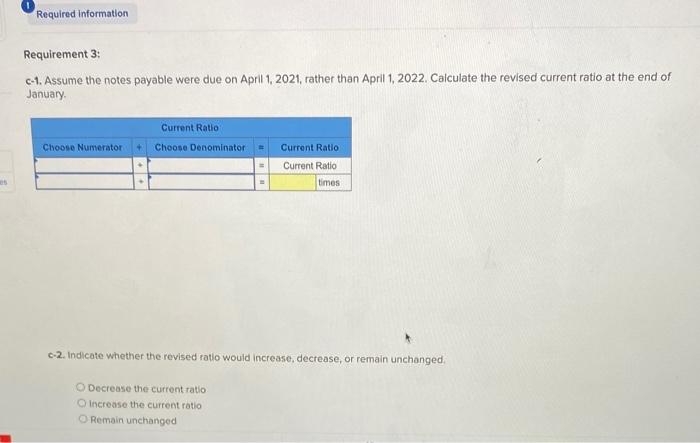

Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 sold gift cards totaling $10,600. The cards are redeemable for merchandime within one year of the January 6 purchaee date. January 6 Purchase additional inventory on account, $160,000. aanuary 23 Receive $126,700 from eistants $80,300. 3anuary 25 Pay $103,000 to inventory a puppliefon accounts receivable. January 2 Hrite off account recelvable ap on on apcount payable. January 30 Firowork nales for the decond hale of ebe month total $155 $141,000 on account, zhe cost of the unite nold is 586,000 , poo. Salen inelude $15,000 for cash and January 31 Pay eanh for monthly salarien, $53,300. fold is 386,000 . 31. Pay canh for monthly salarien, $53,300. January 31 Pay cash for monthiy salarles, $53,300, 7. Analyze the following for ACME Fireworks Requirement 1: a-1. Calculate the current ratio at the end of January. a-2. If the average current ratio for the industry is 1.80, is ACME Fireworks more or less liquid than the industry average? More liquid Less liquid b-1. Calculate the acid-test ratio at the end of January. b-2. If the average acid-test ratio for the industry is 1.50, is ACME Fireworks more or less likely to have difficulty paying its currently maturing debts (compared to the industry overage)? More likely Less likely c-1. Assume the notes payable were due on April 1, 2021, rather than April 1, 2022. Calculate the revised current ratio at the end of January. c-2. Indicate whether the revised ratlo would increase, decrease, or remain unchanged. Decrease the currentratio Increase the current ratio Remain unchanged Required information [The following information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 sold gift cards totaling $10,600. The cards are redeemable for merchandime within one year of the January 6 purchaee date. January 6 Purchase additional inventory on account, $160,000. aanuary 23 Receive $126,700 from eistants $80,300. 3anuary 25 Pay $103,000 to inventory a puppliefon accounts receivable. January 2 Hrite off account recelvable ap on on apcount payable. January 30 Firowork nales for the decond hale of ebe month total $155 $141,000 on account, zhe cost of the unite nold is 586,000 , poo. Salen inelude $15,000 for cash and January 31 Pay eanh for monthly salarien, $53,300. fold is 386,000 . 31. Pay canh for monthly salarien, $53,300. January 31 Pay cash for monthiy salarles, $53,300, 7. Analyze the following for ACME Fireworks Requirement 1: a-1. Calculate the current ratio at the end of January. a-2. If the average current ratio for the industry is 1.80, is ACME Fireworks more or less liquid than the industry average? More liquid Less liquid b-1. Calculate the acid-test ratio at the end of January. b-2. If the average acid-test ratio for the industry is 1.50, is ACME Fireworks more or less likely to have difficulty paying its currently maturing debts (compared to the industry overage)? More likely Less likely c-1. Assume the notes payable were due on April 1, 2021, rather than April 1, 2022. Calculate the revised current ratio at the end of January. c-2. Indicate whether the revised ratlo would increase, decrease, or remain unchanged. Decrease the currentratio Increase the current ratio Remain unchanged

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts