Question: This is all the Info. given. Please show work and no excel functions Joe Exotic Inc. is considering expanding into the cruise line business. To

This is all the Info. given. Please show work and no excel functions

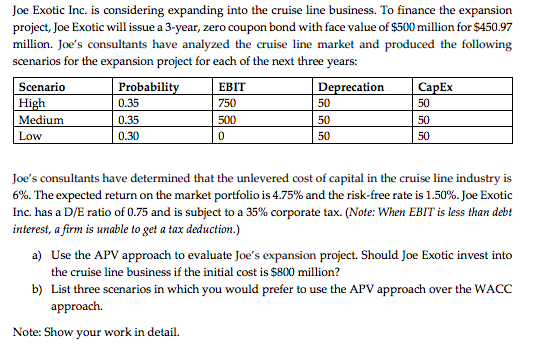

Joe Exotic Inc. is considering expanding into the cruise line business. To finance the expansion project, Joe Exotic will issue a 3-year, zero coupon bond with face value of $500 million for $450.97 million. Joes consultants have analyzed the cruise line market and produced the following scenarios for the expansion project for each of the next three years: Scenario Probability EBIT Deprecation CapEx High 0.35 750 50 50 Medium 0.35 500 50 50 Low 0.30 0 50 50 Joes consultants have determined that the unlevered cost of capital in the cruise line industry is 6%. The expected return on the market portfolio is 4.75% and the risk-free rate is 1.50%. Joe Exotic Inc. has a D/E ratio of 0.75 and is subject to a 35% corporate tax. (Note: When EBIT is less than debt interest, a firm is unable to get a tax deduction.) a) Use the APV approach to evaluate Joes expansion project. Should Joe Exotic invest into the cruise line business if the initial cost is $800 million? b) List three scenarios in which you would prefer to use the APV approach over the WACC approach. Note: Show your work in detail.

Joe Exotic Inc. is considering expanding into the cruise line business. To finance the expansion project, Joe Exotic will issue a 3-year, zero coupon bond with face value of $500 million for $450.97 million. Joe's consultants have analyzed the cruise line market and produced the following scenarios for the expansion project for each of the next three years: Scenario Probability EBIT Deprecation CapEx High 0.35 750 50 50 Medium 0.35 500 50 50 Low 0.30 50 50 Joe's consultants have determined that the unlevered cost of capital in the cruise line industry is 6%. The expected return on the market portfolio is 4.75% and the risk-free rate is 1.50%. Joe Exotic Inc. has a D/E ratio of 0.75 and is subject to a 35% corporate tax. (Note: When EBIT is less than debt interest, a firm is unable to get a tax deduction.) a) Use the APV approach to evaluate Joe's expansion project. Should Joe Exotic invest into the cruise line business if the initial cost is $800 million? b) List three scenarios in which you would prefer to use the APV approach over the WACC approach Note: Show your work in detail. Joe Exotic Inc. is considering expanding into the cruise line business. To finance the expansion project, Joe Exotic will issue a 3-year, zero coupon bond with face value of $500 million for $450.97 million. Joe's consultants have analyzed the cruise line market and produced the following scenarios for the expansion project for each of the next three years: Scenario Probability EBIT Deprecation CapEx High 0.35 750 50 50 Medium 0.35 500 50 50 Low 0.30 50 50 Joe's consultants have determined that the unlevered cost of capital in the cruise line industry is 6%. The expected return on the market portfolio is 4.75% and the risk-free rate is 1.50%. Joe Exotic Inc. has a D/E ratio of 0.75 and is subject to a 35% corporate tax. (Note: When EBIT is less than debt interest, a firm is unable to get a tax deduction.) a) Use the APV approach to evaluate Joe's expansion project. Should Joe Exotic invest into the cruise line business if the initial cost is $800 million? b) List three scenarios in which you would prefer to use the APV approach over the WACC approach Note: Show your work in detail

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts