Question: This is all the info I have been given for this question... please do it asap! thank you R 1005 BMO CIBC RBC HT Investor

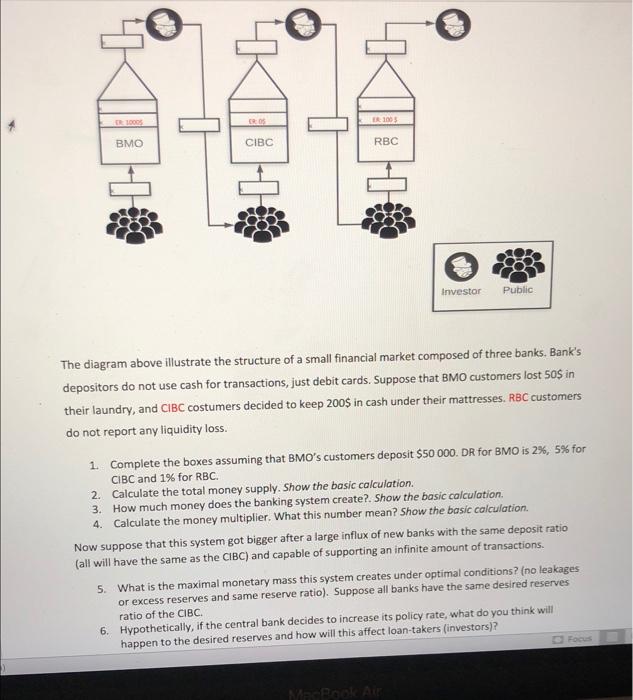

R 1005 BMO CIBC RBC HT Investor Public The diagram above illustrate the structure of a small financial market composed of three banks. Bank's depositors do not use cash for transactions, just debit cards. Suppose that BMO customers lost 50$ in their laundry, and CIBC costumers decided to keep 2005 in cash under their mattresses. RBC customers do not report any liquidity loss. 1. Complete the boxes assuming that BMO's customers deposit $50 000. DR for BMO is 2%, 5% for CIBC and 1% for RBC. 2. Calculate the total money supply. Show the basic calculation. 3. How much money does the banking system create?. Show the basic calculation, 4. Calculate the money multiplier. What this number mean? Show the basic calculation. Now suppose that this system got bigger after a large influx of new banks with the same deposit ratio (all will have the same as the CIBC) and capable of supporting an infinite amount of transactions. 5. What is the maximal monetary mass this system creates under optimal conditions? (no leakages or excess reserves and same reserve ratio). Suppose all banks have the same desired reserves ratio of the CIBC 6. Hypothetically, if the central bank decides to increase its policy rate, what do you think will happen to the desired reserves and how will this affect loan-takers (investors)? Me Book Air R 1005 BMO CIBC RBC HT Investor Public The diagram above illustrate the structure of a small financial market composed of three banks. Bank's depositors do not use cash for transactions, just debit cards. Suppose that BMO customers lost 50$ in their laundry, and CIBC costumers decided to keep 2005 in cash under their mattresses. RBC customers do not report any liquidity loss. 1. Complete the boxes assuming that BMO's customers deposit $50 000. DR for BMO is 2%, 5% for CIBC and 1% for RBC. 2. Calculate the total money supply. Show the basic calculation. 3. How much money does the banking system create?. Show the basic calculation, 4. Calculate the money multiplier. What this number mean? Show the basic calculation. Now suppose that this system got bigger after a large influx of new banks with the same deposit ratio (all will have the same as the CIBC) and capable of supporting an infinite amount of transactions. 5. What is the maximal monetary mass this system creates under optimal conditions? (no leakages or excess reserves and same reserve ratio). Suppose all banks have the same desired reserves ratio of the CIBC 6. Hypothetically, if the central bank decides to increase its policy rate, what do you think will happen to the desired reserves and how will this affect loan-takers (investors)? Me Book Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts