Question: This is all the information for the problem if you can please show the process and results please Virtue Financial Group (VFG) is planning to

This is all the information for the problem if you can please show the process and results please

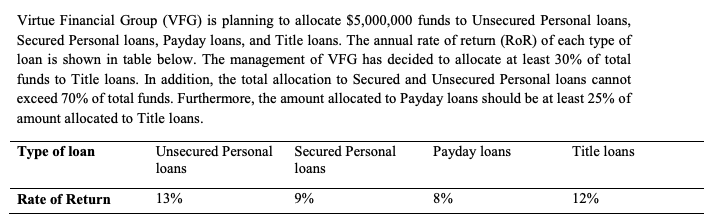

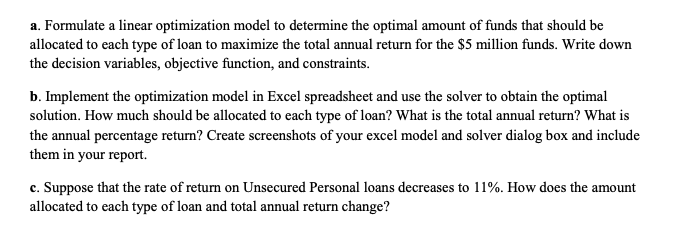

Virtue Financial Group (VFG) is planning to allocate $5,000,000 funds to Unsecured Personal loans, Secured Personal loans, Payday loans, and Title loans. The annual rate of return (RoR) of each type of loan is shown in table below. The management of VFG has decided to allocate at least 30% of total funds to Title loans. In addition, the total allocation to Secured and Unsecured Personal loans cannot exceed 70% of total funds. Furthermore, the amount allocated to Payday loans should be at least 25% of amount allocated to Title loans. Type of loan Unsecured Personal loans Title loans Secured Personal loans Payday loans Rate of Return 13% 9% 8% 12% a. Formulate a linear optimization model to determine the optimal amount of funds that should be allocated to each type of loan to maximize the total annual return for the $5 million funds. Write down the decision variables, objective function, and constraints. b. Implement the optimization model in Excel spreadsheet and use the solver to obtain the optimal solution. How much should be allocated to each type of loan? What is the total annual return? What is the annual percentage return? Create screenshots of your excel model and solver dialog box and include them in your report c. Suppose that the rate of return on Unsecured Personal loans decreases to 11%. How does the amount allocated to each type of loan and total annual return change? Virtue Financial Group (VFG) is planning to allocate $5,000,000 funds to Unsecured Personal loans, Secured Personal loans, Payday loans, and Title loans. The annual rate of return (RoR) of each type of loan is shown in table below. The management of VFG has decided to allocate at least 30% of total funds to Title loans. In addition, the total allocation to Secured and Unsecured Personal loans cannot exceed 70% of total funds. Furthermore, the amount allocated to Payday loans should be at least 25% of amount allocated to Title loans. Type of loan Unsecured Personal loans Title loans Secured Personal loans Payday loans Rate of Return 13% 9% 8% 12% a. Formulate a linear optimization model to determine the optimal amount of funds that should be allocated to each type of loan to maximize the total annual return for the $5 million funds. Write down the decision variables, objective function, and constraints. b. Implement the optimization model in Excel spreadsheet and use the solver to obtain the optimal solution. How much should be allocated to each type of loan? What is the total annual return? What is the annual percentage return? Create screenshots of your excel model and solver dialog box and include them in your report c. Suppose that the rate of return on Unsecured Personal loans decreases to 11%. How does the amount allocated to each type of loan and total annual return change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts