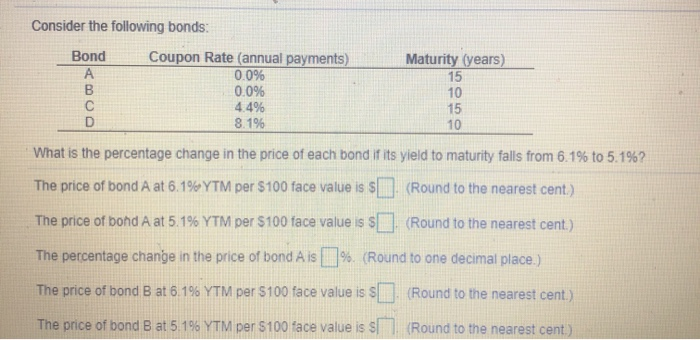

Question: This is all the information given ... Consider the following bonds: Bond Maturity (years) Coupon Rate (annual payments) 0.0% 0.0% 4.496 8.1996 What is the

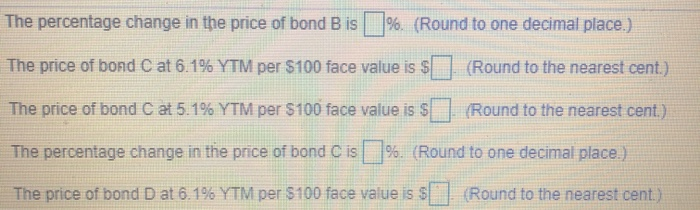

Consider the following bonds: Bond Maturity (years) Coupon Rate (annual payments) 0.0% 0.0% 4.496 8.1996 What is the percentage change in the price of each bond if its yield to maturity falls from 6.1% to 5.1%? The price of bond A at 6.1%YTM per $100 face value is $ (Round to the nearest cent) The price of bond A at 5.1% YTM per $100 face value is $ (Round to the nearest cent.) The percentage change in the price of bond Ais%. (Round to one decimal place.) The price of bond B at 6.19 YTM per 5100 face value is $ (Round to the nearest cent.) The price of bond B at 5.1% YTM per 5100 face value is (Round to the nearest cent) The percentage change in the price of bond B is %. (Round to one decimal place.) The price of bond C at 6.1% YTM per $100 face value is $ (Round to the nearest cent.) The price of bond C at 5.1% YTM per $100 face value is $ (Round to the nearest cent.) The percentage change in the price of bond C is %. (Round to one decimal place.) The price of bond D at 6.1% YTM per $100 face value is $ . (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts