Question: This is all the information given in the problem you can cancel this. thanks Consider the case of Hack Wellington Co. (HWC): Hack Wellington COWC)

This is all the information given in the problem

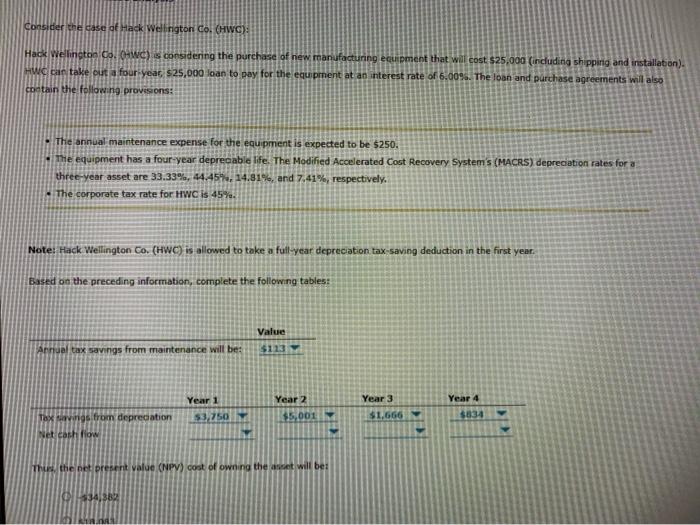

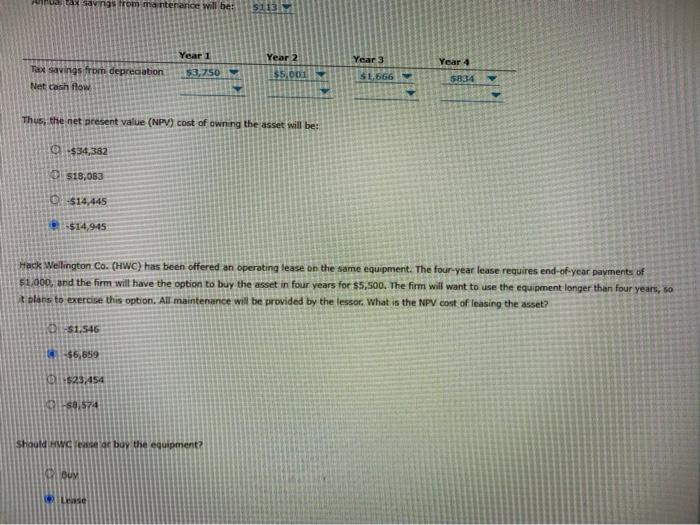

Consider the case of Hack Wellington Co. (HWC): Hack Wellington COWC) is considering the purchase of new manufacturing equipment that will cost $25,000 (including shipping and installation) HWC can take out four year, $25,000 loan to pay for the equipment at an interest rate of 6.009. The loan and purchase agreements will also coetain the following provisions: The annual maintenance expense for the equipment is expected to be $250. The equipment has a four-year deprecable life. The Modified Accelerated Cost Recovery Systems (MACRS) depreciation rates for a three-year asset are 33.33%, 44.45 14.81%, and 7,41%, respectively. The corporate tax rate for HWC is 45%. Note: Hack Wellington Co. (HWC) is allowed to take a full-year depreciation tax-saving deduction in the first year. Based on the preceding information, complete the following tables: Value $123 Annual tax savings from maintenance will be: Year 3 Year 1 53.250 Year 2 55001 Year 4 $834 $1,666 Taxavings from depreciation Net cash flow Then the present Value (NPV) cost of owning the act will be 334,38 Lax savings from manterarice will be 5113 Year 2 Year 1 $3,750 Year 4 Tax savings from depreciation Net cash flow Year 3 $1,566 $5.001 5834 Thus, the net present value (NPV) cost of owning the asset will be 1-$34,382 $18,063 D: 514,445 $14,945 Hack Wellington Co. (HWC) has been offered an operating tease on the same equipment. The four-year lease requires end-of-year payments of $1,000, and the firm will have the option to buy the asset in four years for $5,500. The firm will want to use the equipment longer than four years, so t plans to exercise this option. All maintenance will be provided by the lessor. What is the NPV cost of leasing the asset? $1,546 -$6,659 1523.454 ISO 574 Should HWS Tac buy the equipment DOWY Lee Consider the case of Hack Wellington Co. (HWC): Hack Wellington COWC) is considering the purchase of new manufacturing equipment that will cost $25,000 (including shipping and installation) HWC can take out four year, $25,000 loan to pay for the equipment at an interest rate of 6.009. The loan and purchase agreements will also coetain the following provisions: The annual maintenance expense for the equipment is expected to be $250. The equipment has a four-year deprecable life. The Modified Accelerated Cost Recovery Systems (MACRS) depreciation rates for a three-year asset are 33.33%, 44.45 14.81%, and 7,41%, respectively. The corporate tax rate for HWC is 45%. Note: Hack Wellington Co. (HWC) is allowed to take a full-year depreciation tax-saving deduction in the first year. Based on the preceding information, complete the following tables: Value $123 Annual tax savings from maintenance will be: Year 3 Year 1 53.250 Year 2 55001 Year 4 $834 $1,666 Taxavings from depreciation Net cash flow Then the present Value (NPV) cost of owning the act will be 334,38 Lax savings from manterarice will be 5113 Year 2 Year 1 $3,750 Year 4 Tax savings from depreciation Net cash flow Year 3 $1,566 $5.001 5834 Thus, the net present value (NPV) cost of owning the asset will be 1-$34,382 $18,063 D: 514,445 $14,945 Hack Wellington Co. (HWC) has been offered an operating tease on the same equipment. The four-year lease requires end-of-year payments of $1,000, and the firm will have the option to buy the asset in four years for $5,500. The firm will want to use the equipment longer than four years, so t plans to exercise this option. All maintenance will be provided by the lessor. What is the NPV cost of leasing the asset? $1,546 -$6,659 1523.454 ISO 574 Should HWS Tac buy the equipment DOWY Lee

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts