Question: This is all the information given in the question Malcolm Company uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to

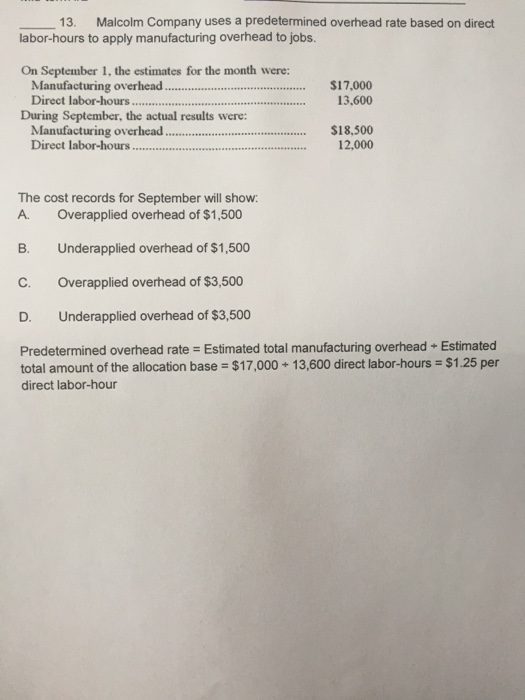

Malcolm Company uses a predetermined overhead rate based on direct labor-hours to apply manufacturing overhead to jobs. On September 1 the estimates for the month were Manufacturing overhead 17000 Direct labor-hours 13600 During September, the actual results were Manufacturing overhead 18500 Direct labor-hours 12000 The cost records for September will show Overapplied overhead of $1500 Underapplied overhead of $1500 Overapplied overhead of $3500 Underapplied overhead of $3500 Predetermined overhead rate= Estimated total manufacturing overhead+ Estimated total amount of the allocation base =$17000 + 13600 direct labor- hours=$1.25 per direct labor-hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts