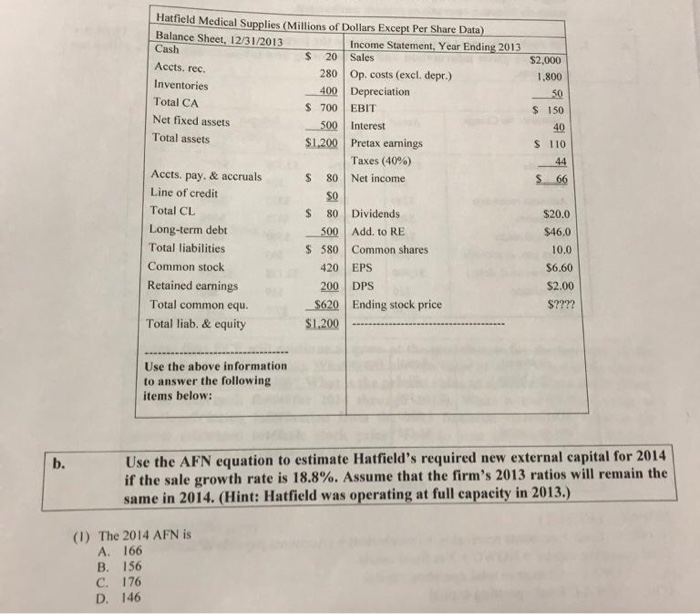

Question: this is all the information given. what other information are you looking for? $2,000 1.800 $ 150 $ 110 Hatfield Medical Supplies (Millions of Dollars

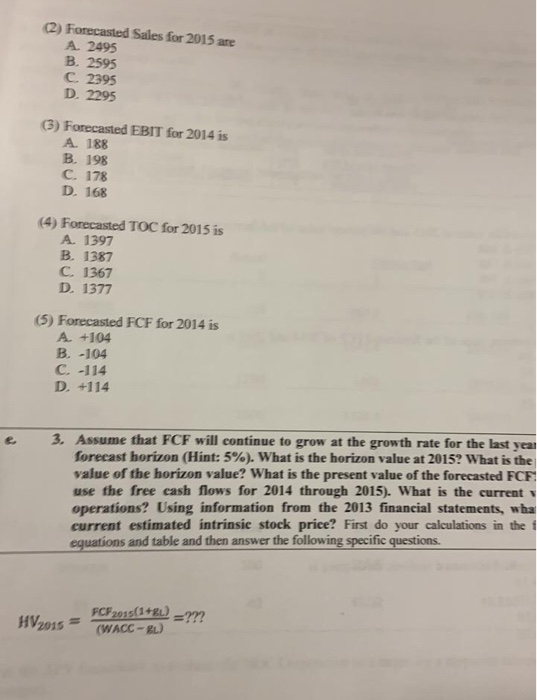

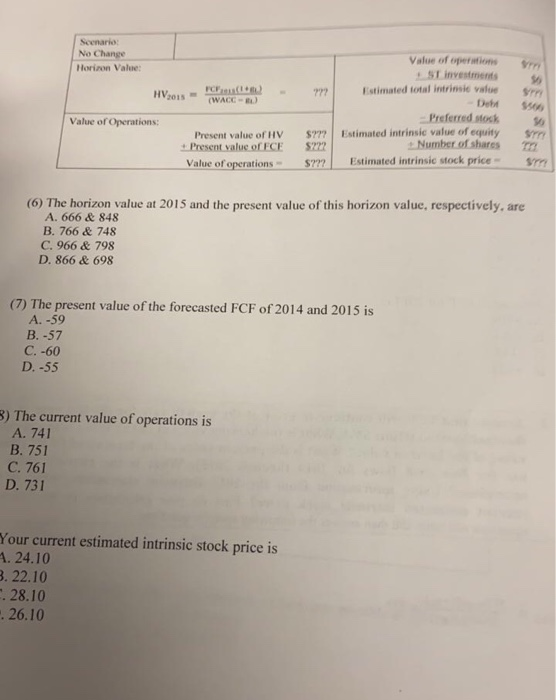

$2,000 1.800 $ 150 $ 110 Hatfield Medical Supplies (Millions of Dollars Except Per Share Data) Balance Sheet, 12/31/2013 Income Statement, Year Ending 2013 Cash $ 20 Sales Accts. rec. 280 Op. costs (excl. depr.) Inventories 400 Depreciation Total CA $ 700 EBIT Net fixed assets 500 Interest Total assets $1.200 Pretax earnings Taxes (40%) Accts. pay. & accruals $ 80 Net income Line of credit $0 Total CL $ 80 Dividends Long-term debt 500 Add to RE Total liabilities $ 580 Common shares Common stock 420 EPS Retained earnings 200 DPS Total common equ. $620 Ending stock price Total liab. & equity $1.200 S66 $20.0 $46,0 10.0 $6.60 $2.00 $???? Use the above information to answer the following items below: Use the AFN equation to estimate Hatfield's required new external capital for 2014 if the sale growth rate is 18.8%. Assume that the firm's 2013 ratios will remain the same in 2014. (Hint: Hatfield was operating at full capacity in 2013.) (1) The 2014 AFN is A. 166 B. 156 C. 176 D. 146 (2) Forecasted Sales for 2015 are A 2495 B. 2595 C. 2395 D. 2295 (3) Forecasted EBIT for 2014 is A. 188 B. 198 C. 178 D. 168 (4) Forecasted TOC for 2015 is A. 1397 B. 1387 C. 1367 D. 1377 (5) Forecasted FCF for 2014 is A. +104 B. -104 C. -114 D. +114 3. Assume that FCF will continue to grow at the growth rate for the last year forecast horizon (Hint: 5%). What is the horizon value at 20152 What is the value of the horizon value? What is the present value of the forecasted FCF use the free cash flows for 2014 through 2015). What is the current operations? Using information from the 2013 financial statements, wha current estimated intrinsie stock price? First do your calculations in the equations and table and then answer the following specific questions. HV 016 = FCF 2015(1+)=m (WACC - EL Scenario No Change Horizon Value: Value of operations + ST investments Estimated total intrinsic value HV01s PC ( 792 (WACC ) Value of Operations: Present value of HV +Present value of FCE Value of operations - $77 522? S7 Preferred stock Estimated intrinsic value of equity Number of shares Estimated intrinsic stock price (6) The horizon value at 2015 and the present value of this horizon value, respectively, are A. 666 & 848 B. 766 & 748 C. 966 & 798 D. 866 & 698 (7) The present value of the forecasted FCF of 2014 and 2015 is A. -59 B.-57 C.-60 D.-55 3) The current value of operations is A. 741 B. 751 C. 761 D. 731 Your current estimated intrinsic stock price is 1. 24.10 3. 22.10 -.28.10 26.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts