Question: this is all the information i have for the question. The following transactions for calendar year 2021 occurred for ABC Company. ABC uses perpetual inventory.

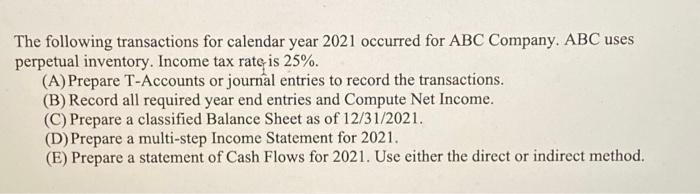

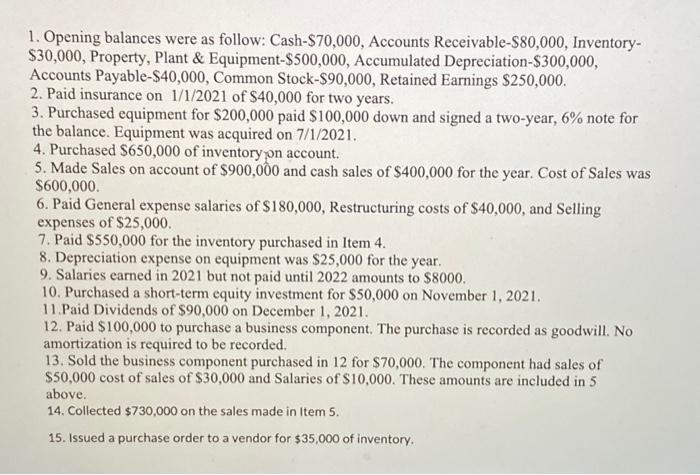

The following transactions for calendar year 2021 occurred for ABC Company. ABC uses perpetual inventory. Income tax rate is 25%. (A) Prepare T-Accounts or journal entries to record the transactions. (B) Record all required year end entries and Compute Net Income. (C) Prepare a classified Balance Sheet as of 12/31/2021. (D) Prepare a multi-step Income Statement for 2021. (E) Prepare a statement of Cash Flows for 2021. Use either the direct or indirect method. 1. Opening balances were as follow: Cash- $70,000, Accounts Receivable- $80,000, Inventory$30,000, Property, Plant \& Equipment- $500,000, Accumulated Depreciation- $300,000, Accounts Payable- $40,000, Common Stock- $90,000, Retained Earnings $250,000. 2. Paid insurance on 1/1/2021 of $40,000 for two years. 3. Purchased equipment for $200,000 paid $100,000 down and signed a two-year, 6% note for the balance. Equipment was acquired on 7/1/2021. 4. Purchased $650,000 of inventory on account. 5. Made Sales on account of $900,000 and cash sales of $400,000 for the year. Cost of Sales was $600,000. 6. Paid General expense salaries of $180,000, Restructuring costs of $40,000, and Selling expenses of $25,000. 7. Paid $550,000 for the inventory purchased in Item 4. 8. Depreciation expense on equipment was $25,000 for the year. 9. Salaries earned in 2021 but not paid until 2022 amounts to $8000. 10. Purchased a short-term equity investment for $50,000 on November 1, 2021. 11. Paid Dividends of $90,000 on December 1, 2021. 12. Paid $100,000 to purchase a business component. The purchase is recorded as goodwill. No amortization is required to be recorded. 13. Sold the business component purchased in 12 for $70,000. The component had sales of $50,000 cost of sales of $30,000 and Salaries of $10,000. These amounts are included in 5 above. 14. Collected $730,000 on the sales made in Item 5 . 15. Issued a purchase order to a vendor for $35,000 of inventory. The following transactions for calendar year 2021 occurred for ABC Company. ABC uses perpetual inventory. Income tax rate is 25%. (A) Prepare T-Accounts or journal entries to record the transactions. (B) Record all required year end entries and Compute Net Income. (C) Prepare a classified Balance Sheet as of 12/31/2021. (D) Prepare a multi-step Income Statement for 2021. (E) Prepare a statement of Cash Flows for 2021. Use either the direct or indirect method. 1. Opening balances were as follow: Cash- $70,000, Accounts Receivable- $80,000, Inventory$30,000, Property, Plant \& Equipment- $500,000, Accumulated Depreciation- $300,000, Accounts Payable- $40,000, Common Stock- $90,000, Retained Earnings $250,000. 2. Paid insurance on 1/1/2021 of $40,000 for two years. 3. Purchased equipment for $200,000 paid $100,000 down and signed a two-year, 6% note for the balance. Equipment was acquired on 7/1/2021. 4. Purchased $650,000 of inventory on account. 5. Made Sales on account of $900,000 and cash sales of $400,000 for the year. Cost of Sales was $600,000. 6. Paid General expense salaries of $180,000, Restructuring costs of $40,000, and Selling expenses of $25,000. 7. Paid $550,000 for the inventory purchased in Item 4. 8. Depreciation expense on equipment was $25,000 for the year. 9. Salaries earned in 2021 but not paid until 2022 amounts to $8000. 10. Purchased a short-term equity investment for $50,000 on November 1, 2021. 11. Paid Dividends of $90,000 on December 1, 2021. 12. Paid $100,000 to purchase a business component. The purchase is recorded as goodwill. No amortization is required to be recorded. 13. Sold the business component purchased in 12 for $70,000. The component had sales of $50,000 cost of sales of $30,000 and Salaries of $10,000. These amounts are included in 5 above. 14. Collected $730,000 on the sales made in Item 5 . 15. Issued a purchase order to a vendor for $35,000 of inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts