Question: This is all the information I have for the question. 1. Suppose that the term structure is described in the following table: maturity 6-month 12-month

This is all the information I have for the question.

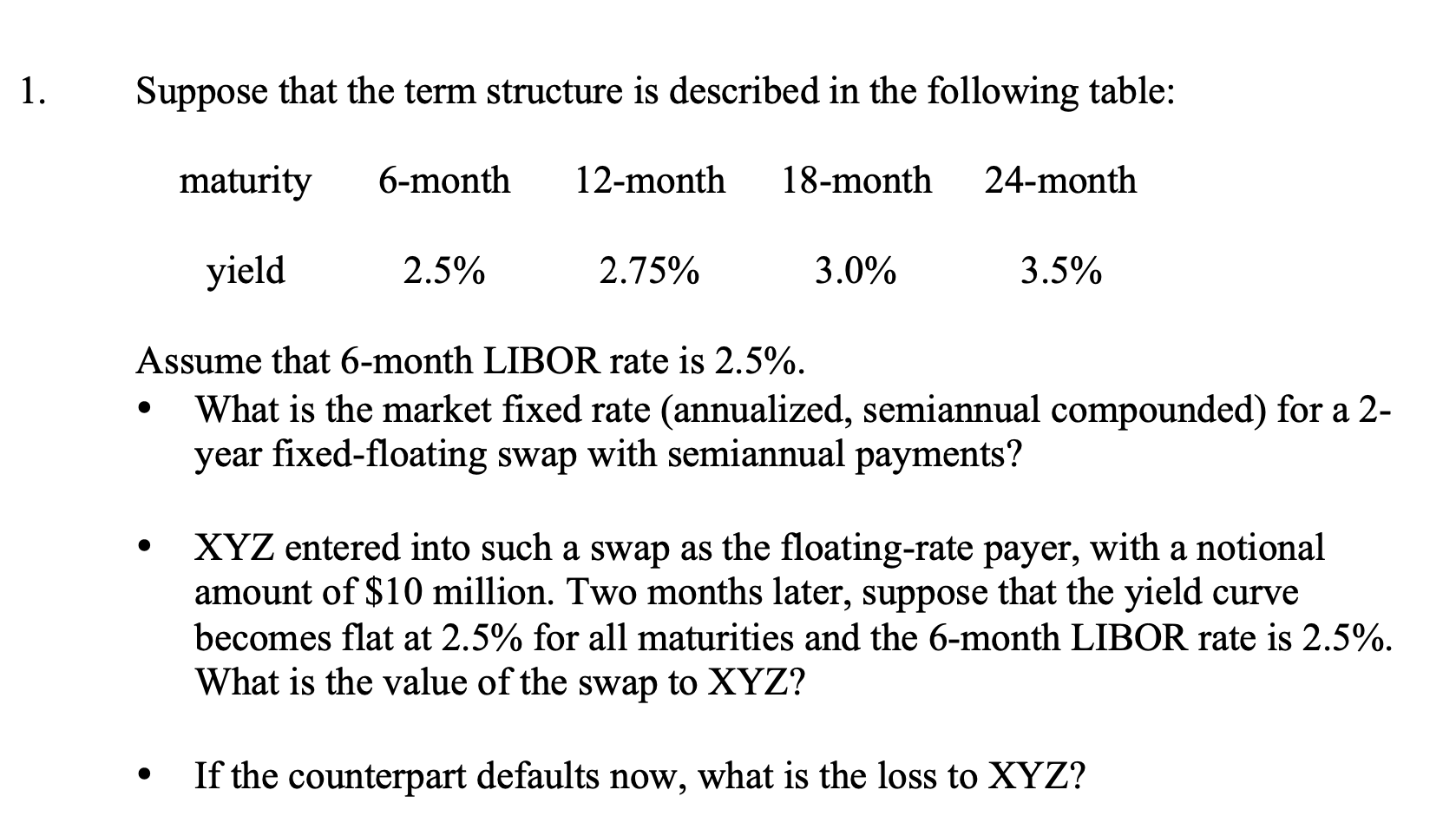

1. Suppose that the term structure is described in the following table: maturity 6-month 12-month 18-month 24-month yield 2.5% 2.75% 3.0% 3.5% Assume that 6-month LIBOR rate is 2.5%. What is the market fixed rate (annualized, semiannual compounded) for a 2- year fixed-floating swap with semiannual payments? XYZ entered into such a swap as the floating-rate payer, with a notional amount of $10 million. Two months later, suppose that the yield curve becomes flat at 2.5% for all maturities and the 6-month LIBOR rate is 2.5%. What is the value of the swap to XYZ? If the counterpart defaults now, what is the loss to XYZ? 1. Suppose that the term structure is described in the following table: maturity 6-month 12-month 18-month 24-month yield 2.5% 2.75% 3.0% 3.5% Assume that 6-month LIBOR rate is 2.5%. What is the market fixed rate (annualized, semiannual compounded) for a 2- year fixed-floating swap with semiannual payments? XYZ entered into such a swap as the floating-rate payer, with a notional amount of $10 million. Two months later, suppose that the yield curve becomes flat at 2.5% for all maturities and the 6-month LIBOR rate is 2.5%. What is the value of the swap to XYZ? If the counterpart defaults now, what is the loss to XYZ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts