Question: this is all the information I have regarding these two questions. Question 9 4 pts Smith & Rock Entertainment Inc.'s CFO has determined the optimal

this is all the information I have regarding these two questions.

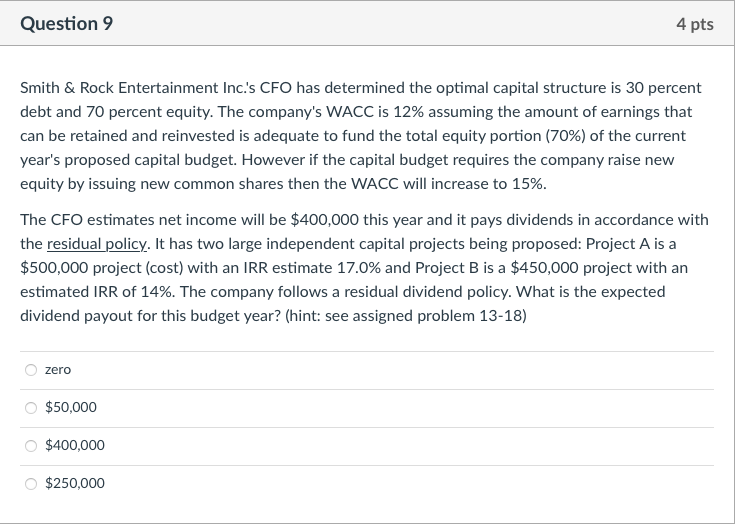

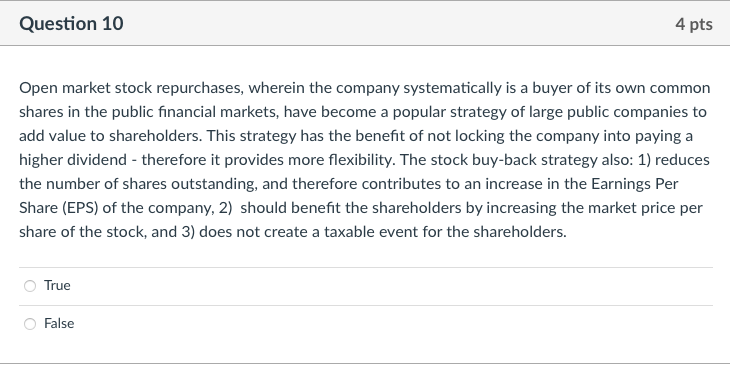

Question 9 4 pts Smith & Rock Entertainment Inc.'s CFO has determined the optimal capital structure is 30 percent debt and 70 percent equity. The company's WACC is 12% assuming the amount of earnings that can be retained and reinvested is adequate to fund the total equity portion (70%) of the current year's proposed capital budget. However if the capital budget requires the company raise new equity by issuing new common shares then the WACC will increase to 15%. The CFO estimates net income will be $400,000 this year and it pays dividends in accordance with the residual policy. It has two large independent capital projects being proposed: Project A is a $500,000 project (cost) with an IRR estimate 17.0% and Project B is a $450,000 project with an estimated IRR of 14%. The company follows a residual dividend policy. What is the expected dividend payout for this budget year? (hint: see assigned problem 13-18) zero $50,000 $400,000 $250,000 Question 10 4 pts Open market stock repurchases, wherein the company systematically is a buyer of its own common shares in the public financial markets, have become a popular strategy of large public companies to add value to shareholders. This strategy has the benefit of not locking the company into paying a higher dividend - therefore it provides more flexibility. The stock buy-back strategy also: 1) reduces the number of shares outstanding, and therefore contributes to an increase in the Earnings Per Share (EPS) of the company, 2) should benefit the shareholders by increasing the market price per share of the stock, and 3) does not create a taxable event for the shareholders. True False Question 9 4 pts Smith & Rock Entertainment Inc.'s CFO has determined the optimal capital structure is 30 percent debt and 70 percent equity. The company's WACC is 12% assuming the amount of earnings that can be retained and reinvested is adequate to fund the total equity portion (70%) of the current year's proposed capital budget. However if the capital budget requires the company raise new equity by issuing new common shares then the WACC will increase to 15%. The CFO estimates net income will be $400,000 this year and it pays dividends in accordance with the residual policy. It has two large independent capital projects being proposed: Project A is a $500,000 project (cost) with an IRR estimate 17.0% and Project B is a $450,000 project with an estimated IRR of 14%. The company follows a residual dividend policy. What is the expected dividend payout for this budget year? (hint: see assigned problem 13-18) zero $50,000 $400,000 $250,000 Question 10 4 pts Open market stock repurchases, wherein the company systematically is a buyer of its own common shares in the public financial markets, have become a popular strategy of large public companies to add value to shareholders. This strategy has the benefit of not locking the company into paying a higher dividend - therefore it provides more flexibility. The stock buy-back strategy also: 1) reduces the number of shares outstanding, and therefore contributes to an increase in the Earnings Per Share (EPS) of the company, 2) should benefit the shareholders by increasing the market price per share of the stock, and 3) does not create a taxable event for the shareholders. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts