Question: This is all the information provided. Please show full workings Thank you. Question 1 a) A pension plan has committed to pay a client 2,000

This is all the information provided. Please show full workings Thank you.

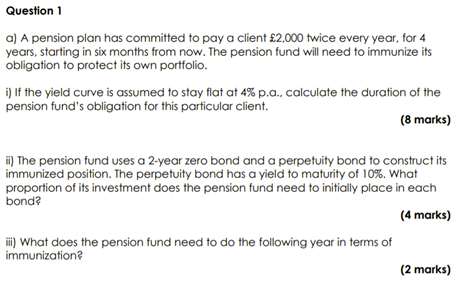

Question 1 a) A pension plan has committed to pay a client 2,000 twice every year, for 4 years, starting in six months from now. The pension fund will need to immunize its obligation to protect its own portfolio. i) If the yield curve is assumed to stay flat at 4% p.a.. calculate the duration of the pension fund's obligation for this particular client. (8 marks) ii) The pension fund uses a 2-year zero bond and a perpetuity bond to construct its immunized position. The perpetuity bond has a yield to maturity of 10%. What proportion of its investment does the pension fund need to initially place in each bonda (4 marks) ii) What does the pension fund need to do the following year in terms of immunization (2 marks) Question 1 a) A pension plan has committed to pay a client 2,000 twice every year, for 4 years, starting in six months from now. The pension fund will need to immunize its obligation to protect its own portfolio. i) If the yield curve is assumed to stay flat at 4% p.a.. calculate the duration of the pension fund's obligation for this particular client. (8 marks) ii) The pension fund uses a 2-year zero bond and a perpetuity bond to construct its immunized position. The perpetuity bond has a yield to maturity of 10%. What proportion of its investment does the pension fund need to initially place in each bonda (4 marks) ii) What does the pension fund need to do the following year in terms of immunization (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts