Question: This is all the information provided. Please show full workings Thank you. b) A stock price is currently 40. Over each of the next two

This is all the information provided. Please show full workings Thank you.

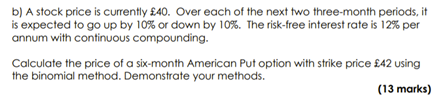

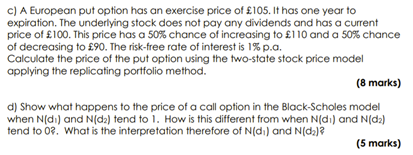

b) A stock price is currently 40. Over each of the next two three- month periods, it is expected to go up by 10% or down by 10%. The risk-free interest rate is 12% per annum with continuous compounding. Calculate the price of a six-month American Put option with strike price 42 using the binomial method. Demonstrate your methods. (13 marks) c) A European put option has an exercise price of 105. It has one year to expiration. The underlying stock does not pay any dividends and has a current price of 100. This price has a 50% chance of increasing to 110 and a 50% chance of decreasing to 90. The risk-free rate of interest is 1% p.a. Calculate the price of the put option using the two-state stock price model applying the replicating portfolio method. (8 marks) d) Show what happens to the price of a call option in the Black-Scholes model when Ndi) and N(da) tend to 1. How is this different from when Nd) and Nida) tend to 02. What is the interpretation therefore of Nid) and Nida)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts