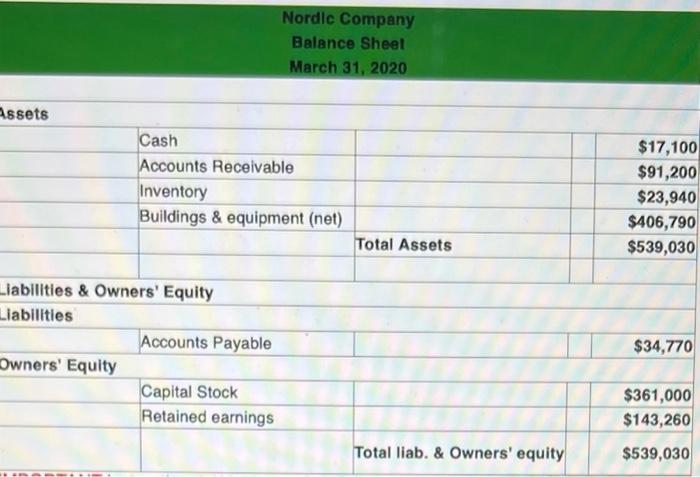

Question: this is all the information that has been given to me. Nordle Company Balance Sheet March 31, 2020 begin{tabular}{|l|r|r|} hline Cash & & $17,100

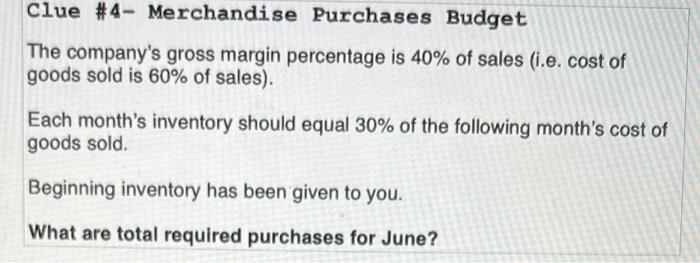

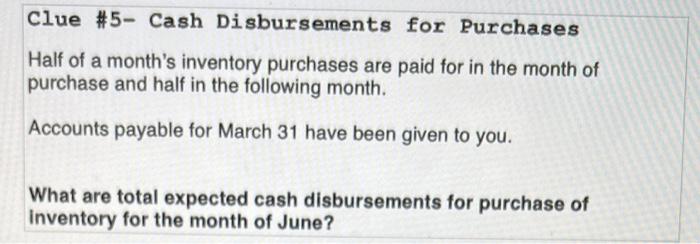

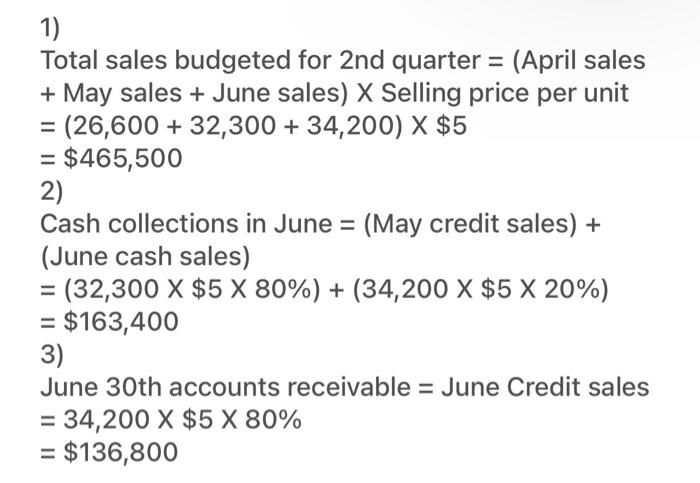

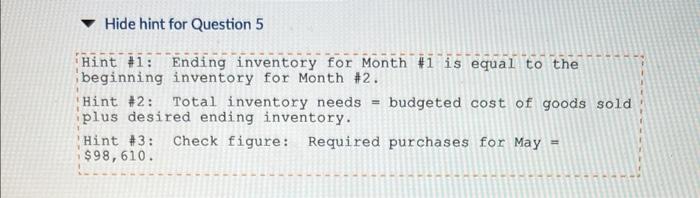

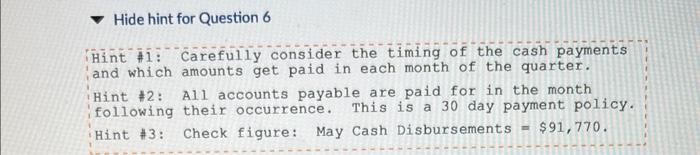

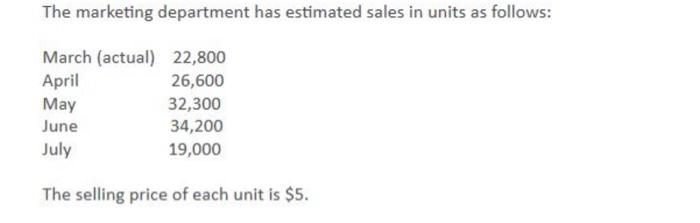

Nordle Company Balance Sheet March 31, 2020 \begin{tabular}{|l|r|r|} \hline Cash & & $17,100 \\ \hline Accounts Receivable & & $91,200 \\ \hline Inventory & & $23,940 \\ \hline Buildings \& equipment (net) & & $406,790 \\ \hline & Total Assets & $539,030 \\ \hline & & \\ \hline \end{tabular} Liabilities \& Owners' Equity Llabilities Accounts Payable $34,770 Owners' Equity \begin{tabular}{|l|r|r|} \hline Capital Stock & & $361,000 \\ \hline Retained earnings & & $143,260 \\ \hline & Total liab. \& Owners' equity & $539,030 \\ \hline \end{tabular} Clue \#4-Merchandise Purchases Budget The company's gross margin percentage is 40% of sales (i.e. cost of goods sold is 60% of sales). Each month's inventory should equal 30% of the following month's cost of goods sold. Beginning inventory has been given to you. What are total required purchases for June? Clue \#5- Cash Disbursements for Purchases Half of a month's inventory purchases are paid for in the month of purchase and half in the following month. Accounts payable for March 31 have been given to you. What are total expected cash disbursements for purchase of Inventory for the month of June? 1) Total sales budgeted for 2 nd quarter = (April sales + May sales + June sales) X Selling price per unit =(26,600+32,300+34,200)$5 =$465,500 2) Cash collections in June = (May credit sales) + (June cash sales) =(32,300$580%)+(34,200$520%) =$163,400 3) June 30th accounts receivable = June Credit sales =34,200$580% =$136,800 Hint \#1: Ending inventory for Month \# 1 is equal to the beginning inventory for Month \#2. Hint \#2: Total inventory needs = budgeted cost of goods sold plus desired ending inventory. Hint \#3: Check figure: Required purchases for May = $98,610 Hide hint for Question 6 Hint \#1: Carefully consider the timing of the cash payments and which amounts get paid in each month of the quarter. Hint $2: A1l accounts payable are paid for in the month following their occurrence. This is a 30 day payment policy. Hint \#3: Check figure: May Cash Disbursements =$91,770. The marketing department has estimated sales in units as follows: The selling price of each unit is $5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts