Question: This is all the information that is given for the problem C:13-35 Transferor Provisions. Val died on May 13, 2021. On July 3, 2018, she

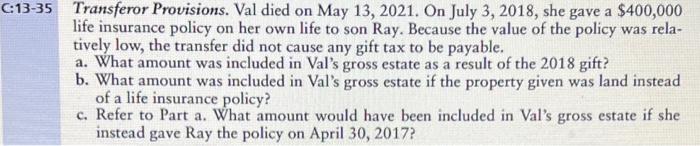

C:13-35 Transferor Provisions. Val died on May 13, 2021. On July 3, 2018, she gave a $400,000 life insurance policy on her own life to son Ray. Because the value of the policy was rela- tively low, the transfer did not cause any gift tax to be payable. a. What amount was included in Val's gross estate as a result of the 2018 gift? b. What amount was included in Val's gross estate if the property given was land instead of a life insurance policy? c. Refer to Part a. What amount would have been included in Val's gross estate if she instead gave Ray the policy on April 30, 2017? C:13-35 Transferor Provisions. Val died on May 13, 2021. On July 3, 2018, she gave a $400,000 life insurance policy on her own life to son Ray. Because the value of the policy was rela- tively low, the transfer did not cause any gift tax to be payable. a. What amount was included in Val's gross estate as a result of the 2018 gift? b. What amount was included in Val's gross estate if the property given was land instead of a life insurance policy? c. Refer to Part a. What amount would have been included in Val's gross estate if she instead gave Ray the policy on April 30, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts