Question: This is all the information that is on the assignment. D E Capital Asset Pricing Model Question 1: Name 2 proxies for the market portfolio

This is all the information that is on the assignment.

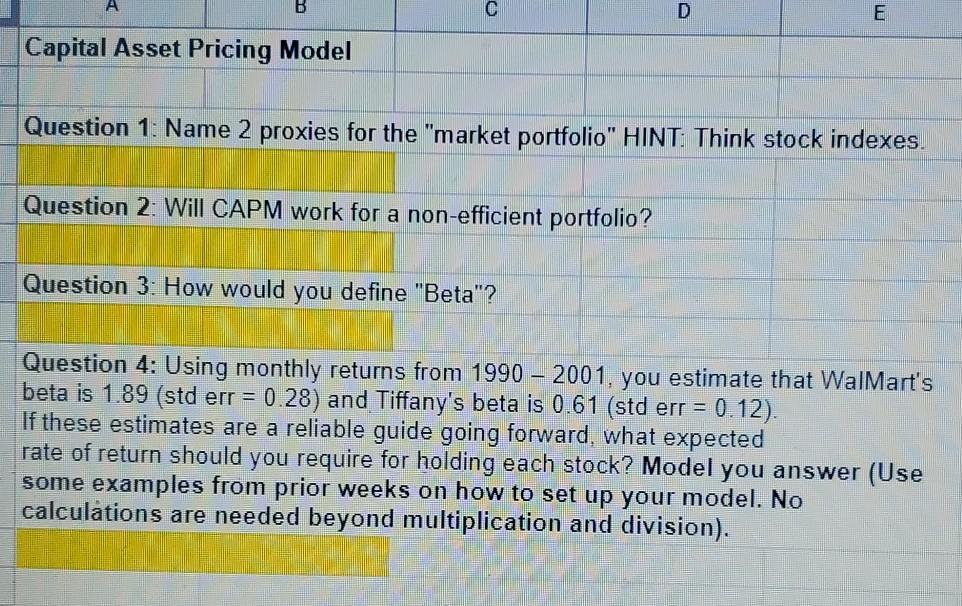

D E Capital Asset Pricing Model Question 1: Name 2 proxies for the "market portfolio" HINT: Think stock indexes. Question 2: Will CAPM work for a non-efficient portfolio? Question 3: How would you define "Beta"? Question 4: Using monthly returns from 1990 2001, you estimate that WalMart's beta is 1.89 (std err = 0.28) and Tiffany's beta is 0.61 (std err = 0.12). If these estimates are a reliable guide going forward, what expected rate of return should you require for holding each stock? Model you answer (Use some examples from prior weeks on how to set up your model. No calculations are needed beyond multiplication and division)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts