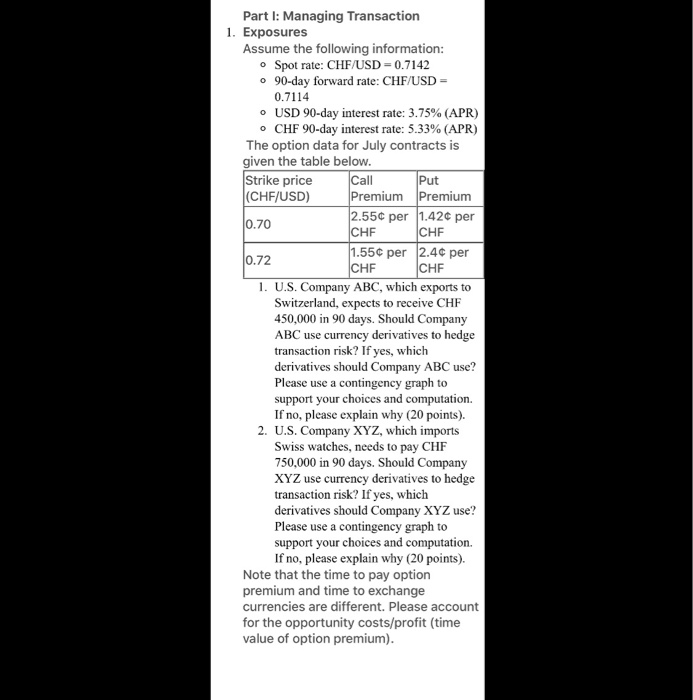

Question: this is all - there are no mising info Part 1: Managing Transaction 1. Exposures Assume the following information: o Spot rate: CHF/USD = 0.7142

Part 1: Managing Transaction 1. Exposures Assume the following information: o Spot rate: CHF/USD = 0.7142 o 90-day forward rate: CHF/USD = 0.7114 USD 90-day interest rate: 3.75% (APR) CHF 90-day interest rate: 5.33% (APR) The option data for July contracts is given the table below. Strike price Call Put (CHF/USD) Premium Premium 2.55 per 1.42 per 0.70 CHF CHF 0.72 1.55 per 2.4 per CHF CHF 1. U.S. Company ABC, which exports to Switzerland, expects to receive CHF 450,000 in 90 days. Should Company ABC use currency derivatives to hedge transaction risk? If yes, which derivatives should Company ABC use? Please use a contingency graph to support your choices and computation. If no, please explain why (20 points). 2. U.S. Company XYZ, which imports Swiss watches, needs to pay CHF 750,000 in 90 days. Should Company XYZ use currency derivatives to hedge transaction risk? If yes, which derivatives should Company XYZ use? Please use a contingency graph to support your choices and computation. If no, please explain why (20 points). Note that the time to pay option premium and time to exchange currencies are different. Please account for the opportunity costs/profit (time value of option premium). Part 1: Managing Transaction 1. Exposures Assume the following information: o Spot rate: CHF/USD = 0.7142 o 90-day forward rate: CHF/USD = 0.7114 USD 90-day interest rate: 3.75% (APR) CHF 90-day interest rate: 5.33% (APR) The option data for July contracts is given the table below. Strike price Call Put (CHF/USD) Premium Premium 2.55 per 1.42 per 0.70 CHF CHF 0.72 1.55 per 2.4 per CHF CHF 1. U.S. Company ABC, which exports to Switzerland, expects to receive CHF 450,000 in 90 days. Should Company ABC use currency derivatives to hedge transaction risk? If yes, which derivatives should Company ABC use? Please use a contingency graph to support your choices and computation. If no, please explain why (20 points). 2. U.S. Company XYZ, which imports Swiss watches, needs to pay CHF 750,000 in 90 days. Should Company XYZ use currency derivatives to hedge transaction risk? If yes, which derivatives should Company XYZ use? Please use a contingency graph to support your choices and computation. If no, please explain why (20 points). Note that the time to pay option premium and time to exchange currencies are different. Please account for the opportunity costs/profit (time value of option premium)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts