Question: THIS IS AN ADVANCED ACCOUTNING QUESTION Question 2 [50 marks! On January 1, 2019, Puri Ltd. purchased 90% of the shares of Sabji Ltd. for

THIS IS AN ADVANCED ACCOUTNING QUESTION

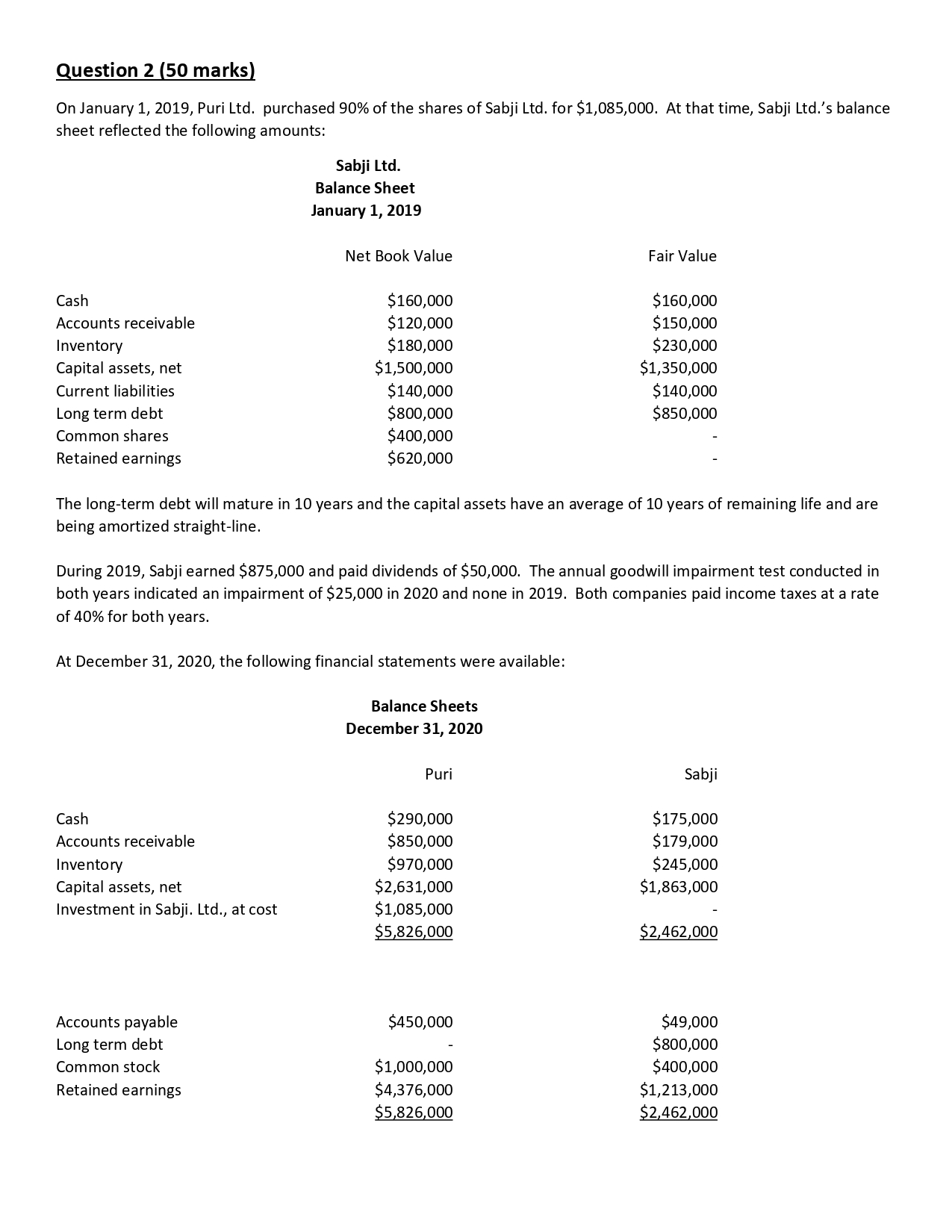

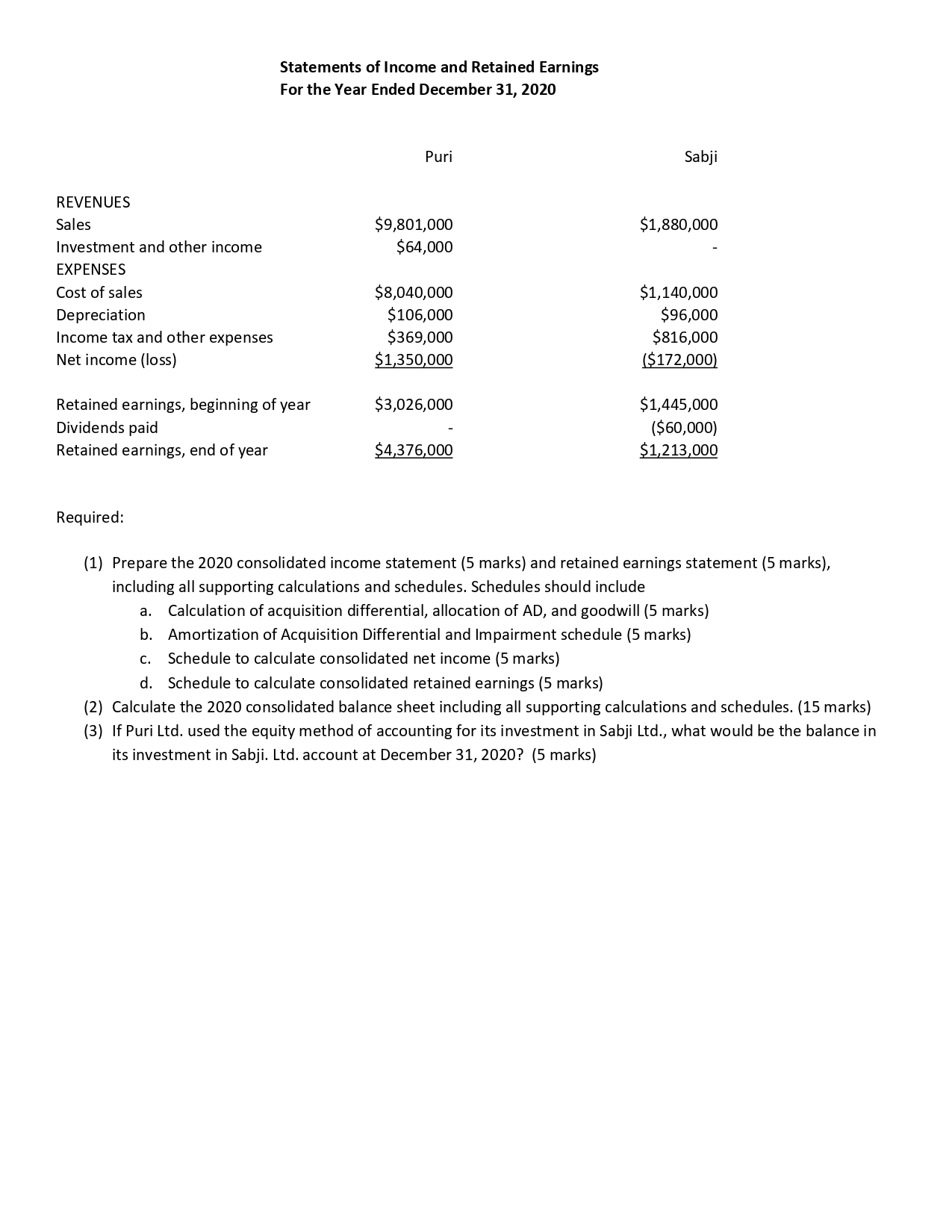

Question 2 [50 marks! On January 1, 2019, Puri Ltd. purchased 90% of the shares of Sabji Ltd. for $1,085,000. At that time, Sabji Ltd.'s balance sheet reflected the following amounts: Sabji Ltd. Balance Sheet January 1, 2019 Net Book Value Fair Value Cash $160,000 $160,000 Accounts receivable $120,000 $150,000 Inventory $180,000 $23 0,000 Capital assets, net $1,500,000 $1,350,000 Current liabilities $140,000 $140,000 Long term debt $800,000 $850,000 Common shares $400,000 - Retained earnings $620,000 - The long-term debt will mature in 10 years and the capital assets have an average of 10 years of remaining life and are being amortized straight-line. During 2019, Sabji earned $875,000 and paid dividends of $50,000. The annual goodwill impairment test conducted in both years indicated an impairment of $25,000 in 2020 and none in 2019. Both companies paid income taxes at a rate of 40% for both years. At December 31, 2020, the following financial statements were available: Balance Sheets December 31, 2020 Puri Sabji Cash $290,000 $175,000 Accounts receivable $850,000 $179,000 Inventory $970,000 $245,000 Capital assets, net $2,631,000 $1,863,000 Investment in Sabji. Ltd., at cost $1,085,000 - 5l825 000 52'452 000 Accounts payable $450,000 $49,000 Long term debt - $800,000 Common stock $1,000,000 $400,000 Retained earnings $4,376,000 $1,213,000 $5,826 000 $2,462 000 Statements of Income and Retained Earnings For the Year Ended December 31, 2020 Puri Sabji REVEN UES Sales $9,801,000 $1,380,000 Investment and other income $64,000 - EXPENSES Cost of sales $8,040,000 $1,140,000 Depreciation $106,000 $96,000 Income tax and other expenses $369,000 $816,000 Net income (loss) $1,350 000 j$172,000[ Retained earnings, beginning of year $3,026,000 $1,445,000 Dividends paid - ($60,000) Retained earnings, end of year $4,376 000 $1,213 000 Required: (1) Prepare the 2020 consolidated income statement (5 marks) and retained earnings statement {5 marks}, including all supporting calculations and schedules. Schedules should include a. Calculation of acquisition differential, allocation of AD, and goodwill (5 marks) b. Amortization of Acquisition Differential and Impairment schedule {5 marks) c. Schedule to calculate consolidated net income (5 marks) d. Schedule to calculate consolidated retained earnings (5 marks) (2) Calculate the 2020 consolidated balance sheet including all supporting calculations and schedules. {15 marks) (3) If Puri Ltd. used the equity method of accounting for its investment in Sabji Ltd., what would be the balance in its investment in Sabji. Ltd. account at December 31, 2020